Writing about CBDC, John Cochrane makes it clear that he is in favor. He links to my work and writes Dirk Niepelt has written a lot about CBDC theory, including reserves for all in 2015, a recent Vox-EU summary and papers, here with Markus Brunnermeier a JME paper “CBDC coupled with central bank pass-through funding need not imply a credit crunch nor undermine financial stability,” a follow up including “The model implies annual implicit subsidies to U.S. banks of up to 0.8 percent...

Read More »SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks. Entities with fintech licences whose business model makes them significant participants in the area of Swiss franc payment transactions will therefore be granted access to the SIC system and to...

Read More »“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

[embedded content] Wer soll Franken herstellen dürfen? Nur die Schweizerische Nationalbank, oder auch die Geschäftsbanken wie UBS, CS oder die Kantonalbanken? Ginge es nach der Vollgeld-Initiative, über die wir am 10. Juni abstimmen, wäre künftig klar: Geld als gesetzliches Zahlungsmittel gäbe es nur von der SNB. Offsetmaschine zum Druck von Schweizer Banknoten bei der Schweizerischen Nationalbank. Keystone - Click to...

Read More »SNB Rejects Vollgeld and Questions ‘Reserves for All’

In the NZZ, Peter Fischer reports that SNB president Thomas Jordan rejects the Vollgeld initiative and stops short of endorsing the ‘reserves for all’ proposal. … wehrt sich die Nationalbank auch gegen Vorschläge aus akademischen Kreisen, die von der Nationalbank fordern, nicht mehr nur Banken, sondern auch direkt den Schweizer Bürgern elektronisches Zentralbankgeld zur Verfügung zu stellen. Am einfachsten ginge dies,...

Read More »Swiss Perfectionism

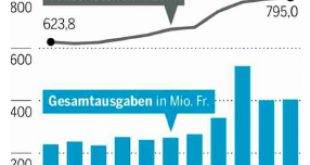

In Der Bund, Adrian Sulc comments on the Swiss National Bank’s perfectionism. Keine andere Schweizer Organisation kommuniziert so professionell wie die SNB, keine andere Organisation kann so gut dichthalten. Perfectionism is costly. Der Personalbestand ist in den letzten fünf Jahren um 18 Prozent auf 795 Vollzeitstellen gestiegen. … Die durchschnittlichen Lohnkosten pro Mitarbeiter betragen mittlerweile 155 000 Franken...

Read More »Switzerland’s Changing International Linkages

In a CEPR discussion paper, Cedric Tille argues that Switzerland’s international linkages have been transformed over the last decade. Abstract: - Click to enlarge Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding...

Read More »The SNB’s Currency Interventions

On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that it seems the SNB’s relentless accumulation of foreign assets has been pointless — at best. More likely, the behaviour qualifies as predatory mercantilism at the expense of the rest of the world, especially Switzerland’s hard-hit neighbours. SNB Holdings, 2001 - 2017(see...

Read More »Digital Swiss Francs

The Swiss National Bank held its annual general meeting of shareholders (web TV). In response to one of the questions posed by shareholders Thomas Jordan suggested (2:58–2:59) that possibly a digital Swiss Franc might be introduced sometime in the future. Tags: Digital currency,Electronic money,Featured,M0 base...

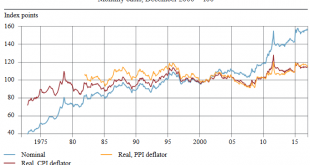

Read More »Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the...

Read More »How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract: The removal of the floor led to extreme price moves in the forwards market, similar to those...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org