Part I of II – Interview with Fernando del Pino Calvo-Sotelo As 2021 draws to an end, it is a good time for us all to pause for a moment, look back and take stock of the year that is almost behind us. It is especially interesting to recall what our expectations were at the start of the year and see how they measure up to what actually transpired. It might seem like it was eons ago, but it was actually only last January when politicians in most advanced economies were still...

Read More »Government interventions and the Cobra effect – Part I

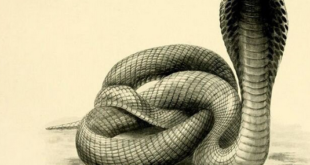

Part I of II Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for. The term was inspired by an incident that took place in India during the British rule, when the authorities tried to reduce the number of deadly cobras in Delhi by offering a cash reward to citizens for...

Read More »Government interventions and the Cobra effect – Part I

Part I of II Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for. The term was inspired by an incident that took place in India during the British rule, when the authorities tried to reduce the number of deadly cobras in Delhi by offering a cash reward to citizens for every dead...

Read More »War on Cash: EU steps up the fight

by Claudio Grass, Hünenberg See, Switzerland The prolonged and repeated lockdowns, business closures and travel bans have caused widespread economic devastation and changed the way all of us live, work and interact with each other. These were the most obvious changes that the covid crisis brought with it, however, a lot more has been unfolding in the background. Governments in most advanced economies have grasped the opportunity of this crisis and all the fear and uncertainty that...

Read More »“The bank and the government have essentially blended into one entity” – Part II

Interview with Karim Taleb Part II of II Claudio Grass (CG): Part and parcel of that same institutional “strategy”, especially in its current form, is the idea that deficits and debt don’t matter. Basically, after 2020, it can be argued that we’re all Modern Monetary Theorists now, as nobody in any position of authority has expressed any real concern over the actual costs of all this “free money”. Given the undeniable political advantages of such a “Magic Money Tree”, do you think...

Read More »A blueprint for a European superstate

The EU Pandemic Relief Deal After intense negotiations, long days and nights of clashes and a distinctly sour note underlying the entire summit, European Union leaders finally agreed on an unprecedented 1.82 trillion-euro ($2.1 trillion) budget and COVID recovery package. This agreement provided €750 billion in funding meant to counter the impact of the pandemic, while it also includes €390bn in non-repayable grants to the hardest-hit members, with Italy and Spain being the main...

Read More »Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable. The last couple of months...

Read More »Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable. The last couple of months have had a severe...

Read More »Media hysteria: Lessons from Brexit for citizens and for investors

The coronavirus epidemic has instilled real terror in the hearts of many investors, triggering a rude awaking to the actual state of the economy and panic unseen since 2008. This fear, that has spread among investors as it has among the general public, has been largely fueled by the coverage of the threat. Mainstream media, having themselves been threatened with extinction over the last decade, due to rising public mistrust, irrelevance in the age of the Internet and social media,...

Read More »Modern Monetary Theory is an old Marxist Idea

There is nothing new under the sun Modern Monetary Theory, or “MMT”, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and therefore deficits don’t matter, actually goes back to the Polish Marxist economist, Michael Kalecki (1899 – 1970). MMT as a centralisation tool MMT says...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org