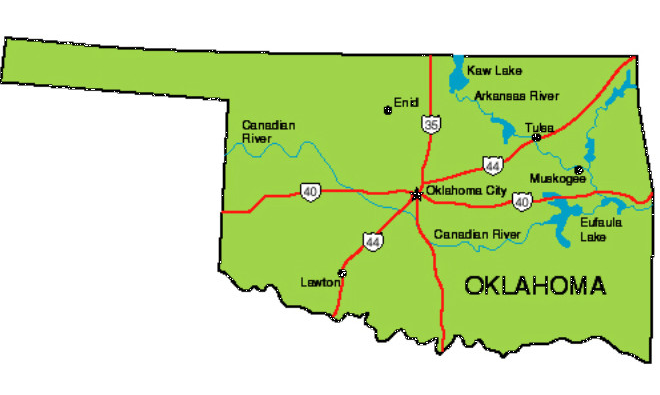

(Oklahoma City, Oklahoma, USA – January 20, 2022) – Oklahoma ended sales taxes on purchases of precious metals long ago, but now a representative from Broken Arrow wants to eliminate yet another tax on on gold and silver transactions. Introduced by Sen. Nathan Dahm, Senate Bill 1480 would end capital gain transactions on the exchange of gold and silver. Arizona, Utah, and Wyoming have enacted similar measures into law. Idaho has considered this measure recently and a similar measure is expected to be heard before the West Virginia legislature this year. In recent decades, monetary gold and silver — and dollars redeemable in gold and silver — have been supplanted by the Federal Reserve Note as America’s currency. However, an increasing number of West Virginia

Topics:

Jp Cortez considers the following as important: 6a.) Gold Standard, 6a) Gold & Monetary Metals, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

(Oklahoma City, Oklahoma, USA – January 20, 2022) – Oklahoma ended sales taxes on purchases of precious metals long ago, but now a representative from Broken Arrow wants to eliminate yet another tax on on gold and silver transactions.

(Oklahoma City, Oklahoma, USA – January 20, 2022) – Oklahoma ended sales taxes on purchases of precious metals long ago, but now a representative from Broken Arrow wants to eliminate yet another tax on on gold and silver transactions.

Introduced by Sen. Nathan Dahm, Senate Bill 1480 would end capital gain transactions on the exchange of gold and silver.

Arizona, Utah, and Wyoming have enacted similar measures into law. Idaho has considered this measure recently and a similar measure is expected to be heard before the West Virginia legislature this year.

In recent decades, monetary gold and silver — and dollars redeemable in gold and silver — have been supplanted by the Federal Reserve Note as America’s currency. However, an increasing number of West Virginia citizens are realizing that holding gold and/or silver as a form of savings can help protect against the ongoing devaluation of the Federal Reserve Note.

Here are a few reasons why slapping an income tax on the monetary metals is wrong:

- Current Oklahoma law assesses taxes on imaginary gains. Under current law, a taxpayer who sells precious metals may end up with a capital “gain” in terms of Federal Reserve Notes. This capital “gain” is not necessarily a real gain, it’s often a nominal gain that results from the inflation created by the Federal Reserve and the attendant decline in the dollar’s purchasing power.

Yet this nominal gain is taxed at the federal level – and, because West Virginia uses federal adjusted gross income (AGI) as a starting point for Oklahoma income calculations, this nominal gain is taxed again by the Sooner State.

- Inflation harms the poorest among us. Inflation is a regressive tax. The hardest hit are wage earners, savers, and pensioners on fixed incomes – as well as those who own few or no tangible assets.

- Taxing imaginary gains is harmful to citizens attempting to protect their assets. Investments in precious metals coins and bullion are rightly exempt from Oklahoma’s sales tax. Neutralizing Oklahoma’s income tax treatment of the monetary metals would remove the last major disincentive in the state that stands against the ownership and use of the monetary metals.

Policies that penalize savers in precious metals reduce the likelihood that Oklahoma citizens will take prudent steps to insulate themselves from the inflation and financial turmoil caused by the Federal Reserve.

Oklahoma savers, wage earners, and all those who use gold and silver to insulate against the devastating effects of inflation should be able to protect themselves without getting punished by taxation.

Tags: Featured,newsletter