China is on the edge of recession — excluding Covid, for the first time since 2008 — as new data showed all-important manufacturing contracted for the fourth month in a row with particular weakness in new orders.In other words, what they’ve got is a backlog, then it’s a cliff.Manufacturing makes up a third of China’s economy — much more than the US. The collapse of China’s property — another third of China’s economy — is adding further fuel to the fire.Offices Emptier than CovidLondon’s Financial Times reports that office buildings in China are emptier than they were during the Covid lockdowns. FT notes that work-at-home hasn’t taken off in China, implying the main driver of empty offices is layoffs.In Shanghai, office vacancies are at 21%. In Shenzhen, China’s

Topics:

Peter St. Onge considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

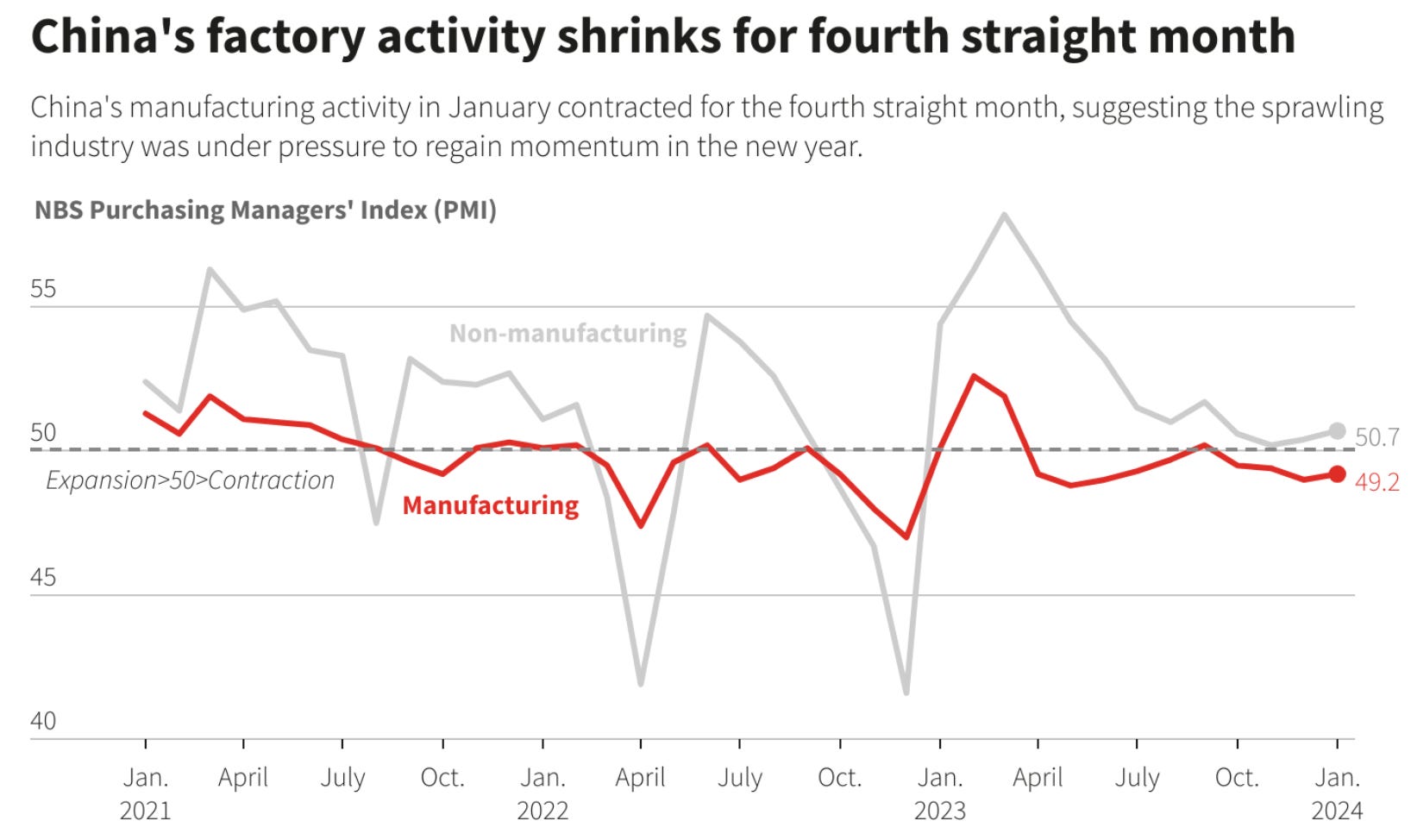

China is on the edge of recession — excluding Covid, for the first time since 2008 — as new data showed all-important manufacturing contracted for the fourth month in a row with particular weakness in new orders.

