Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal government. With the economy still gripped by the latest recession, and oil prices rising worldwide as supplies continue to be squeezed, Brazilians have been caught in the vise between fuel prices and unemployment – pure misery for a nation still reeling from Euro$ #3’s (2014-16) crushing impacts. A depression for years

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bills, bonds, Brazil, broad trade-weighted us dollar index, Collateral, currencies, Dollar, dollar funding, DXY, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, global dollar shortage, Markets, Mexico, newsletter, Notes, peso, real, Repo, rising dollar, ruble, Russia, U.S. Treasuries, urjit patel, US Dollar Index

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal government.

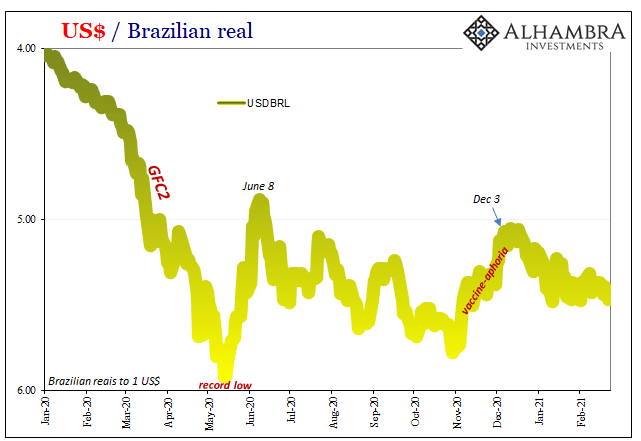

With the economy still gripped by the latest recession, and oil prices rising worldwide as supplies continue to be squeezed, Brazilians have been caught in the vise between fuel prices and unemployment – pure misery for a nation still reeling from Euro$ #3’s (2014-16) crushing impacts. A depression for years before COVID…and now this. While shares of Petrobras, as the company is better known, dropped by more than a fifth in frenzied Monday trading, it tanked Brazil’s main stock index, the Bovespa, by around 5%. And the currency fell sharply. Presumably, real to dollar exchange is reacting to the idiosyncratic news of specific Brazilian politics. While that may have been true for yesterday’s trading, the Brazilian real had fallen out of reflationary mode months ago. |

US Dollar / Brazilian Real, 2020-2021 |

| Like many markets and currencies around the world, vaccine-aphoria pushed BRL modestly into reflationary territory (not really far off record lows) at least when compared to the June to November downward trend. It only lasted until early December as the exchange value nearly touched 5.0 to the dollar for the first time since briefly in June.

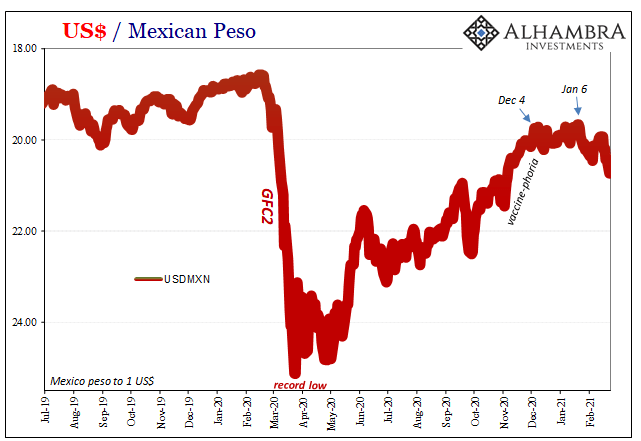

But Brazil’s currency does not trade alone in its anti-reflation, post-early December hangover. An entire swath of EM currencies has followed almost exactly in the same way (raising suspicions so far as the violence of market reaction to yesterday’s news might be concerned). From Mexico to Russia, where’d all that good reflation go? |

