We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list. To

Topics:

George Dorgan considers the following as important: 2.) Trade Balance News Service Bunt [FR], 2) Swiss and European Macro, Featured, newsletter, Switzerland Exports, Switzerland Imports, Switzerland Trade Balance

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true.

Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans.

But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

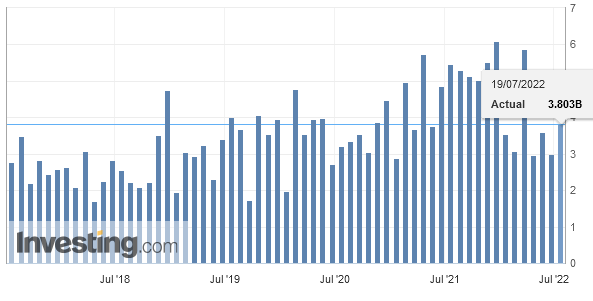

Exports and Imports YoY DevelopmentSwiss foreign trade strengthened further in both traffic directions in the 2nd quarter of 2022, reaching new highs. Exports increased by 0.9% and imports by 2.4% compared to the previous quarter. Prices have risen both at entry and exit. The trade balance closes with a surplus of 7.6 billion francs. In short

⇑Metal exports: their dynamism propels them to a record level ⇑Europe, engine of export growth ⇓Exports of immunological products: −1.3 billion francs ⇓Eurozone imports plunged by 1 billion francs |

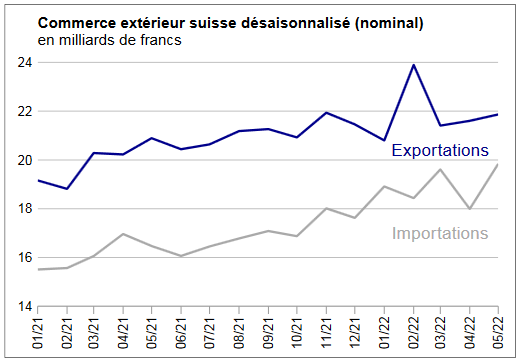

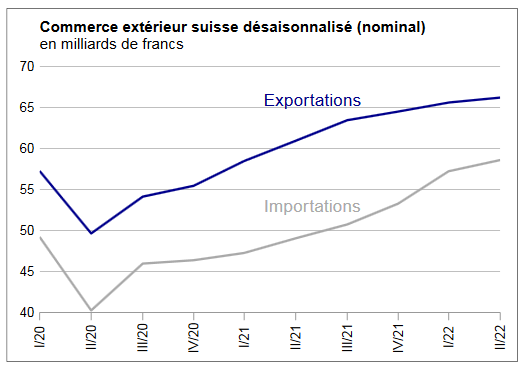

Swiss exports and imports, seasonally adjusted (in bn CHF), Q2 2022(see more posts on Switzerland Exports, Switzerland Imports, ) Source: newsd.admin.ch - Click to enlarge |

Global developmentDuring the 2nd quarter of 2022 and on a seasonally adjusted basis, exports increased by 0.9% or 603 million francs (actual: −0.5%). With this eighth consecutive quarterly increase, they set a new record at 66.2 billion francs. Imports increased by 2.4% (actual: +0.6%) to reach a historic high of 58.6 billion francs. The trade balance ends with a surplus of 7.6 billion francs – the lowest recorded since the third quarter of 2020. |

Switzerland Trade Balance, Q2 2022(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

