On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that it seems the SNB’s relentless accumulation of foreign assets has been pointless — at best. More likely, the behaviour qualifies as predatory mercantilism at the expense of the rest of the world, especially Switzerland’s hard-hit neighbours. SNB Holdings, 2001 - 2017(see...

Read More »The SNB’s Currency Interventions

On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that it seems the SNB’s relentless accumulation of foreign assets has been pointless — at best. More likely, the behaviour qualifies as predatory mercantilism at the expense of the rest of the world, especially Switzerland’s hard-hit neighbours.

Read More »Swiss Franc Exchange Rate Index

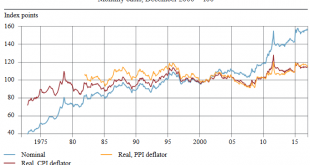

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the...

Read More »Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the countries incorporated into the index; and calculation of a chained index....

Read More »Big Macs, Swiss Francs and Euros

Adjusted for GDP, The Economist’s Big Mac Index suggests that the Swiss Franc is 9 percent over valued relative to the US Dollar while the Euro is 17 percent under valued.

Read More »“Zinsen, Inflation und Realismus (Interest, Inflation and Realism),” FuW, 2016

Finanz und Wirtschaft, April 30, 2016. PDF. Ökonomenstimme, May 6, 2016. HTML. The winners and losers of the current monetary environment are not that easy to identify. Investors holding long-term, non-indexed debt gain as unexpectedly low inflation shifts wealth from borrowers to lenders. Governments suffer from increased real debt burdens and reduced revenue due to effectively lower capital income tax rates. Policies that succeed in affecting the real exchange rate entail...

Read More »Exchange Rate Predictability

In a Study Center Gerzensee working paper, Pinar Yesin argues that the IMF’s Equilibrium Real Exchange Rate model (ERER) helps predict medium term exchange rate changes. The reduced form equation relates the real effective exchange rate to macroeconomic fundamentals. … one of the models, namely the ERER model, outperforms not only the other two in predicting future exchange rate movements, but also the (average) IMF assessment. … the IMF assessments are better at predicting future exchange...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org