I am on vacation, and then on a business trip that will interrupt the commentary until the weekly note on April 30. The May monthly analysis will be published the following week after the FOMC meeting and April employment report. I wanted to weigh in on a few key market issues before leaving. New Divergence: The continued robust US jobs growth (276k average in Q1 24 and 251k average in 2023) and above-trend growth allow the Federal Reserve to remain focused on...

Read More »FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment. Theory needs to accommodate the new facts. Theory is being...

Read More »FX Weekly Preview: Cutting to the Quick

Central banks are prepared to take fresh measures to strengthen and extend the business cycle primarily because price pressures are below what their predecessors thought would be acceptable levels. Draghi, speaking for the ECB, the Federal Reserve, and the Bank of Japan ratcheted up their concerns, which, even without new initiatives, were sufficient to drive interest rates lower. Eurozone There is no real definition...

Read More »FX Weekly Preview: Curiouser and Curiouser

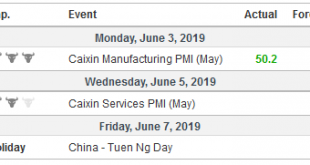

The first week of June features the Reserve Bank of Australia meeting, an ECB meeting, and the US employment data. The RBA is expected to deliver its first rate cut in three years. The market appears to have discounted not only a second cut in H2 but has priced nearly half of a third cut as well. A soft inflation reading after the seasonal bump in April and disappointing survey data, with Brexit and trade tensions,...

Read More »Cool Video: A Tentative Answer to the Low Vol Question

I had the privilege of joining the set of anchors Julie Cchatterley, ScarletFu, and Joe Weisenthal on the set of “What’d You Miss” today. The unrehearsed discussion took an unexpected turn when Joe asked about the low volatility. The anchors were patient and gave me time to provide a sketch of the thesis of my book, Political Economy of Tomorrow, where I suggest a under appreciated factor in the low price of capital is...

Read More »Another Look at Why the Return to Capital is Low

(summary of presentation based on my book, Political Economy of Tomorrow, delivered to Bank Credit Analyst conference yesterday) Alice laughed. There is no use trying; she said, “one can’t believe impossible things.” I dare say you haven’t had much practice, said the queen. When I was younger, I always did it for half an hour a day. Why sometimes I’ve believed as many as six impossible things before breakfast. — Lewis...

Read More »The Need for Higher Wages: Lots of Thunder, No Rain

Summary: Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who’s goal is to boost labor’s share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth. Charlie Chaplin All that is solid is melting. After...

Read More »Great Graphic: The Decline in Durable Goods Prices

Summary: Service prices are rising, while goods prices have steadily fallen. Non-durable goods prices are stabilizing, while durable goods prices are still falling. The decline in durable goods prices is an important economic development. The rust line is service prices. They are steadily increasing. No deflation or disinflation here. Think about rent, medical services, education, and entertainment. The three...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org