In other words, what they’ve got is a backlog, then it’s a cliff.

Manufacturing makes up a third of China’s economy — much more than the US. The collapse of China’s property — another third of China’s economy — is adding further fuel to the fire.

Offices Emptier than Covid

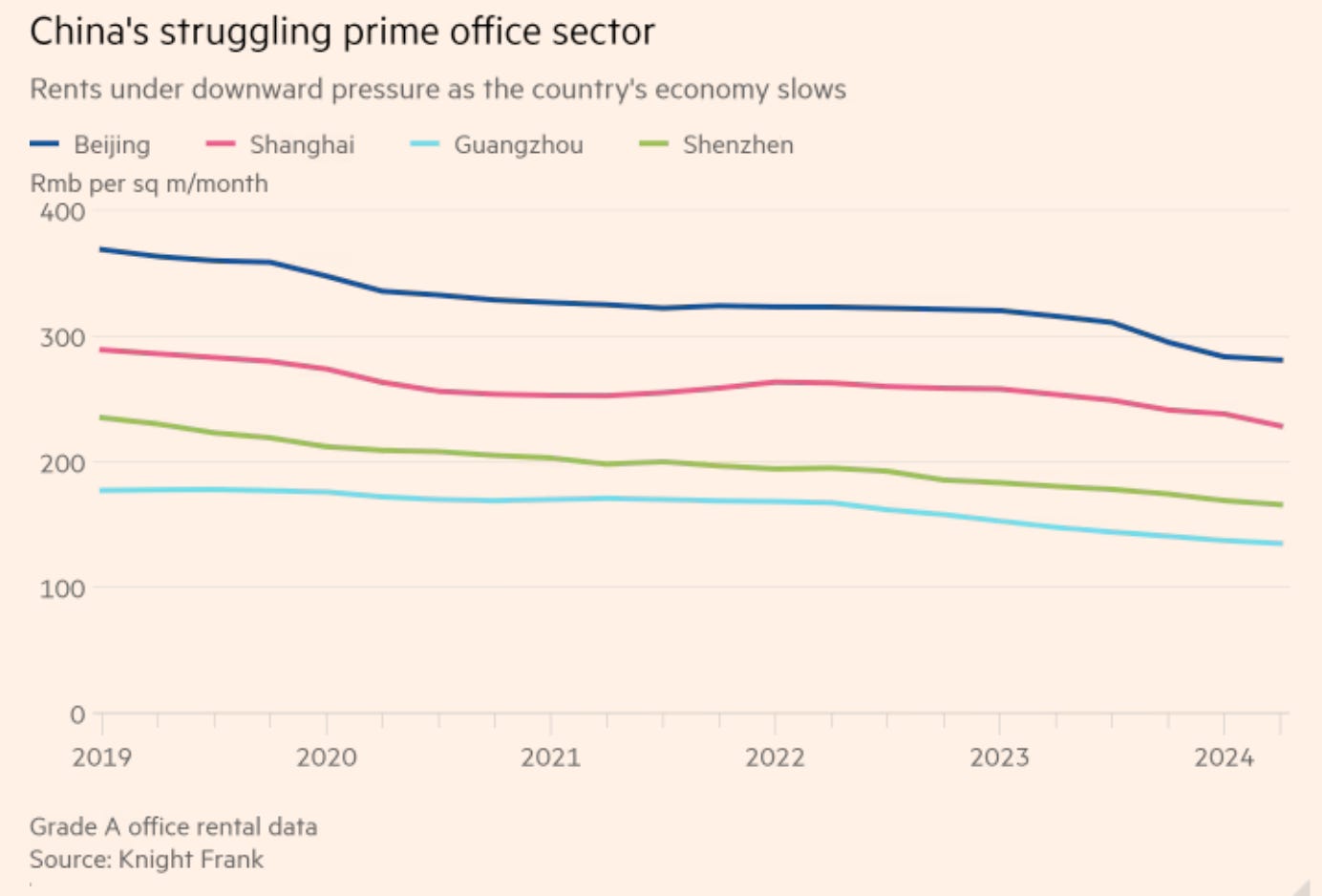

London’s Financial Times reports that office buildings in China are emptier than they were during the Covid lockdowns. FT notes that work-at-home hasn’t taken off in China, implying the main driver of empty offices is layoffs.

In Shanghai, office vacancies are at 21%. In Shenzhen, China’s central export hub, vacancies are at 27%. These are both much worse than vacancies during Covid lockdowns.

