By Bryan Cutsinger

Why did the United States abandon the gold standard?

In an article published recently by the Federal Reserve Bank of St. Louis, Maria Hasenstab cites the international gold shortage during the Great Depression. “Countries around the world basically ran out of supply and were forced off the gold standard,” she writes.

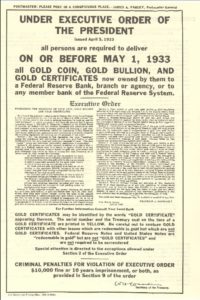

In passing, the article mentions the American people were not forced off by an international gold shortage, instead by President Roosevelt, who required all but a small amount of gold coin, bullion, and certificates be handed over to the Federal Reserve at $20.67 per troy ounce.

What the article doesn’t mention is the messy details of confiscating gold: refusing to comply faced fines of up to $10,000

Articles by Sound Money Defense League News

REPORT: 2025’s BEST and WORST U.S. States for Sound Money

November 20, 2024(Charlotte, NC – November 20th, 2024) – The newly released 2025 Sound Money Index has identified Wyoming, South Dakota, and Alaska as the states with the most favorable policies toward constitutional sound money, while Vermont, Maine, and California take the most hostile stances.

Released annually by the Sound Money Defense League and Money Metals Exchange, the Sound Money Index is a comprehensive scorecard evaluating how each U.S. state promotes or impedes sound money policies.

Ranked policies include sales, income, and gross revenue taxes connected with precious metals, state affirmation of gold and silver as money, strengthening protections of gold and silver clause contracts, state precious metals depositories.

Additional criteria

Legislators Seek Repeal of Wisconsin’s Controversial Sales Tax on Gold and Silver

February 4, 2023Madison, Wisconsin – (February 4th, 2023) – A large bipartisan contingent of Wisconsin legislators seek to end Wisconsin’s controversial practice of levying sales tax on purchases of gold and silver.

Senate Bill 33, primarily sponsored by Sen. Duey Strobel (R – Saukville) and Sen. Rachael Cabral-Guevara (R – Appleton), and cosponsored by Rep. Shae Sortwell, enjoys wide support – and would align Wisconsin with the policies of 42 other U.S. states.

Senate Bill 33 would exempt “precious metals bullion,” defined as coins, bars, rounds, and sheets that contain at least 35% gold, silver, copper, platinum, or palladium.

In 2019, Rep. Shae Sortwell (R – Two Rivers) introduced a similar measure that didn’t not receive a hearing. But upon introduction this year, Senate

Central Banks Turn to Gold as Losses Mount

January 25, 2023In 2022, central banks will have purchased the largest amount of gold in recent history. According to the World Gold Council, central bank purchases of gold have reached a level not seen since 1967. The world’s central banks bought 673 metric tons in one month, and in the third quarter, the figure reached 400 metric tons. This is interesting because the flow from central banks since 2020 had been eminently net sales.

Why are global central banks adding gold to their reserves? There may be different factors.

Most central banks’ largest percentage of reserves are US dollars, which usually come in the form of US Treasury bonds. It would make sense for some of the central banks, especially China, to decide to depend less on the dollar.

China’s high foreign exchange

Minnesota Lawmakers Seek Full Sales Tax Exemption of Gold and Silver

January 17, 2023(St. Paul, Minnesota, USA – January 16th, 2023) – Legislators in the Twin Cities seek to fully exempt gold and silver from Minnesota’s state sales tax.

House Rep. B. Olson and Sen. Draheim have introduced HF 106 and SF 373, respectively. These two measures would include coins to Minnesota’s current sales tax exemption, which only exempts bars and rounds.

Under current law, Minnesota citizens are discouraged from insuring their savings in precious metals coins against the devaluation of the dollar because they are penalized with taxation for doing so. Passage of this measure would remove disincentives to holding gold and silver coins for this purpose. HF 106 is important for a few reasons:

Minnesota does not tax the purchase of other investments. Minnesota does not

West Virginia Delegate Introduces “Legal Tender Act,” Would End Taxes on Gold and Silver

January 12, 2023(Charleston, West Virginia, USA – January 11th, 2023) – Another pro-sound money legislative effort has been introduced in West Virginia.

