As we go through an important paradigm shift in politics, in the global economy, in equity markets, and of course in precious metals too, the fundamental economic principles we used to rely on seem to be increasingly under attack. Central bankers the world over are doubling down on reckless monetary policies, punishing savers and responsible, long-term investors. In Europe, we have already seen the damage that negative interest rates and protracted QE have inflicted, and will continue to...

Read More »“Our prosperity is temporary and illusory. “ – Jeff Deist

As we go through an important paradigm shift in politics, in the global economy, in equity markets, and of course in precious metals too, the fundamental economic principles we used to rely on seem to be increasingly under attack. Central bankers the world over are doubling down on reckless monetary policies, punishing savers and responsible, long-term investors. In Europe, we have already seen the damage that negative interest rates and protracted QE have inflicted, and will continue...

Read More »Developed market equities update: a fairly reassuring reporting season

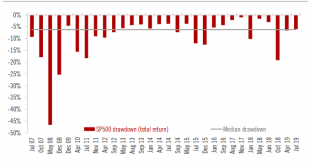

There is an ongoing tug-of-war between trade tensions and fundamentalsDue to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises.Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August low and 10-year US...

Read More »Developed market equities update: a fairly reassuring reporting season

There is an ongoing tug-of-war between trade tensions and fundamentals Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises. Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August...

Read More »JULY FED MEETING REVIEW

The Federal Reserve cut rates by 25bps on 31 July for the first time in 10 years. We continue to expect another rate cut in September.As expected and as telegraphed, the Fed cut rates by 25bps on 31 July – the first rate cut since December 2008 – and it ended prematurely its quantitative tightening programme (in August instead of September).Chairman Jerome Powell justified the rate cut as an “insurance” cut, i.e. to insure against the downside risks to US growth, mostly coming from weak...

Read More »All this borrowing to consume is unsustainable and the bill is overdue

INTERVIEW WITH KEITH WEINER June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail,...

Read More »All this borrowing to consume is unsustainable and the bill is overdue

INTERVIEW WITH KEITH WEINER June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail, confirm the strategic superiority of precious metals holdings in this...

Read More »Gold is the secret knowledge of the financial universe

Interview with Chris Powell Every seasoned gold investor and every student of monetary history has likely stumbled upon various theories about institutional manipulation of the gold market. While it is true that rarely is there smoke without fire, it is still important to approach this matter rationally and form opinions based on sound evidence and solid research. This is why I have personally been following the work of...

Read More »Gold is the secret knowledge of the financial universe

Interview with Chris Powell Every seasoned gold investor and every student of monetary history has likely stumbled upon various theories about institutional manipulation of the gold market. While it is true that rarely is there smoke without fire, it is still important to approach this matter rationally and form opinions based on sound evidence and solid research. This is why I have personally been following the work of the Gold Anti-Trust Action Committee Inc (GATA) for quite some time....

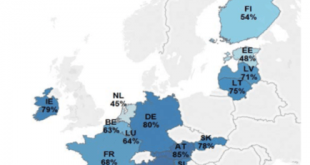

Read More »THE WAR ON CASH: A CLOSER LOOK AT ITS FAR-REACHING IMPLICATIONS – PART II

Economic, social and human cost Beyond privacy, there is also widespread concern over the economic impact of a fully cashless system. For one thing, as citizens slowly become exclusively dependent on big banks and card companies the systemic risk to the wider economy spikes. But it goes further than that too. Without the option to keep some cash outside the banking system and retain some degree of financial flexibility, banks have the potential to essentially keep their clients hostage....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org