In an interview with the NZZ, Christoph Schaltegger argues that Swiss cantons loose revenue when new firms move in, due to badly structured inter cantonal revenue sharing (Finanzausgleich).

Read More »Python and Julia for Economists

On their “Quantitative Economics” website, Thomas Sargent and John Stachurski offer great introductions to the Python and Julia programming languages.

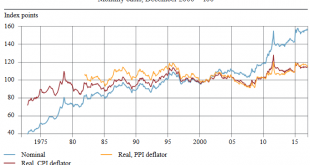

Read More »Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the...

Read More »Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the countries incorporated into the index; and calculation of a chained index....

Read More »On the State of Macroeconomics

In a paper, Ricardo Reis defends macroeconomics against various critiques. He concludes: I have argued that while there is much that is wrong with macroeconomics today, most critiques of the state of macroeconomics are off target. Current macroeconomic research is not mindless DSGE modeling filled with ridiculous assumptions and oblivious of data. Rather, young macroeconomists are doing vibrant, varied, and exciting work, getting jobs, and being published. Macroeconomics informs...

Read More »Models Make Economics A Science

In the Journal of Economic Literature, Ariel Rubinstein discusses Dani Rodrik’s “superb” book “Economics Rules.” The article nicely articulates what economics and specifically, economic modeling is about. Some quotes (emphasis my own) … … on the nature of economics: [A] quote … by John Maynard Keynes to Roy Harrod in 1938: “It seems to me that economics is a branch of logic, a way of thinking”; “Economics is a science of thinking in terms of models joined to the art of choosing models...

Read More »Who Voted for Brexit?

In a CEPR Discussion Paper, Sascha Becker, Thiemo Fetzer, and Dennis Novy argue that education and income mainly explain voting outcomes. In the abstract of their paper, the authors write: We find that exposure to the EU in terms of immigration and trade provides relatively little explanatory power for the referendum vote. Instead, … fundamental characteristics of the voting population were key drivers of the Vote Leave share, in particular their education profiles, their historical...

Read More »Independent Fiscal Institutions

In the FT blog, Peter Doyle emphasizes the importance of independent fiscal watchdogs. They matter. That’s why less autocratic governments pursuing competent policies support them (and others don’t). It would be useful to have independent fiscal institutions and policy watchdogs on a supranational level.

Read More »Does the Swiss Agricultural Sector Add Value?

In December 2016, the Swiss Federal Council concluded that in international comparison, government support for the Swiss agricultural sector is very high. But critics point out that the government report might understate the social cost of government support. In a separate study the lobby group `Vision Landwirtschaft’ had presented estimates according to which the Swiss agricultural sector adds negative value, on the order of 1 billion CHF per year. NZZ reports by Désirée Föry: February...

Read More »Citigroup Advises Against the `Fiscal Theory of the Price Level’

In a recent Citigroup Global Economics View Research report, Willem Buiter discusses “Bad and Good ‘Fiscal Theories of the Price Level’.” Quoting my own work on the Fiscal Theory, Buiter warns that policy makers start to pay attention to the theory: It does not often happen that a rather obscure technical bit of economic theory merits an audience wider than the small band of academics who spend their waking hours pondering such matters because that is the kind of thing they do. This note...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org