To give a flavor, Shenzhen rents have collapsed 15% percent year on year.

Of course, China’s official GDP numbers are immune from the storms, but then nobody believes them — not even in China.

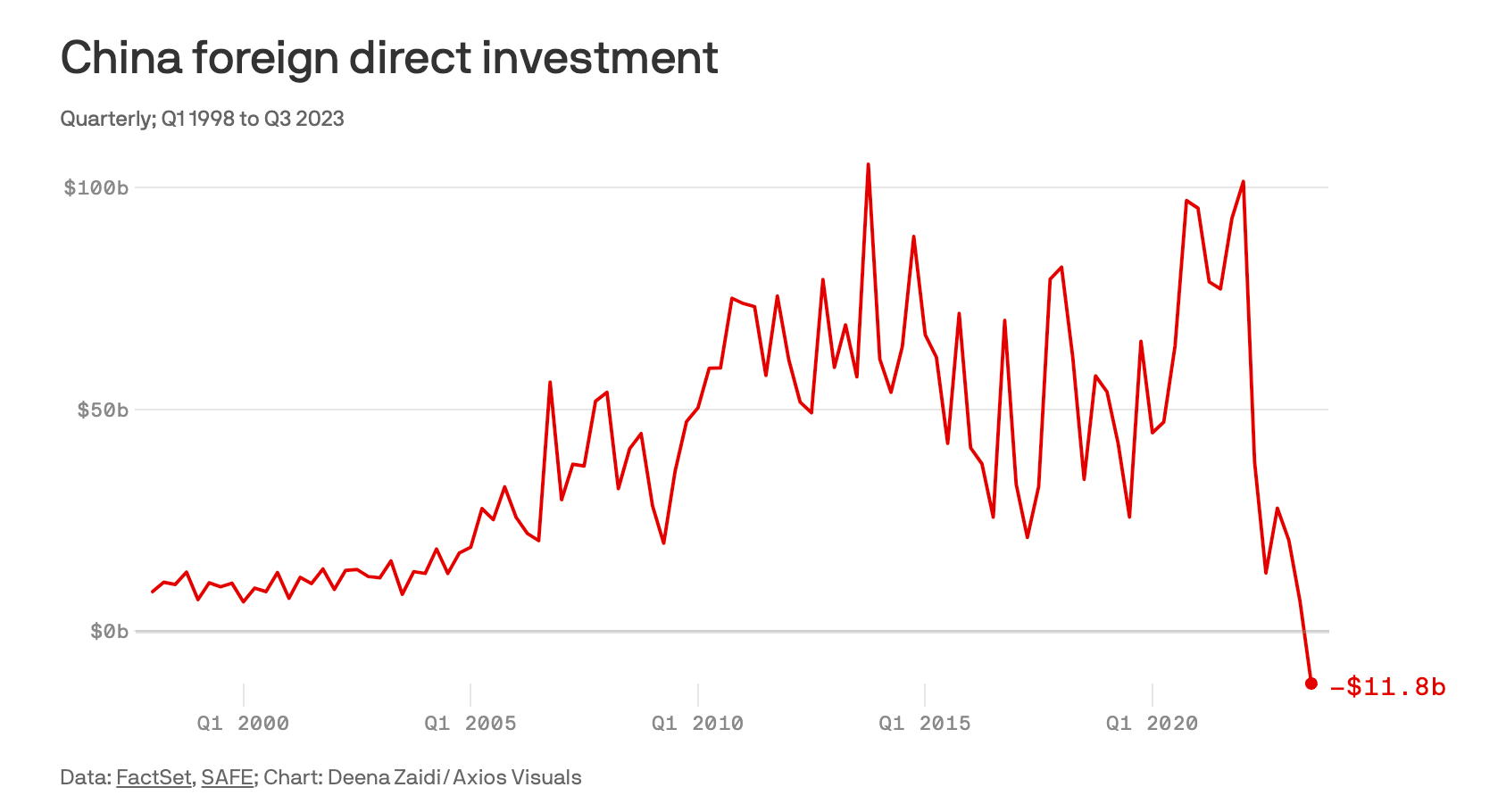

Interestingly, not all the layoffs are domestic companies: Foreign investment in China has plunged by a third in the past year as President Xi’s authoritarianism is driving out foreign firms.

They’re vacating their Chinese offices and setting up shop in safer places like Vietnam or Mexico, with the factories to follow.

