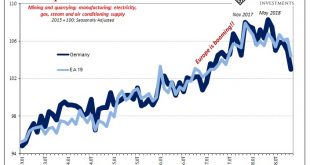

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention. China put up some bad trade numbers for last month, but Europe’s goods downturn came first. According to...

Read More »As Germany and France Come Apart, So Too Will the EU

If we follow the logic and evidence presented in these seven points, we are forced to conclude that the fractures in France, Germany and the EU are widening by the day. When is a nation-state no longer a functional state? It’s an interesting question to ask of the European nation-states trapped in the devolving European Union. Longtime correspondent Mark G. recently posed seven indicators of dissolving national...

Read More »The Decline and Fall of the European Union

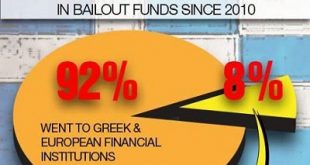

This exhaustion of the neocolonial-neofeudal model was inevitable, and as a result, so too is the decline and fall of the European integration/exploitation project. That a single currency, the euro, would fracture rather than unite Europe was understood long before the euro’s introduction as legal tender on January 1, 2002. The euro, the currency of 19 of the 28 member states of the European Union, is only one of the...

Read More »Where Will You Be Seated at the Banquet of Consequences?

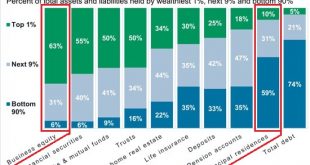

To get a good seat at the banquet of consequences, the owner of capital has to shift his/her capital into scarce forms for which there is demand. The Banquet of Consequences is being laid out, and so the question is: where will you be seated? The answer depends on two dynamics I’ve mentioned many times: what types of capital you own and the asymmetries of our economy. One set of asymmetries is the result of the system...

Read More »The Recession Will Be Unevenly Distributed

Those households, enterprises and organizations that have no debt, a very low cost basis and a highly flexible, adaptable structure will survive and even prosper. The coming recession will be unevenly distributed, meaning that it will devastate many while leaving others relatively untouched. A few will actually do better in the recession than they did in the so-called “recovery.” I realize many of the concepts floated...

Read More »You Know It’s Coming

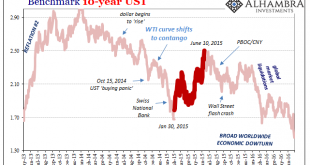

After a horrible December and a rough start to the year, as if manna from Heaven the clouds parted and everything seemed good again. Not 2019 this was early February 2015. If there was a birth date for Janet Yellen’s “transitory” canard it surely came within this window. It didn’t matter that currencies had crashed and oil, too, or that central banks had been drawn into the fray in very unexpected ways. Actually it...

Read More »If You’ve Lost The ISM…

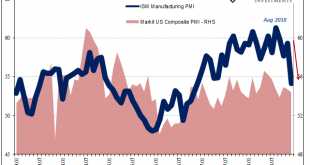

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow. Yesterday, completely different story. Apple got it started downhill and the ISM pushed it off the cliff. The tech giant’s CEO admitted the global economy is...

Read More »Living In The Present

The secret of health for both mind and body is not to mourn for the past, nor to worry about the future, but to live in the present moment wisely and earnestly. Buddha Review It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable...

Read More »Could Stocks Rally Even as Parts of the Economy Are Recessionary?

It’s not yet clear that the stock market swoon is predictive or merely a panic attack triggered by a loss of meds. We contrarians can’t help it: when the herd is bullish, we start looking for a reversal. When the herd turns bearish, we also start looking for a reversal. So now that the herd is skittishly bearish, anticipating a recession, contrarians start wondering if a most hated rally is in the offing, one that would...

Read More »Nothing To See Here, It’s Just Everything

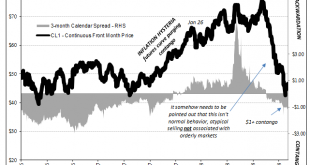

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal. In May, the Trump administration formally withdrew from the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org