There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells. The combination of those two will act to bring prices back down until the process reverses. As prices...

Read More »Macro Housing: Bargains and Discounts Appear

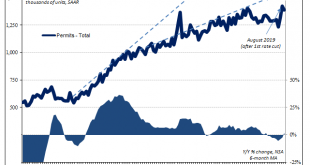

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space. Homebuilders, at least, responded in August 2019 to the first rate cut in a decade exactly the way the FOMC had imagined when...

Read More »Deja Vu

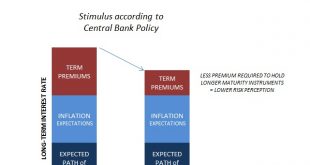

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org