China’s Youth Crisis

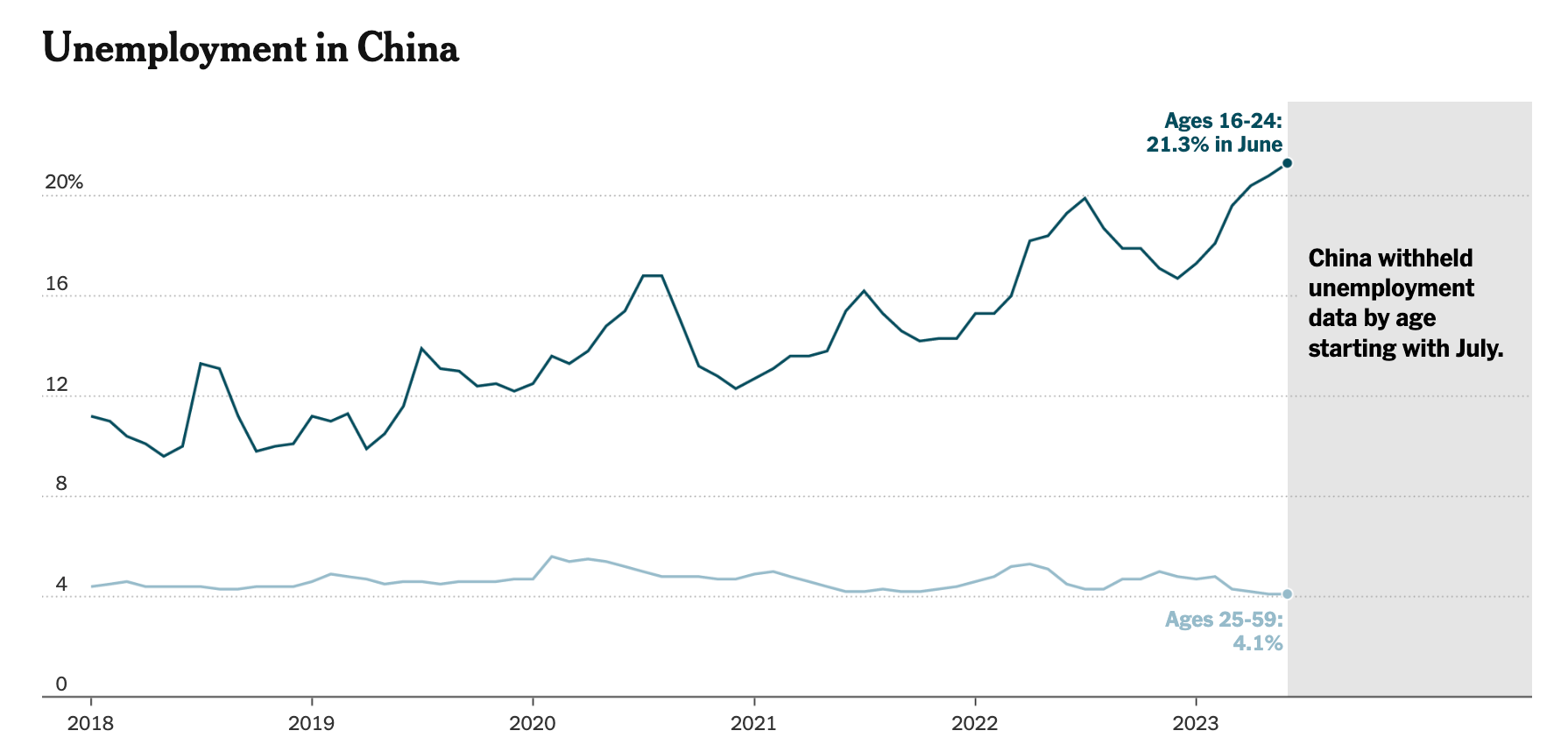

The contraction is hitting young Chinese hardest, with youth unemployment jumping to nearly one in four young Chinese without a job.

With a record 12 million Chinese college students about to graduate and hit the job market, they won’t like what they find.