US Dollar / Mexican Peso, 2019-2021 |

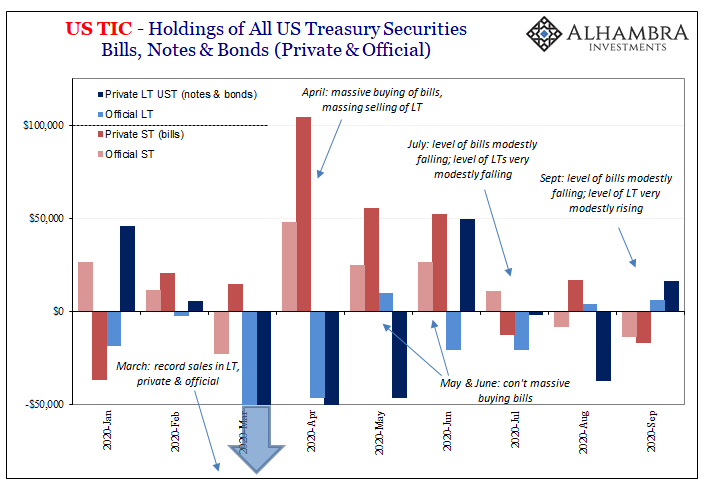

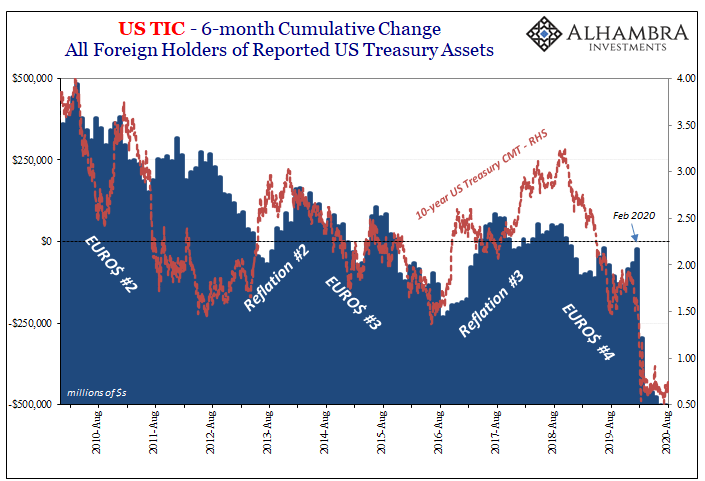

| In terms of US Treasuries and their yield curve, currencies have turned in more like the front-end bills and have stopped their concerted relationship liking what’s been offered in longer UST notes or bonds.

This is not a worrisome dollar-surge by any means, instead what gets our attention is the time component; this has been the longest stretch of renewed stubborn (neither up nor down) dollar exchange rates (lower foreign currency translations) since last March. It hasn’t gotten very far up the scale (down on these charts), though it now seems as durable as the coincident drop in UST bill yields both possibly reflecting the same issues. And, again, it has been widespread rather than limited to a few specific currencies here or there – to the point that even DXY (meaning euro) picks it up, too. |

