In spite of an initial rise in 10-year Bund yields after the ECB’s latest stimulus, our central scenario is for a renewed decline by year’s end.The 10-year Bund yield moved up from its recent lows of -0.71% to -0.45% on September 16, driven mostly by an element of disappointment regarding the European Central Bank’s (ECB) latest stimulus measures and some renewed hopes for a US-China trade truce. In particular, we suspect the rebound in yields was triggered by the ECB’s failure to increase issuer limits for its purchases of government bonds. This was a big disappointment for the sovereign bond market, as were news reports that some important ECB members were not in favour of restarting quantitative easing (QE).By year’s end, we see the 10-year Bund yield falling back towards -0.6% as the

Read More »Articles by Laureline Chatelain and Nadia Gharbi

PROSPECT OF CALMER POLITICAL WATERS REVIVES INTEREST IN ITALIAN BONDS

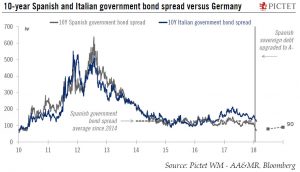

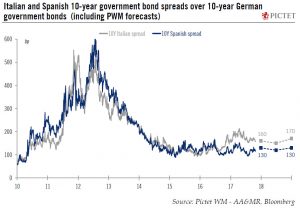

August 30, 2019Spreads on Italian debt could continue to drop, as Italy’s relations with Brussels become calmer. But much will depend on the new government’s durability and its commitment to reducing the debt burden.President of the Republic Sergio Mattarella has instructed Giuseppe Conte to form a new government backed by a coalition of the Five Star Movement (M5S) and the Democratic Party (PD). Importantly, there are still many hurdles to overcome, and a last-minute breakdown in discussions cannot be ruled out.There are strong political divergences between these two parties, but the new government’s attitude towards Europe should be less hostile and more constructive than the previous ones.With the new coalition government almost a done deal, we have revised our 10-year Italian BTP – Bund spread

Read More »Bund yields — Heading further down?

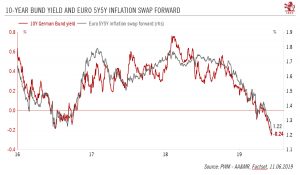

June 13, 2019Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside.Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative territory until at least October in our central scenario (55% probability). As such, we remain underweight core euro sovereign bonds.Our central scenario is for the 10-year Bund yield to move back into positive territory toward the end of 2019 for a number of reasons. First, in contrast with market expectations for further monetary policy easing, we foresee neither rate cuts nor

Read More »Peripheral bonds after the Spanish election

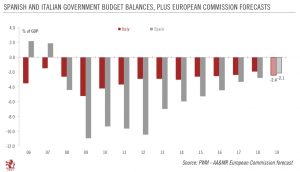

April 29, 2019We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility.On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to lift much before the regional and European elections on May 26.The misty political outlook is likely to have only a limited economic impact, at least initially. Although down from 2.5%, we expect the Spanish economy to grow by 2.1% this year, placing it among the top performers in the euro area.Since the beginning of 2019, peripheral spreads have remained range bound—between

Read More »Italy: rough waters could grow calmer

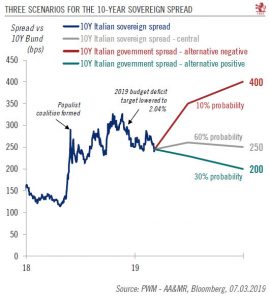

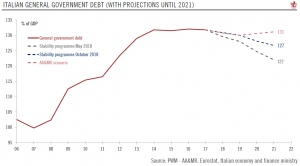

March 8, 2019With the country in recession, we remain cautious on Italian sovereign debt. But growing tensions inside the government could have a silver lining.The main leading indicators are pointing towards the recession continuing in Q1 2019 in Italy. We expect growth to move marginally back into the black in Q2 2019, with the Italian economy growing by 0.3% in 2019 overall. Even though we have ruled out a snap 2019 election from our central scenario, the chances of one being called are significant enough not to be overlooked, given rising tensions within the populist governing coalition. Should a snap election be held in 2019, it would be unlikely, in our view, to happen before September/October.Along with uncertainties surrounding the governing coalition and poor economic prospects, rating