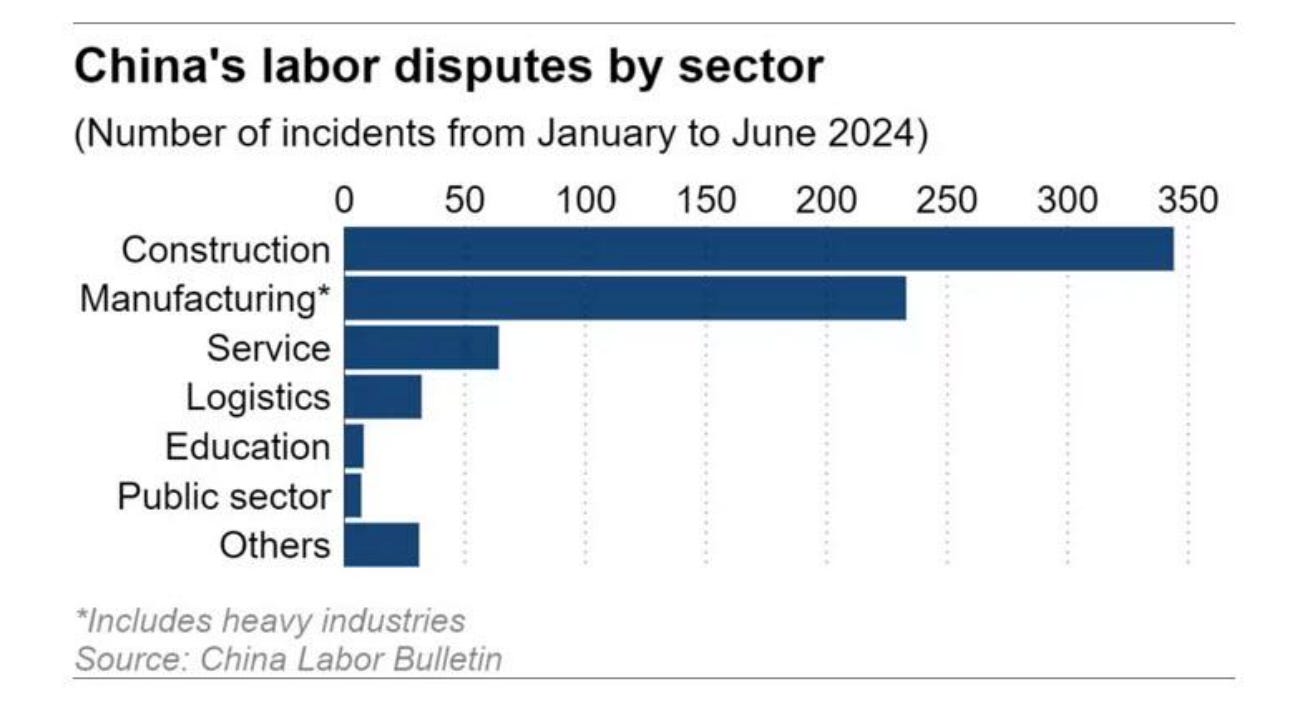

This is all, of course, social tinder. Public protests are now rising in China, with banners on overpasses demanding free elections and ex-soldiers accusing the government of “strangling” service members.

Labor strikes have jumped, including 1,000 workers in a Nike factory who, ironically, rose up after production was moved to Indonesia. Along with hundreds of strikes by unpaid construction workers as property developers collapse.

The background here is hundreds of millions of Chinese work informally — you need a kind of domestic passport to move to a big city where wages are decent, and most rural Chinese don’t have one.

But you also need fifteen years of formal work to get government pensions. That means for older workers, especially those without kids, thanks to government birth control, layoffs could mean literally starving in old age. They’re desperate.

What Went Wrong With the Chinese Miracle?

Growth under President Xi has collapsed to half its old rate — China now grows like a normal middle-income country.

This is because the Mao-worshipping Xi cracked down on business — even “disappearing” prominent businessmen like Ali Baba’s Jack Ma when they opposed Xi.

Meanwhile, Xi plowed trillions into government-favored industries — above all, green energy and housing. These have both now collapsed with over-capacity and under-demand.

To illustrate, at one point, China had nearly 1,500 electric car makers. Almost all have either gone bust or are in the process.

Meanwhile, housing has at least five and a half trillion dollars in bad loans, with millions of Chinese losing the half-built apartments they’d parked their life savings into as developers go under.

Between the housing collapse and stocks that have been flat since 2008, the Chinese don’t have the money to keep spending, pulling down the economy even further.

What’s Next

The last time China hit a recession, in 2008, Beijing dumped massive stimulus into the economy. This time, China’s debt — over $50 trillion — has grown to the point it can’t afford it.

And if China fails? The social contract in China is based on obedience for growth. If the government can’t hold up growth, historically, the Chinese have gotten very kinetic. There’s a reason Xi’s been installing a police state, but of course, if opposition is widespread enough, even the police flip sides.

China could be in for a bumpy ride. And if it gets desperate and needs a nationalist distraction, it could pull Taiwan — and America — into the storm.

The original version of this article was published at ProfStOnge.com.

Tags: Featured,newsletter