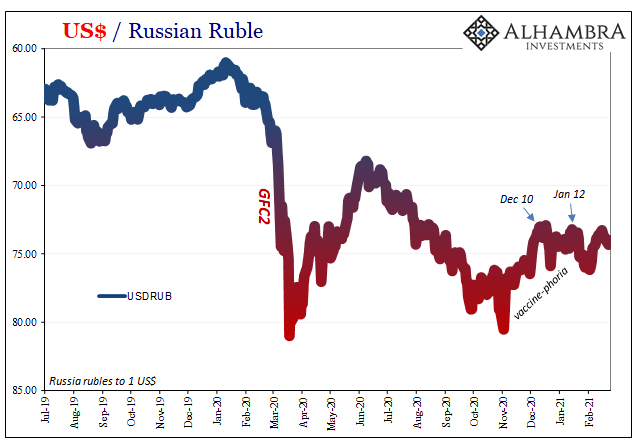

US Dollar / Russian Ruble, 2019-2021 |

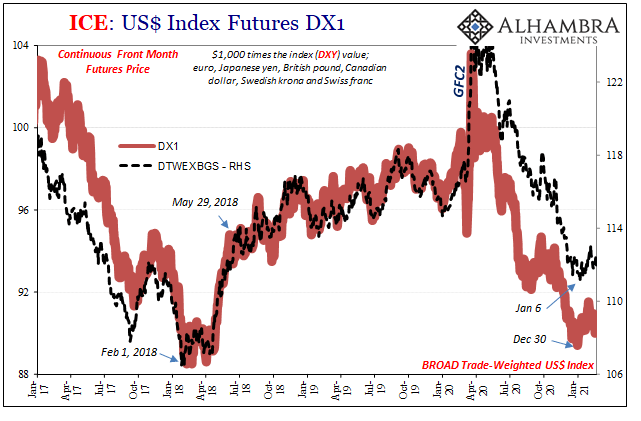

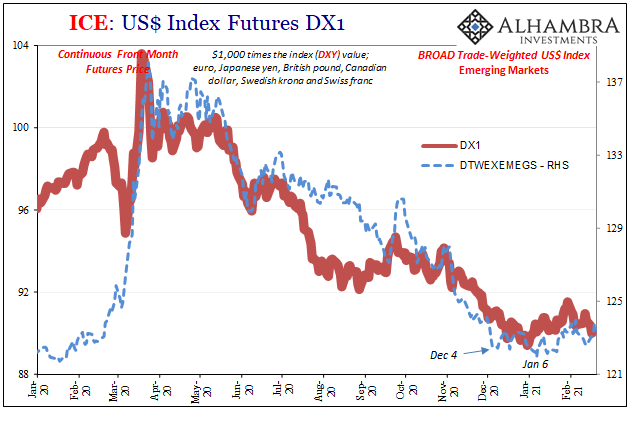

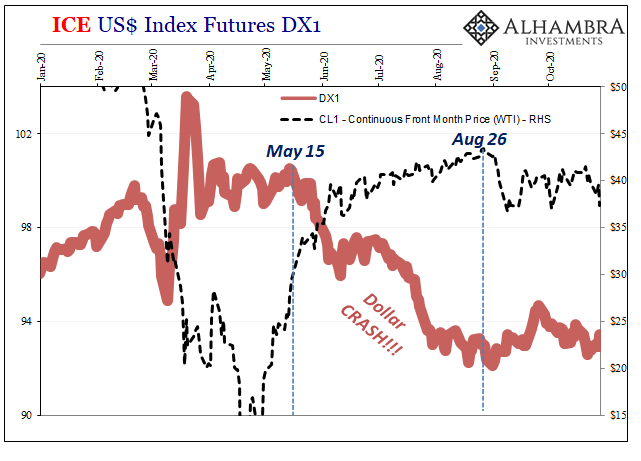

| DXY bottomed out on December 30 while the Fed’s broad trade-weighted US dollar index’s lowest point came on January 6.

Looking at just EM currencies, that trade-weighted index replicates the real, peso, ruble dynamic which traces back into early December. Some will argue this is, in fact, the textbook product of those very long-term UST yields on the rise; upward interest rate differentials that according to many mainstream textbooks drive US$ exchange rates higher. As yields go up and threaten to rise even more, the dollar gets “stronger” by comparison. |

