“I don’t understand you,’ said Alice. ‘It’s dreadfully confusing!’ ‘That’s the effect of living backwards,’ the Queen said kindly: ‘it always makes one a little giddy at first–‘ ‘Living backwards!’ Alice repeated in great astonishment. ‘I never heard of such a thing!’ ‘–but there’s one great advantage in it, that one’s memory works both ways.’ ‘I’m sure mine only works one way,’ Alice remarked. ‘I can’t remember things before they happen.’ ‘It’s a poor sort of memory that only works backwards,’ the Queen remarked.” Lewis Carroll, Through the Looking-Glass, and What Alice Found There The seemingly nonsensical conversation between Alice and the White Queen in Lewis Carrol’s sequel to Alice in Wonderland, just might be the perfect description of Finance and Economics. Unfortunately, we live and make investments in a world using the “poor sort of memory”. We don’t “live backwards” like the Queen, although market pundits sometimes make predictions as if they did. Whether it be the economy, the financial markets or the future value of a particular security, economists, analysts and portfolio managers use memories that only work “one way” as their starting point. Historical information forms the basis of the underlying assumptions used in modeling and forecasting.

Topics:

Margarita Fernandez considers the following as important: Featured, Monthly Earnings Update, newslettersent, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

“I don’t understand you,’ said Alice. ‘It’s dreadfully confusing!’

‘That’s the effect of living backwards,’ the Queen said kindly: ‘it always makes one a little giddy at first–‘

‘Living backwards!’ Alice repeated in great astonishment. ‘I never heard of such a thing!’

‘–but there’s one great advantage in it, that one’s memory works both ways.’

‘I’m sure mine only works one way,’ Alice remarked. ‘I can’t remember things before they happen.’

‘It’s a poor sort of memory that only works backwards,’ the Queen remarked.”

Lewis Carroll, Through the Looking-Glass, and What Alice Found There

| The seemingly nonsensical conversation between Alice and the White Queen in Lewis Carrol’s sequel to Alice in Wonderland, just might be the perfect description of Finance and Economics. Unfortunately, we live and make investments in a world using the “poor sort of memory”. We don’t “live backwards” like the Queen, although market pundits sometimes make predictions as if they did.

Whether it be the economy, the financial markets or the future value of a particular security, economists, analysts and portfolio managers use memories that only work “one way” as their starting point. Historical information forms the basis of the underlying assumptions used in modeling and forecasting. The uncertainty of predicting the future is evident when one considers that buyers and sellers, with access to the same information, come to opposite conclusions. So far in 2017 equity buyers’ crystal balls have proved more accurate. The improvement in corporate earnings – that we began to see in the second half of last year – is expected to continue and that is what has propelled the stock market higher. It seems a bit presumptuous (at least for now) to call this a Trump rally. President Trump’s promises of infrastructure spending, regulatory change and tax reform may have added frosting but the cake was already in the oven. If “the Donald” can successfully implement his policies and they prove beneficial, I will have no problem giving him credit when the time comes. But for now, the only thing that he has changed is the national attitude and we should probably stick to analyzing the positives that are having an effect, in real-time, on earnings expectations and revisions. Historically, (there’s that looking backwards again), stock prices have responded to actual and/or anticipated improvements in earnings. We’ve had the former and while it is premature for analysts to include the potential effect of the administration’s plans, that doesn’t mean that investors aren’t considering the impact in their investment decisions. President Trump has impacted market sentiment, but most of the change seems to me to be based on what has been happening on corporate income statements and expectations that an “earnings refresh” may be taking place. Aggregate fourth quarter earnings growth for the S&P 500 index overall finished up about 5% – the second consecutive quarter of earnings growth following over a year of earnings contraction. Although the 2016 full year earnings growth rate was an anemic 0.4%, earnings growth was back-ended last year and first quarter 2017 is expected to deliver an almost 9% increase. However, even with our “poor sort of memory”, we can probably expect that number to come down. In fact, it has already been pared down from 12% where it stood at year-end. |

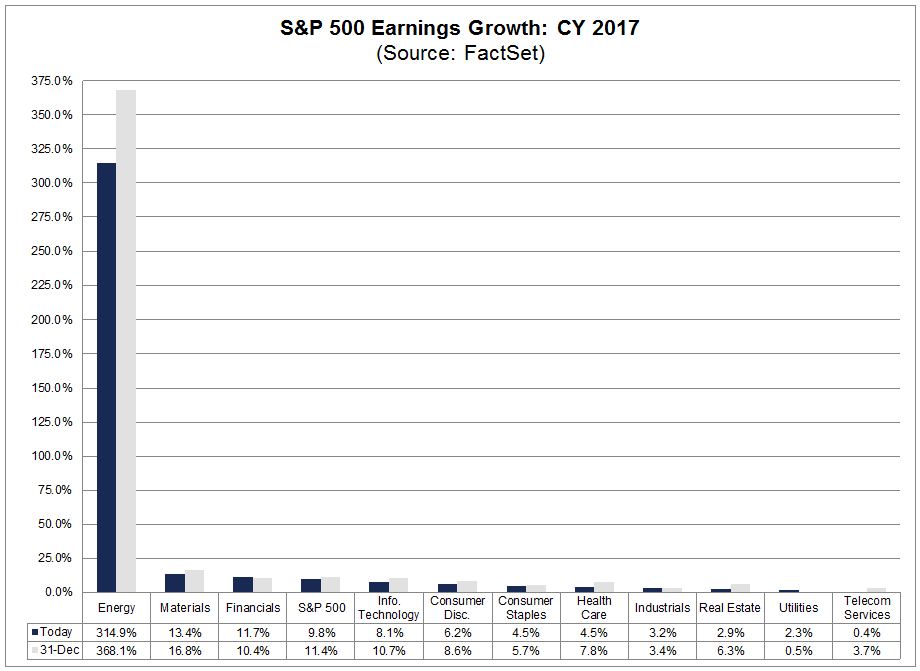

S&P 500 Earnings |

As illustrated above in FactSet’s graph of bottom-up earnings growth estimates, earnings growth is expected to continue in 2017 despite what have been subdued economic growth expectations (see Joe Calhoun’s Bi-Weekly Economic Review). A rebound in the Energy sector, reflecting the rise in oil prices, is clearly anticipated to provide a significant portion of the boost in earnings. If oil prices keep falling as they did last week, it will be interesting to see what happens to energy sector earnings estimates. Expectations for Q1 2017 have already been falling steadily, down from $31 a year ago to $29.37 today. Expectations for all of 2017 have been falling as well, from $135.95 last year to $130.21 today. If the Q1 operating earnings come through as expected – a mighty if – that would represent a 20%+ gain over the same quarter last year, which as explained above, is probably sufficient to justify the gains in stocks this year. Of course, those estimates are just that and shouldn’t be etched in stone. Recent years have taught us to expect estimate cuts through the quarter and that’s what we continue to see. Guidance in 4th quarter calls ran almost two to one negative over positive.

There is reason though – other than hoping for economic policy changes that may or may not happen – for optimism on stocks. Earnings are growing again and there has been a noticeable pick-up in the economic statistics of late. Whether that will last or not is something that only the White Queen knows.

March 10, 2017

Margarita V. Fernandez

Vice President – Alhambra Investment Partners, LLC

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Margie Fernandez can be reached at:

305-233-3774

Tags: Featured,Monthly Earnings Update,newslettersent