Del. Chris Pritt has introduced House Bill 2333, the “Legal Tender Act.” This measure would establish gold and silver as legal tender in West Virginia, as well as create a nonrefundable tax credit for the use gold and silver in West Virginia on state taxes.

Arizona, Utah, and Wyoming have enacted similar measures into law. Idaho has considered this measure recently and a similar measure is expected to be heard before the Oklahoma legislature this year.

In recent decades, monetary gold and silver — and dollars redeemable in gold and silver — have been supplanted by the Federal Reserve Note as America’s currency. However, an

Inflation Firestorm Fuels Sound Money Movement

December 13, 2022Sound money, in the form of physical gold and silver, look to be ending the year on a bullish footing.

Meanwhile, things are looking positive on the sound money public policy front as well, thanks to some big wins at the state level in 2022 combined with renewed enthusiasm among our legislative allies as we head into the 2023 legislative season.

Looking back on 2022, one reality has emerged: Sound money is clearly a winning issue at the state level.

At a time of record-high inflation and geopolitical uncertainty across the globe, with some prompting from Money Metals Exchange, the Sound Money Defense League, and our Money Metals customers, several state legislatures have taken tangible steps to better enable citizens to acquire, sell, and/or use gold and silver.

2022 Sound Money Scholarship Winners Announced

December 7, 20226 Outstanding Students Earn Almost $10,000 in Tuition Assistance

Eagle, Idaho (December 6, 2022) – Six outstanding students beat out almost 100 of their high-school and college peers in making the best case for sound money through an international, gold-backed scholarship competition…

…and the winners walked away with a total of $9,500 in scholarship awards for their exceptional, thought-provoking essays.

For the sixth-straight year, Money Metals Exchange, the U.S. precious-metals dealer ranked “Best Overall” has teamed up with the Sound Money Defense League to offer the only gold-backed scholarship of the modern era.

These groups have set aside 100 ounces of physical gold to reward over time those exemplary students who display a thorough understanding of

Read More »Rep. Alex Mooney Advocates for Gold Standard Bill on Fox Business

October 21, 2022Rep. Alex Mooney (R-WV) joined Fox Business in support of H.R. 9157, the Gold Standard Restoration Act.

“The Federal Reserve note has lost more than 30 percent of its purchasing power since 2000, and 97 percent of its purchasing power since 1913,” the Congressman from West Virginia told host Kennedy.

Economists have observed that the elimination of gold redeemability from the monetary system freed central bankers and federal government officials from accountability when they irresponsibly expand the money supply, robbing savers of the purchasing power of their money. The “impotent overlords of fiat currency,” as Kennedy so eloquently put it, created this inflation by increasing the money supply by over 40% since 2020.

To make matters worse, the Federal Reserve and

How Sound Money Won the Battle of Yorktown—and Saved the American Revolution

October 19, 2022Early this month, Congressman Alex Mooney of West Virginia introduced the Gold Standard Restoration Act (H.R. 9157). If enacted into law, it would require public disclosure of the federal government’s gold holdings and eventually define the dollar as a weight of gold.

For the moment, the bill’s chances of passage are as nil as nil gets. Sound money, whether it’s gold or silver or paper that is “backed” by one or both metals, may not acquire a sizable constituency again until a monetary disaster demands it. That’s a sad commentary on the general state of economic knowledge. In the meantime, we can at least hope that Mr. Mooney’s bill may stimulate a long overdue discussion.

America is a nation whose very independence was first jeopardized by unbacked paper money

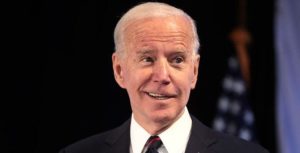

Biden Crows About the Latest 8.5 percent Annual Inflation Rate

August 16, 2022Precious metals markets continued rallying this week. Investors weighed new inflation data showing price pressures in the economy are finally slowing. Wednesday’s Consumer Price Index report came in slightly lower than expected for a change. The CPI rose 8.5% on an annualized basis in July.

Normally such a reading would be nothing to cheer about. But the fact that the inflation rate finally came down a tad after months and months of relentless increases gave Joe Biden an opportunity to gloat. In a particularly laughable moment, the President went so far as to claim that inflation has fallen to zero.

