Interview with Robert Hartmann As we enter the second quarter of 2021, the year during which so many mainstream analysts and politicians have predicted we’ll see a miraculous recovery from the covid crisis, it is becoming increasingly clear that the damage inflicted by the lockdowns and the shutdowns is really very extensive an persistent. Of course, I’m referring to the damage to the real economy, that is, to actual businesses, households and the countless citizens...

Read More »Precious metals are and always have been the ultimate insurance

Interview with Robert Hartmann As we enter the second quarter of 2021, the year during which so many mainstream analysts and politicians have predicted we’ll see a miraculous recovery from the covid crisis, it is becoming increasingly clear that the damage inflicted by the lockdowns and the shutdowns is really very extensive an persistent. Of course, I’m referring to the damage to the real economy, that is, to actual businesses, households and the countless citizens that were...

Read More »The Growing Opposition Against the ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone. After all, over the last decade, the ECB has proved to be a “one-trick pony”, with negative rates and bond-buying...

Read More »THE GROWING OPPOSITION AGAINST THE ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone. After all, over the last decade, the ECB has proved to be a “one-trick pony”, with negative rates and bond-buying being used as a...

Read More »THE GROWING OPPOSITION AGAINST THE ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone. After all, over the last decade, the ECB has proved to be a “one-trick pony”, with negative rates and bond-buying being used as a...

Read More »A buying opportunity in precious metals

After a remarkable run over the past few months, gold and silver now appear to have entered a period of consolidation. Many speculators and short-term focused investors have sold their positions fearing a correction, while mainstream market commentators fuel these fears, with analyses that proclaim “the end of the road” for gold and silver. Of course, nothing could be further from the truth. All the very serious concerns and the fundamental reasons that caused the metals to rise so...

Read More »A buying opportunity in precious metals

After a remarkable run over the past few months, gold and silver now appear to have entered a period of consolidation. Many speculators and short-term focused investors have sold their positions fearing a correction, while mainstream market commentators fuel these fears, with analyses that proclaim “the end of the road” for gold and silver. Of course, nothing could be further from the truth. All the very serious concerns and the fundamental reasons that caused the...

Read More »A buying opportunity in precious metals

After a remarkable run over the past few months, gold and silver now appear to have entered a period of consolidation. Many speculators and short-term focused investors have sold their positions fearing a correction, while mainstream market commentators fuel these fears, with analyses that proclaim “the end of the road” for gold and silver. Of course, nothing could be further from the truth. All the very serious concerns and the fundamental reasons that caused the metals to rise so...

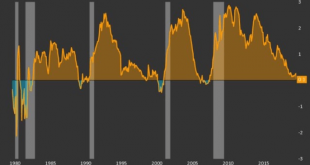

Read More »A turning point in the bond market?

We’ve recently seen a lot of coverage and even more “expert analyses” on the state of the bond market, to the extent that the average investor, or the average citizen for that matter, is likely to be overwhelmed and very confused about what it all means. Experts from the institutional side and defenders of the current monetary direction argue that it is all the result of policy choices, that’s it’s all under control and that we really shouldn’t worry about the...

Read More »A turning point in the bond market?

We’ve recently seen a lot of coverage and even more “expert analyses” on the state of the bond market, to the extent that the average investor, or the average citizen for that matter, is likely to be overwhelmed and very confused about what it all means. Experts from the institutional side and defenders of the current monetary direction argue that it is all the result of policy choices, that’s it’s all under control and that we really shouldn’t worry about the extreme phenomena and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org