In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey. For the first time since 1979, Social Democrats...

Read More »Ranking finds Switzerland lagging on wind power

(Keystone / Jean-christophe Bott) In a comparison of European solar and wind power generation, Switzerland ranks near the bottom. Per year and inhabitant, Switzerland produces 250 kilowatt hours of solar (236kWh) and wind (14kWh) power – the amount needed to power a dishwasher, roughly. This puts Switzerland in 25th place when compared with the 28 European Union nations, according to a study published by the Swiss...

Read More »FX Daily, May 29: Equity Slump Deepens while Yields Plunge

Swiss Franc The Euro has fallen by 0.20% at 1.1222 EUR/CHF and USD/CHF, May 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The slump in equities continues after the poor showing in the US yesterday. Nearly all bourses in Asia Pacific and Europe are lower. Indonesia is the notable exception as domestic operators re-position after the election. Foreign investors...

Read More »Swiss Trains Test Free Mobile Internet Access

In order to benefit from the free internet service on the trains, travellers must have a mobile phone, download the “FreeSurf SBB” application and have a Swiss SIM card from Salt or Sunrise. - Click to enlarge The Swiss Federal Railways has started testing free mobile internet based on 3G/4G coverage on the main train routes. However, it does not cover all Swiss operators. The state-owned company has started testing...

Read More »Switzerland GDP Q1 2019: +0.6 percent QoQ, +1.7 percent YoY

Switzerland’s GDP rose by 0.6% in the 1st quarter of 2019. Growth was driven primarily by increasing domestic demand. Foreign trade also provided positive impetus. Value added grew in most sectors. Switzerland Gross Domestic Product (GDP) QoQ, Q1 2019(see more posts on Switzerland Gross Domestic Product, ) Source: investing.com - Click to enlarge Switzerland’s GDP rose by 0.6% in the 1st quarter of 2019, after...

Read More »Lesson of the S-Curve: Doing More of What’s Failed Will Fail Spectacularly

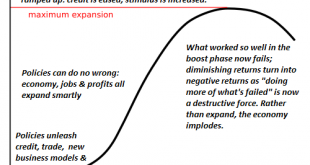

That nothing is truly “free” will be another lesson of the S-Curve. I often refer to the S-Curve because Nature so often tracks this curve of ignition, rapid expansion, stagnation and decline. One lesson of the S-Curve is that the human bias to keep doing more of what worked so well in the past leads to doing more of what failed even as results turn negative. The dynamic in play is diminishing returns: the yield on the...

Read More »In Gold We Trust 2019

The New Annual Gold Report from Incrementum is Here We are happy to report that the new In Gold We Trust Report for 2019 has been released today (the download link can be found at the end of this post). Ronnie Stoeferle and Mark Valek of Incrementum and numerous guest authors once again bring you what has become the reference work for anyone interested in the gold market. Gold in the Age of Eroding Trust This year’s...

Read More »The Crime of ‘33, Report 27 May

Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys: Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves If it doesn’t buy another...

Read More »Bannockburn’s Chandler: We’re at the lower rungs of a large trade escalation ladder

Marc Chandler of Bannockburn Global Forex discusses what people may be missing from the US-China trade war, and other global risks that could impact markets.

Read More »Bannockburn’s Chandler: We’re at the lower rungs of a large trade escalation ladder

Marc Chandler of Bannockburn Global Forex discusses what people may be missing from the US-China trade war, and other global risks that could impact markets.

Read More » SNB & CHF

SNB & CHF