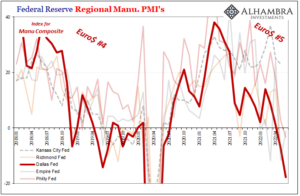

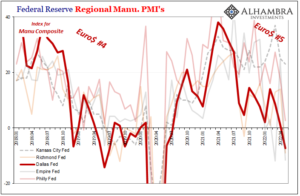

Well, that was a mess. The Richmond Fed’s Manufacturing Survey was at first released before being taken back. Initially reported as a plunge in the headline number, it was quickly scrapped once the statisticians remembered they had just discontinued their average workweek component – but had kept a zero in its place when tallying the overall PMI.

With it, the PMI was originally calculated to have gone from bad in May (-9) to horrible in June (-19). Refiguring the whole thing for what today are now fewer inputs, the good folks in Richmond confidently say the corrected number is “merely” -11.

Talk about exceeding radically lowered expectations.

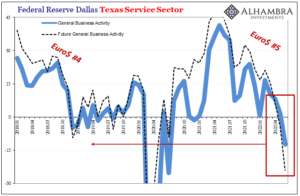

It wasn’t the case, however, where it counts the most going forward.

.

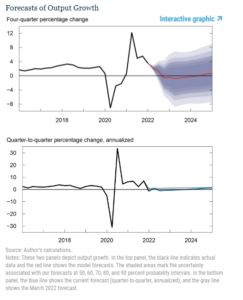

As always, new orders. Unaffected by the litany of