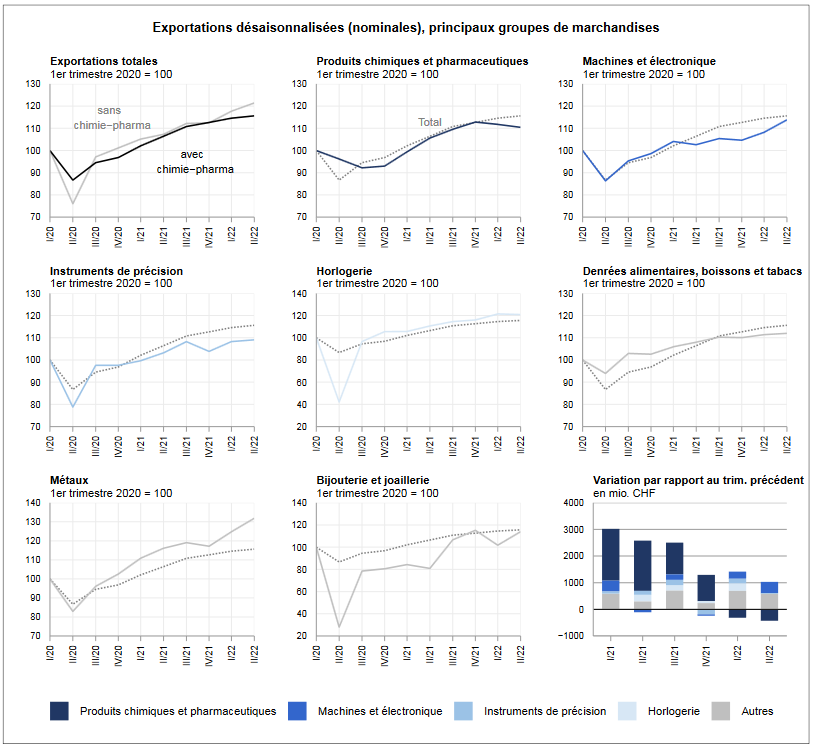

Watch exports stagnate at a high levelIn the 2nd quarter, the increase in exports was based on three groups of goods: machinery and electronics (+420 million francs), jewelery and jewelery (+334 million) and metals (+223 million). The latter have shown dynamism since the beginning of the year and have been propelled to a record level. Precision instruments grew slightly compared to the previous quarter while watch sales stagnated at a high level. On the other hand, chemical and pharmaceutical products suffered a setback of 1.2% or 403 million francs. Here, the decline affected all sub-groups, with immunological products in the lead (−1.3 billion francs). Contrasting developments characterized the three main markets. While exports to Europe strengthened by 3.4% to a record level of 39.2 billion francs, shipments to Asia and North America dipped slightly (−0.6 and −0 .3% to respectively 14.0 and 13.5 billion francs). On the Old Continent, Slovenia (+738 million francs; pharma) stood out. Italy was not left behind (+4.0% or +182 million; pharma and energy products) and reached a new peak. On the Asian side, the contraction towards China – its fourth decline in five quarters – as well as towards Japan and Hong Kong (−15.0%) drove the continent’s result into the red figures, this trio showing a drop of 593 million francs. In North America, shipments to the United States lost 257 million francs in the space of a quarter (pharma). |

Swiss Exports per Sector |

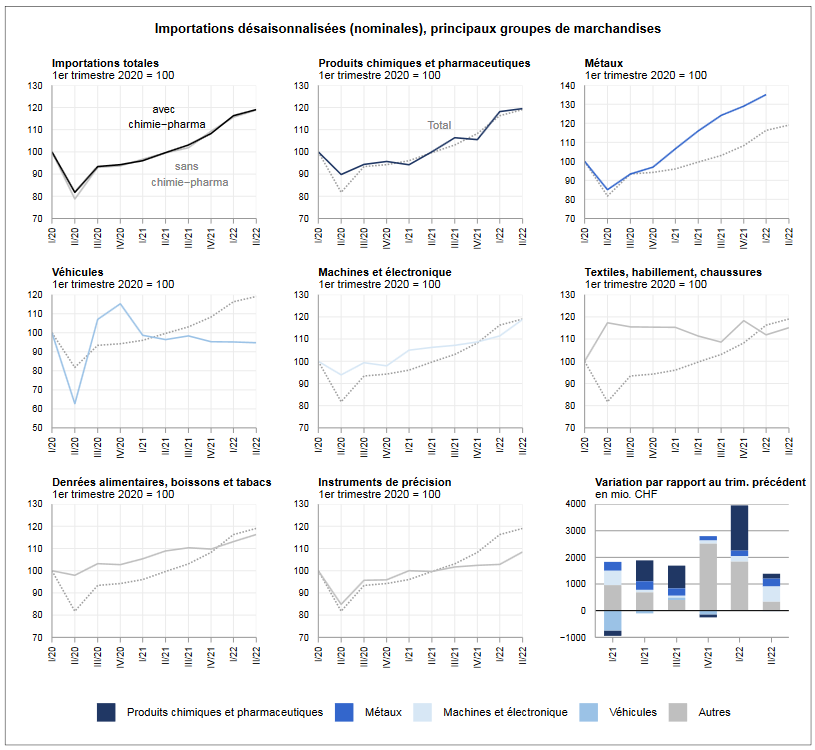

Imports from Slovenia quadruple over one yearOn imports, almost all the main commodity groups gained ground in the 2nd quarter of 2022. Growth was mainly based on the sectors of jewelery and jewelery (+25.2%), machinery and electronics (+ 6.7%) and metals (+6.5%). The latter thus sign their eighth quarterly increase in a row. Imports of chemical and pharmaceutical products increased slightly (+1.1% or 182 billion francs), after surging by 12% in the previous quarter. Entries in the energy products group (−10.1%; real: −1.3%) were characterized by a drop in prices, after the surge in the previous quarters. Imports from Asia (+5.3%) and North America (+3.6%; USA: +275 million francs) took the lift while those from Europe suffered their first decline since the second quarter of 2020 (−1.1%). On the Asian side, Japan (+240 million) and India shone. The Japanese partner also posted a record level. On the European side, the setback has taken hold in Germany, Ireland and Austria, where the cumulative decline has reached 818 million francs. France (−91 million francs) and the Netherlands (−86 million) also weighed on the result. Conversely, arrivals from Slovenia (+394 million) and Italy (+287 million) increased, confirming the strong upward trend in both countries. |

Swiss Imports per Sector |

Tags: Featured,newsletter,Switzerland Exports,Switzerland Imports,Switzerland Trade Balance