Read More »Germany: economy and sovereign bonds

February 25, 2019After a difficult second half of 2018, the outlook for Germany’s economy and soverign bonds turns brighter.A host of factors weighed on German growth in H2 2018: a sharp slowdown in global demand on the external side and several transitory factors on the domestic side impacted industrial activity. At the same time, the 10-year German Bund yield has been trending downward. The steep fall in the oil price in late 2018, the economic slowdown and the Bund’s safe haven status are all factors behind the German bund’s yield fall.Based on our central scenario (to which we assign 55% probability), we expect the 10-year Bund yield to rise from its current low level of 0.13% (as on 21 February) to 0.3% by mid-year and 0.5% by the end of 2019. All in all, we continue to see limited value in core euro

Read More »Outlook for euro periphery bonds

January 16, 2019Economic fundamentals should come back into focus, but politics still a factor.After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political equilibrium remains fragile, with a risk of snap elections in 2019.With the end of quantitative easing (QE), European Central Bank (ECB) bond purchases are set to have a negligible impact on markets. However, the extent to which the ECB manages to hike rates this year will be key for euro area periphery bonds. In our central scenario, we still expect rate increases in the second

Read More »Bumpy road ahead for Italian budget

October 18, 2018Rome’s budget plans put it on a collision course with the European Commission.The Italian government has submitted its 2019 draft budget plan (DBP) to the European Commission. The proposed DBP is not in line with European Union rules and sets the government on a collision course with the European authorities.Several elements within the Italian government’s budget plan have been raising eyebrows. First, the plans’ economic assumptions seem too optimistic to us, and there is a risk that the budget deviates from its owns deficit targets. Second, the budget’s composition appears insufficient to overcome Italy’s structural problems. Third, the budget plans put Italy’s government on a collision course with Europe, setting the stage for further volatility. Finally, Italy’s systemic importance is

Read More »Italy tests the EU’s tolerance

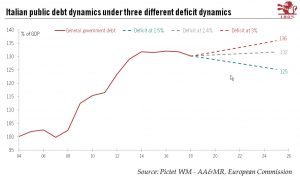

September 28, 2018The populist government’s plans to increase the deficit could set it on a collision course with Brussels. We remain bearish Italian bonds and euro peripheral bonds in general.Leaders of Italy’s coalition government and the finance minister yesterday agreed on a 2.4% GDP deficit target. The new target is higher than our expectation of a deficit “above but close to 2.0%” in 2019. For us, the key issue is not so much the deficit figure in itself, but more the fact that the government plans the same 2.4% deficit for next three years (2019-21). Such deficit targets are unlikely to be welcomed by the European Commission.Currently, we have limited visibility on the assumptions used in the government’s projections for the budget deficit. Based on our own forecasts for Italian growth and rates, a

Read More »Fiscal battle looms over Italian bonds

September 4, 2018Given the market volatility we expect around 2019 budget discussions in Italy, we remain bearish on euro peripheral bonds in general.Italy is coming back into focus as investors become increasingly nervous about 2019 budget discussions. September will be a key moment to gauge the intentions of the Italian government regarding its 2019 budget. Indeed, more details will become available when the Italian government publishes the updated Economic and Financial Document (DEF), no later than 27. The DEF will tell us to what extent the populist ruling coalition is willing to challenge the European Union’s fiscal rules.One of the key questions is how the government will manage to find a compromise between the contradictory views expressed by Giovanni Tria, the finance minister and the government

Read More »Robust outlook supports low Spanish sovereign bond spreads

February 8, 2018Strong metrics mean we expect the 10-year Spanish government bond spread over Bunds to widen less than we thought before.Strong, relatively broad-based economic recovery and the limited economic impact of the Catalan crisis pushed Fitch to upgrade Spanish sovereign debt by one notch to A-/Stable in January. The upgrade triggered a significant rally, with the spread on Spanish 10-year bonds versus Bunds dropping below 70 basis points (bp) on February 1 for the first time since 2009.The compression in Spanish spreads is even more impressive in light of the enduring political uncertainty in Catalonia, the forthcoming Italian general elections, and the gradual unwinding ECB stimulus. With the improved macroeconomic environment, peripheral euro area countries in general seem more robust than

Read More »Italian and Spanish bonds relatively immune to politics

October 31, 2017While political risks have fallen marginally in Italy, political tensions have intensified in Spain. But, as things stand, we do not think that political risk in either country will lead to a systemic crisis.Italy and Spain have been at the centre of market attention again in recent weeks. Italian politics have livened up as we move towards the general election next spring 2018, while the threat of Catalan independence has placed the spotlight on Spain. But we expect only a slight widening of Italian spreads over Bunds by end-2018, while Spanish spreads could remain around their current level.This forecast is based on our analysis of three relevant factors: monetary policy, the business cycle and politics.Starting with monetary policy, the ECB’s exit from QE should be very gradual, as it

Read More »