Joe Biden: Today, we received news that our economy had 0% inflation in the month of July, 0%. Here’s what that means. While the price of some things went up last

The ‘Wishful Thinking’ Fed Is Anything But ‘Neutral’

August 2, 2022With last week’s second 75 basis-point rate hike, the Federal Reserve now claims it has achieved a “neutral” monetary policy stance. That would mean, in theory, that interest rates are neither stimulating nor restraining the economy.

“Now that we’re at neutral, as the process goes on, at some point, it will be appropriate to slow down,” Fed Chairman Jerome Powell said.

Powell was effectively telling markets he intends to pivot away from inflation fighting.

Yet inflation, even when measured by the Fed’s own preferred gauge, continues to run hot.

The Personal Consumption Expenditures price index came in at 6.8% in Friday’s report from the Bureau of Economic Analysis.

A Fed funds rate that currently stands at just 2.5% doesn’t look “neutral” at all when the official

Speaker Boehner Readies Final Sellout As Debt Ceiling Debacle Looms

June 12, 2022It’s campaign season, and that means non-stop media coverage of candidate polls, quips, gaffes, tweets, emails, controversies, lies, and scandals. It all makes for a good soap opera. Unfortunately, it’s almost all irrelevant in the big picture.

The media prefer to focus on the sideshow rather than the 800-pound gorilla in the room: the looming debt crisis. Nothing that comes out of a pundit’s mouth or a Hillary Clinton email will close the $210 trillion long-term fiscal gap the U.S. now faces.

More immediately, Congress faces a likely debt ceiling debacle in the next few weeks.

First up, Members of Congress are considering full funding for Obama’s budget, and the fiscal year begins October 1st. Not surprisingly, the Obama administration’s new budget calls for

The War on Gold Ensures the Dollar’s Downfall

May 13, 2022Last month was the 89th anniversary of one of America’s biggest blunders on her descent from honest, sound money into weaponized political money: Executive Order 6102.

Signed on April 5, 1933, U.S. President Franklin Delano Roosevelt required all persons holding more than five ounces of gold to deliver their “gold coin, gold bullion, and gold certificates, now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the Federal Reserve System.”

By outlawing the so-called “hoarding” of gold, Roosevelt intended to destroy gold as an everyday currency, transferring the purchasing power of gold to the U.S. government.

In exchange for Americans’ gold, the government gave them Federal Reserve Notes at the exchange rate of $20 per

Read More »Alabama Passes Sound Money Law, Expands Sales Tax Exemption Involving Gold and Silver

April 17, 2022(Montgomery, Alabama – April 14, 2022) – With Governor Kay Ivey’s signature on sound money legislation today, Alabama has become the second state this year to expand its sales tax exemption involving gold and silver.

Alabama Senate Bill 13, championed by Sen. Tim Melson and Rep. Jamie Kiel, passed with unanimous support out of the Alabama Senate and then passed unanimously through the Alabama House before making it to the Governor’s desk.

In 2019, Alabama originally removed sales taxes from most gold, silver, platinum, and palladium coins and bars. This year, SB 13 clarified that the exemption covers all common forms of bullion, removed burdensome reporting requirements, and extended the sales tax exemption until 2028.

Backed by the Sound Money Defense League,

Virginia Ends All Taxes on Purchases of Gold and Silver

April 14, 2022(Richmond, Virginia – April 12, 2022) – By signing sound money legislation last night, Virginia Governor Glenn Youngkin has ended Virginia’s discriminatory practice of assessing sales taxes on smaller purchases of gold, silver, platinum, and palladium bullion and coins.

Virginia’s House Bill 936, originally introduced by Del. Amanda Batten, was considered by multiple House and Senate committees before passing overwhelmingly out of both chambers and reaching the governor’s desk.

Virginia had been one of only seven states in the United States maintaining merely a partial sales tax exemption on purchases of precious metals. Virginia’s regressive practice of taxing only purchases under $1,000 singled out small-time savers for a tax penalty that larger gold and silver

Freedom and Prosperity: The Importance of Sound Money

January 31, 2020Sound money is a key to a free and prosperous society. That principle was clearly reflected in the monetary system that the Constitution established when it called the federal government into existence.

Our ancestors didn’t trust government officials with power. They believed that the greatest threat to their own freedom and well-being lay not with some foreign regime but rather with their own government. They understood that historically most people had lost their freedom and prosperity at the hands of their own governments rather than at the hands of some conquering foreign power.