ICE: US$ Index Futures, DX1 2017-2021 |

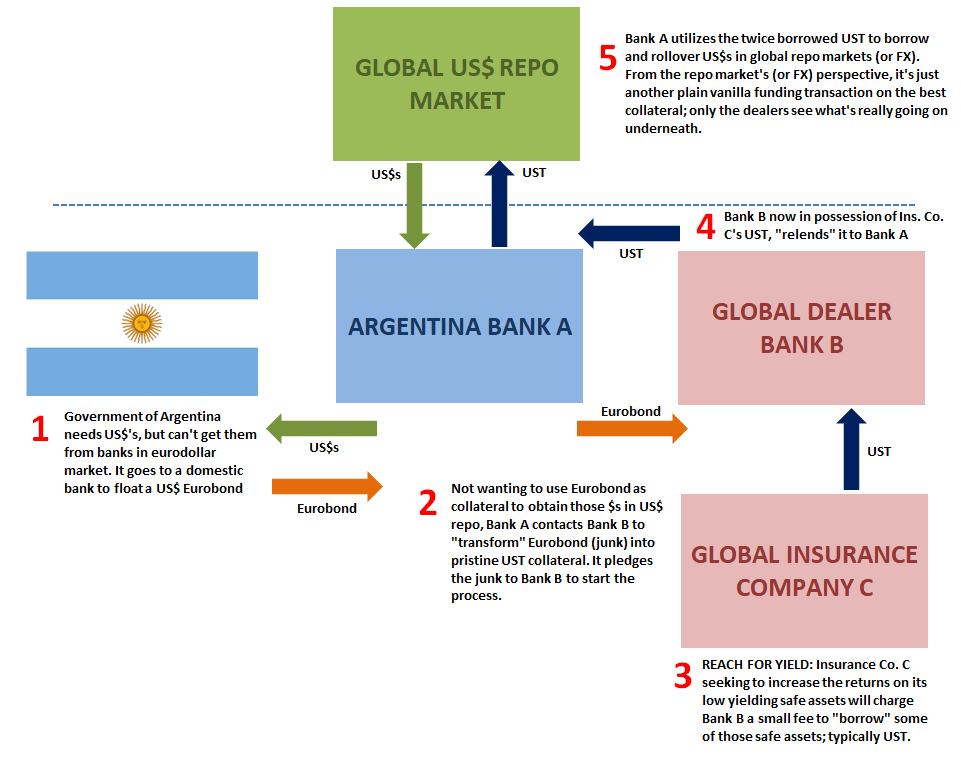

However, this view had been, you might recall, put forward back in 2018 when exchange values worldwide suddenly tanked (dollar up) beginning that April. In fact, India’s top central banker at the time, Urjit Patel, went public accusing rates (caused, he said, by the exploding fiscal deficit) working negatively alongside the Fed’s QT for being the cause of such unnecessary destruction across especially Emerging Market financial systems and their economies.

Dollar funding has evaporated, notably from sovereign debt markets. Emerging markets have witnessed a sharp reversal of foreign capital flows over the past six weeks mid-April to June 2018, often exceeding $5bn a week. As a result, emerging market bonds and currencies have fallen in value. emphasis added But, as the history of the past several years in between has shown, “dollar funding has evaporated” kept being a problem right on into March 2020 (and for quite some time afterward). And during the vast majority of that period, UST yields – long and short – had declined substantially while post-September 2019 the Fed’s balance sheet was again expanded by hundreds of billions more bank reserves. |

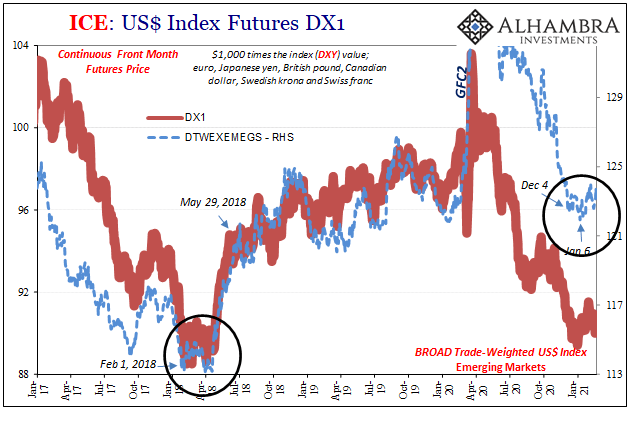

ICE: US$ Index Futures, DX1 2020-2021 |

| The dollar went up and stayed up anyway because, as Patel registered, “dollar funding has evaporated”; he, like the rest of them, have yet to figure out why this happens and, importantly for 2021, can keep happening.

Going back to early 2018, you might also recall something similar where the dollar’s broad exchange values had been concerned: right before the big jump in April, the US currency had abruptly pulled out of its “crash” from late 2017 and then traded basically sideways for several months. The implication, obviously, is for a potential rerun; we’ve got bills suggesting collateral issues at the short end the same time mild/questionable reflation at the long end (just like early ’18) while the dollar is no longer reflationar-ily dropping across a very wide range of currencies. It’s not heading upward, but, like ’18, is it shifting toward that next stage which then might see a more sustained and disruptive rise? |

ICE: US$ Index Futures, DX1 2017-2021 |

The irony, such that there might be any, is that for many of these countries on the wrong end of the dollar they’re being squeezed by higher oil prices that in this case are have been pushed upward for the “wrong” reasons of (deflationary) supply factors. Had it been more consistent with the “good” inflationary trends of healthy demand returning to a world returning to normal, then we’d expect the dollar to continue lower.

And it just might; right now, the “next stage” dollar saga is itself just a possibility though one made all the more compelling by how the pattern repeats itself (including 2014; bill/collateral indications late in ’13, minor currency problems concurrent, and then dollar up straight away in ’14 followed later in the year by the more devastating stuff).

We shouldn’t be surprised if the dollar does begin to rise more forcefully, especially if what’s indicated by bill yields keeps up.

If that does happen, it doesn’t necessarily mean disaster, either; only that we’ll have more work to do in order to piece together and understand the nature and severity of the “dollar funding has evaporated” which will have set all these things further in motion.

We aren’t there quite yet. A few things are starting to align, but we’ll see how this goes heading toward mid-March.

Tags: bills,Bonds,Brazil,broad trade-weighted us dollar index,collateral,currencies,dollar,dollar funding,Dollar Index,DXY,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,global dollar shortage,Markets,Mexico,newsletter,Notes,Peso,real,repo,rising dollar,ruble,Russia,U.S. Treasuries,urjit patel