Summary:

Many observers conclude OPEC is dead. Oh, its demise has been claimed before, but after the oil cartel failed to provide a quota (output goal) in last week's statement, the claim has been given new life. The problem is that OPEC's action under Saudi leadership may be perfectly rational for a cartel. Suppose you were playing Machiavelli to a Saudi Prince. What would you advise? The Prince is concerned that many OPEC and non-OPEC producers increased their output and expected the Prince to bear the burden and cut output. The loss of control of the oil market costs money, prestige, and if allowed to persist, would challenge the lifestyle and strategic role of the kingdom. Perhaps, it would be useful to begin by looking at the strategy of other cartels, like J.D. Rockefeller or Andrew Carnegie. You would find that they would drive the price of oil or steel down to squeeze out inefficient producers, and often scoop up their assets on the cheap. After regaining control of the market, they would be able to raise prices again, and earn what economists call "monopoly rents." Saudi Arabia is insisting on similar tactics. Many OPEC countries have had to go along with Saudi Arabia because they smaller producers. Many observers seem confused. They see the lower price of oil as a failure of the Saudi strategy. It signals some say, the end of OPEC.

Topics:

Marc Chandler considers the following as important: Featured, FX Trends, newsletter

This could be interesting, too:

Many observers conclude OPEC is dead. Oh, its demise has been claimed before, but after the oil cartel failed to provide a quota (output goal) in last week's statement, the claim has been given new life. The problem is that OPEC's action under Saudi leadership may be perfectly rational for a cartel. Suppose you were playing Machiavelli to a Saudi Prince. What would you advise? The Prince is concerned that many OPEC and non-OPEC producers increased their output and expected the Prince to bear the burden and cut output. The loss of control of the oil market costs money, prestige, and if allowed to persist, would challenge the lifestyle and strategic role of the kingdom. Perhaps, it would be useful to begin by looking at the strategy of other cartels, like J.D. Rockefeller or Andrew Carnegie. You would find that they would drive the price of oil or steel down to squeeze out inefficient producers, and often scoop up their assets on the cheap. After regaining control of the market, they would be able to raise prices again, and earn what economists call "monopoly rents." Saudi Arabia is insisting on similar tactics. Many OPEC countries have had to go along with Saudi Arabia because they smaller producers. Many observers seem confused. They see the lower price of oil as a failure of the Saudi strategy. It signals some say, the end of OPEC.

Topics:

Marc Chandler considers the following as important: Featured, FX Trends, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Many observers conclude OPEC is dead. Oh, its demise has been claimed before, but after the oil cartel failed to provide a quota (output goal) in last week's statement, the claim has been given new life.

The problem is that OPEC's action under Saudi leadership may be perfectly rational for a cartel. Suppose you were playing Machiavelli to a Saudi Prince. What would you advise? The Prince is concerned that many OPEC and non-OPEC producers increased their output and expected the Prince to bear the burden and cut output. The loss of control of the oil market costs money, prestige, and if allowed to persist, would challenge the lifestyle and strategic role of the kingdom.

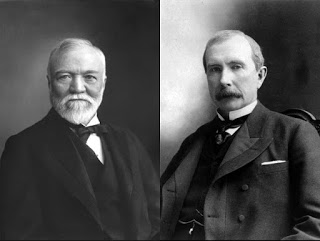

Perhaps, it would be useful to begin by looking at the strategy of other cartels, like J.D. Rockefeller or Andrew Carnegie. You would find that they would drive the price of oil or steel down to squeeze out inefficient producers, and often scoop up their assets on the cheap. After regaining control of the market, they would be able to raise prices again, and earn what economists call "monopoly rents."

Saudi Arabia is insisting on similar tactics. Many OPEC countries have had to go along with Saudi Arabia because they smaller producers. Many observers seem confused. They see the lower price of oil as a failure of the Saudi strategy. It signals some say, the end of OPEC. What they miss is that through a decline in prices the cartel seeks to re-establish its control. The drop in oil prices will reduce some supply. Non-OPEC output is expected to fall next year. It likely would not have if Saudi Arabia continued its previous strategy of acting as a swing producer.

How does one tell the difference between someone winking, someone with a twitch, and someone mimicking someone winking or twitching? The acts look alike, but the context and social meaning are quite distinct. The action of a cartel trying to discipline the market and a collapsed cartel may look eerily similar from a high level of abstraction, but they are as different as a surgeon cutting a patient in a surgical procedure and a stabbing.

This is not the first time the Saudi Arabia has rejected the role as a swing producer. It is not the first time oil prices have sold off in response. While some see the arms race as having toppled the Soviet Union, others suggest it was Saudi Arabia that boost in oil output. The price of oil fell to near $10 a barrel in the mid-1980s. This, so the argument goes, created the strains that eventually toppled that regime.

Even less appreciated is the restraint that Saudi Arabia is exercising. The lack of a formal quota gave rise to the idea of a free-for-all. This is not necessarily true. Most countries have little spare to capacity already, but Saudi Arabia holding roughly 16% of its capacity back, or around 2.5 mln barrels a day.

Saudi Arabia is pursuing a grand strategy. While come countries and producers are trying to maximize current revenue, Saudi Arabia is trying to preserve the value of its vast wealth that is still mostly in the ground. It is trying to shape the global energy dynamics for years to come. How fast the world can move away from the carbon standard is partly a function of prices, which act as incentives for other oil producers as well as the development of alternatives.

Saudi Arabia has repeatedly demonstrated that it is willing to make near-term sacrifices for strategic goals. It ran large deficits between 1983 and 1998 to pursue its energy and domestic agenda. It financed nearly 50% of the first Gulf War.

One must assume that when Saudi Arabia first contemplated this strategy, they anticipated the price of oil would fall. We also suspect, based on the rational-actor model that Saudi officials understood that it would likely take some time for the strategy to take hold.

As we have noted before, businesses with high fixed costs (including debt servicing) are incentivized to continue to produce, even at a loss. Moreover, a survey of publicly available reports would have shown that some non-OPEC producers, like Canadian tar sands and US shale producers, develop capital-saving technology and techniques that lower their production costs.

This leads us to conclude that developments in the oil market, both within OPEC and outside of it, has not been a significant surprise to Saudi officials. Investment in the sector is drying up. Global demand is increasing. If high-cost non-OPEC producers continue to be squeezed, and output falls a little and world demand continues to grow, perhaps the OPEC meeting this time next year will produce a different outcome.

The purpose here is not to discuss or defend the merits of a cartel. They collect monopoly rents and stifle competition. Rather the point is to think more broadly in the aftermath of last week's meeting whether OPEC has collapsed.

There are two types of errors one can make. One can assume that the oil cartel has collapsed, and it hasn't. Or one can assume that the cartel has not collapsed, and it has. The former error seems more costly from an investment point of view. The latter is consistent with the strategic principle of not under-estimating one's adversary.