That was why the American people lived for more than a decade under the Articles of Confederation, a governmental structure that provided for a federal government with extremely weak

New Federal Legislation Requires Full Audit of America’s Gold Reserves

May 9, 2019Congressman Alex Mooney (R-WV)

Washington, DC (May 8, 2019) – U.S. Representative Alex Mooney (R-WV) introduced legislation this week to provide for the first audit of United States gold reserves since the Eisenhower Administration.

The Gold Reserve Transparency Act (H.R. 2559) – backed by the Sound Money Defense League and government accountability advocates – directs the Comptroller of the United States to conduct a “full assay, inventory, and audit of all gold reserves, including any gold in ‘deep storage,’ of the United States at the place or places where such reserves are kept.”

HR 2559 requires more than just a physical assay, inventory, and audit, however. Even if all United States gold can be physically

Rep. Alex Mooney: Bring Back Gold!

September 12, 2018This article originally appeared here.

Washington has been quite the circus lately. Bret Kavanaugh’s appearance in front of the Senate Judiciary Committee prompted dozens of interruptions from Democrats and numerous protests from leftists. During Twitter CEO Jack Dorsey’s testimony to the House Commerce Committee, journalist Laura Loomer demanded to be verified on the social media platform, and Representative Billy Long (R-MO) held an auction. Alex Jones tried to fight Senator Marco Rubio, a has-been actress got escorted from the premise, and CNN’s Oliver Darcy was on the brink of tears.

What a time it was on Capitol Hill.

But as the crazies enveloped these events, a more subdued and mundane hearing occurred at the

Sound Money Needed Now More Than Ever

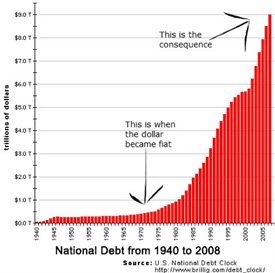

June 26, 2018The sound money movement reemerged on the national political scene a decade ago. In 2008, the financial crisis brought in a fresh wave of U.S. gold and silver investors.

Ron Paul and the Tea Party advocated for limiting government and ending the Federal Reserve system. Sound money advocates made real inroads in recruiting Americans to their cause based on evidence that the nation is headed for bankruptcy.

The implications of the most recent financial crisis went way beyond budget and finance.

Many Americans grasped the more significant lesson. The perpetual expansion of government spending lay behind the corresponding decline in personal liberty for them, their children, and their children’s children.

National Debt

Read More »BOOM: Wyoming Ends ALL TAXATION of Gold & Silver

March 16, 2018– Click to enlarge

Breakthrough Sound Money Bill Becomes Law Today with Wide Support

Cheyenne, Wyoming (March 14, 2018) – Sound money activists rejoiced as the Wyoming Legal Tender Act became law today. The bill restores constitutional, sound money in Wyoming.

Backed by the Sound Money Defense League, Campaign for Liberty, Money Metals Exchange, and in-state grassroots activists, HB 103 removes all forms of state taxation on gold and silver coins and bullion and reaffirms their status as money in Wyoming, in keeping with Article 1, Section 10 of the U.S. Constitution.

Introduced by Representative Roy Edwards (R-Gillette), HB 103 received a 55-5 favorable vote on final passage in the Wyoming House last week

Sound Money and Your Personal Finances

January 24, 2017Sound money principles can serve to help grow the economy and restrain government. The political class, however, doesn’t particularly want to restrain itself. Washington, D.C. is addicted to the easy money policies that have enabled $20 trillion in national debt accumulation and tens of trillions more in unfunded liabilities.

Even with a new and unconventional GOP president who vows to take on waste and overregulation, the built in momentum of “mandatory” spending means the Trump budgets won’t be balanced. The debt will keep growing – and likely at a faster pace than the economy. Thus, political demand for the Federal Reserve’s artificially low interest rates and Treasury bond purchases will continue to be strong.

Short of a currency crisis that forces a monetary revolution, sound money reform efforts will have to proceed in baby steps.

Any fundamental proposed changes – such as tying the currency supply to gold and silver reserves – will encounter enormous resistance from Congress, the Federal Reserve, and its member banks. A metallic standard would also be roundly opposed by Wall Street, which benefits from the Fed’s artificial inflation of the financial sector.