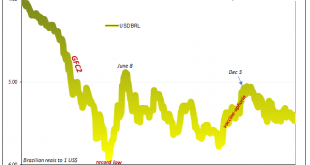

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal government. With the...

Read More »Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

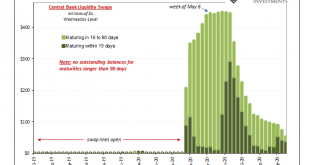

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday. Six months after Jay Powell conducted what he called a “flood”, with every financial media outlet reporting as fact this stream of digital dollars into every corner of the world, how can there be anything greater than zero in overseas liquidity swaps? Six months is an eternity....

Read More »Major Currency Pairs & The Election (Video)

By EconMatters We focus on the Election effects regarding the major currency pairs and the US Dollar in this video. Check out the Swiss Franc and the Mexican Peso Price Action after the election. This election has probably been great for CNN`s ratings, that would be a short after the election cycle is over. [embedded content] Related posts: October...

Read More »Market Impact of a Trump Presidential Win

The probability of Republican Donald Trump winning the U.S. presidential election on November 8 seems remote at the moment—economists on Credit Suisse’s Global Markets team put it at less than 10 percent. So if it did happen, it would come as a major surprise for financial markets. The last time that kind of seemingly low-likelihood event came to pass—during last June’s Brexit vote—most investors were caught wrong-footed. So how might they best prepare for something as unexpected as President...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org