In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September.

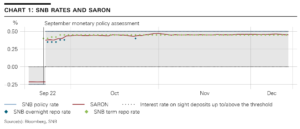

The switch from a negative to a positive SNB policy rate required us to make an adjustment to the implementation of our monetary policy in the money market. The new approach comprises two elements: reserve tiering – that is, tiered remuneration of the sight deposits that banks and other financial market participants hold at the SNB – and reserve absorption. This approach has proved successful. Following our monetary policy decision on 22 September, secured short-term

Articles by Andréa Maechler

Andréa M. Maechler: Introductory remarks, news conference

June 16, 2022I will begin my remarks with a review of developments on the financial markets over the past half-year. I would then like to discuss the lowering of the threshold factor mentioned by Thomas Jordan.

Situation on the financial markets

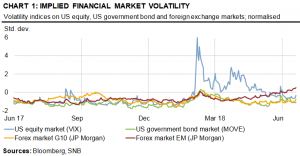

Volatility on the financial markets has increased again significantly since the beginning of the year (cf. chart 1). This was driven by the sharp rise in inflation abroad and by attendant expectations regarding a speedier tightening of monetary policy – especially in the US. Indeed, the Fed has already raised the target range for its federal funds rate in several increments and signalled its intention to increase rates further. In addition, the war in Ukraine and the associated sanctions have exacerbated existing supply bottlenecks

Andréa M. Maechler / Thomas Moser: Life after Libor: A new era of reference interest rates

April 1, 2022A new era of reference interest rates began at the start of this year. Libor, which had been the key reference rate for several decades and several currencies, including the Swiss franc, ceased to exist in many currencies at the end of 2021. SARON has now fully replaced Swiss franc Libor.

This speech explains why reference rates play a central role in financial markets and discusses the circumstances under which some interest rates either achieve or lose reference rate status. Following the Global Financial Crisis of 2007 to 2009, Libor increasingly failed to satisfy two important criteria for reference rates – reliability and robustness – and had to be replaced by alternative reference rates. Given the huge importance of reference rates, intensive work was

Andréa M. Maechler: Introductory remarks, news conference

June 21, 2018I will begin my remarks with an overview of the situation on the financial markets, before giving an update on the status of the reforms regarding reference interest rates. And in closing I would like to say a few words about our branch office in Singapore, which is celebrating its fifth anniversary.

Situation on the financial markets

Let me start with the developments on the financial markets.

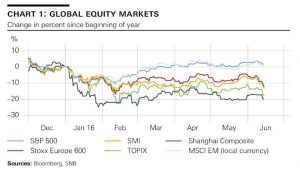

The first half of 2018 was characterised by a return of volatility on the markets, as well as price movements shaped by the continuing normalisation of monetary policy in the US.

The higher volatility followed a prolonged phase of exceptionally low levels, and was driven by the marked correction on global equity markets in

Read More »Andréa M. Maechler: Introductory remarks, news conference

December 14, 2017Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank

News conference of the Swiss National Bank, Berne, 14.12.2017

Complete text: PDF (478 KB)

I will begin my remarks with a review of the situation on the financial markets, before going on to discuss the progress made in reference interest rate reform.

Situation on the financial markets

Let me start with developments on the financial markets.

The monetary policy pursued by the large central banks was once again the focus of attention for the financial markets in the second half of the year. Given moderate inflation growth, financial market participants are expecting only a very gradual normalisation of monetary policy across the world.

Read More »Andréa M. Maechler: Introductory remarks, news conference

June 15, 2017Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank

News conference of the Swiss National Bank, Berne, 15.06.2017

Complete text: PDF (478 KB)

I will begin by reviewing the situation on the international financial markets. I will then address some developments on the Swiss money and foreign exchange markets – specifically

the establishment of SARON as the leading reference rate for interest rate derivatives and the adoption of a global code of conduct for foreign exchange market transactions.

Situation on the financial markets

Let me start with developments on the international financial markets.

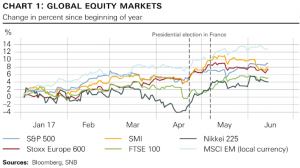

Overall, positive sentiment has continued to prevail since the beginning of the year. Economic

SNB’s Maechler on Negative Rates and our Critique

June 17, 2016At the news conference of the Swiss National Bank, Andréa Maechler discusses the current situation of financial markets and the negative interest environment. She explains the recent Swiss experience with negative interest rates. Negative rates have the desired effect: It makes holding money on Swiss bank accounts less attractive.

We see different issues with this explanation:

Negative rates make only holding money on accounts less attractive but not cash, real estate or stocks.

As her colleague Fritz Zurbrügg explained, nearly all Swiss banks still offer rates slightly above zero for their clients.

Finally negative interest rates only reduce the profits of banks. In combination with strong regulator requirements, it reduces bank profits and therefore GDP.

Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank

News conference of the Swiss National Bank, Berne, 16.06.2016

Complete text PDF (310 KB)

I will begin with a review of developments on the financial markets, before commenting on our experience of negative interest in Switzerland. I shall conclude with some remarks about important innovations affecting financial market infrastructure relevant to the SNB.

Situation on financial markets

Let me start with developments on the financial markets.

Read More »