– UK debt crisis is here – consumer spending, employment and sterling fall while inflation takes off – Personal debt crisis coming to fore – litigation cases go beyond 2008 levels – October consumer spending fell by 2% in October, the fastest year-on-year decline in four years– Britons ‘face expensive Christmas dinner’ as food price inflation soars – Gold investors buying physical gold due to precarious UK and US outlook - Click to enlarge The long heralded UK debt crisis is here and data released in the U.K. this week clearly shows this. This is seen in UK retail sales and consumer spending which plunged in October, employment falling, pay stagnant and inflation ticking higher as sterling remains under

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| – UK debt crisis is here – consumer spending, employment and sterling fall while inflation takes off – Personal debt crisis coming to fore – litigation cases go beyond 2008 levels – October consumer spending fell by 2% in October, the fastest year-on-year decline in four years – Britons ‘face expensive Christmas dinner’ as food price inflation soars – Gold investors buying physical gold due to precarious UK and US outlook |

|

| The long heralded UK debt crisis is here and data released in the U.K. this week clearly shows this.

This is seen in UK retail sales and consumer spending which plunged in October, employment falling, pay stagnant and inflation ticking higher as sterling remains under pressure. Yesterday, official UK figures showed prices were up by 4.2% last month on 12 months earlier, the highest level in four years. Britons ‘face expensive Christmas dinner’ as food price inflation soars reported The Guardian yesterday. Meanwhile stock markets make new highs every week but the underlying economic data is not reflecting the “irrational exuberance” being seen in global stock markets. Increased litigation as consumer debt climbs Personal loans are becoming increasingly dangerous and more bubblelicious than even the stock market. We have outlined a few times how UK consumer debt levels are at dangerous highs risking a new UK debt crisis. Recently Standard & Poor’s raised their own concerns regarding the rapid rise in UK consumer debts.

The high levels of debt are down to easy monetary policy, according to the standards agency:

However this is unsustainable and major lenders should be on high alert due to the low levels of repayments. The situation is now so bad that the number of cases taken to court over late payments have reached levels higher than those seen in 2008. As explained in the FT:

All of this is despite low unemployment levels and an apparent increase in real incomes. The Daily Mail provided an interesting snapshot of where some of the excess debt is coming. Namely in the form of car loans which are almost mimicking the subprime market seen in the run up to 2008: |

|

| The situation of increased loans doesn’t even seem to be helping the wider economy. Retail sales have fallen sharply.

High borrowing but low spending October’s retail figures made for some dire reading. According to Visa spending fell by 2% in October, the fastest year-on-year decline in four years. As outlined in the Guardian:

Visa explained the poor figures on financial strains on households. Despite the apparent rise in real incomes the fact is inflation is climbing and shrinkflation is really impacting household expenses, not to mention Brexit.

The life raft of gold The above is just a a quick snapshot of how things at the grassroots level of the UK economy are and suggest a new UK debt crisis looms large. Real world economic conditions are really not projecting the same confidence that the stock markets are. Usually when things are performing as well as they are in equity markets then we see gold outflows and major sales. This has not been the case, as mentioned in Reuters:

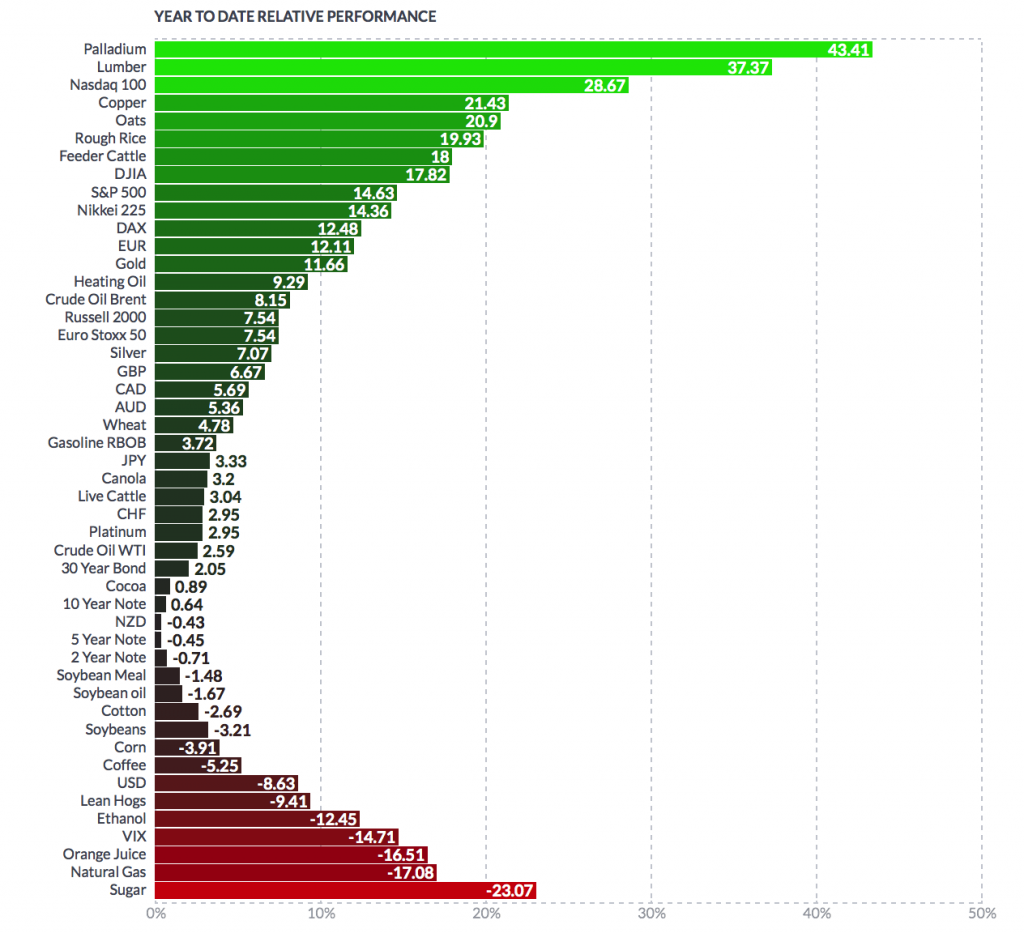

Whilst the price might not have performed to the level many were expecting, it is still significantly up on the year – by over 11%. |

|

| Gold’s price climb, along with low gold liquidations, increased demand for gold coins and bars and central bank purchases suggests that gold buyers have identified that not all is as it seems in the so called “recovery”.

It is obvious from both political and economic events that the global economic crisis is not over. Data shows that we are fast approaching circumstances worse than those seen prior to 2008. Sadly no one is acknowledging them and solutions and preparations are not being considered. |

Tags: Daily Market Update,Featured,newslettersent