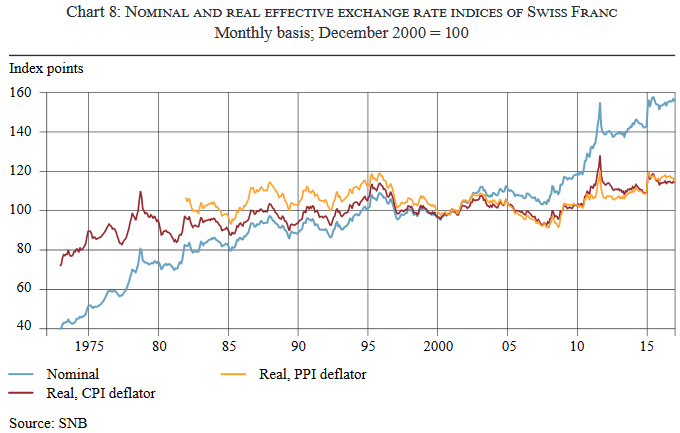

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the countries incorporated into the index; and calculation of a chained index. The methodological changes in the calculation of the new index have only a slight effect on the development of the nominal index. However, the difference between the nominal and real index (CPI-based) has increased with the new calculation. This is explained by the fact that countries with a greater weighting in the new index have higher average rates of inflation than those whose weighting has been reduced. Nominal and real effective exchange rate indices of Swiss Franc(see more posts on Swiss Franc Index, ) Source: www.snb.

Topics:

Dirk Niepelt considers the following as important: Dirk Niepelt, Exchange rate, Featured, newsletter, Notes, Real exchange rate, SNB, Swiss Franc, Swiss National Bank

This could be interesting, too:

investrends.ch writes SNB mit Quartals-Gewinn von 6,7 Milliarden Franken

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract:

|

Nominal and real effective exchange rate indices of Swiss Franc(see more posts on Swiss Franc Index, ) Source: www.snb.ch - Click to enlarge |

Tags: exchange rate,Featured,newsletter,Notes,Real Exchange Rate,Swiss Franc,Swiss National Bank