Swiss Franc The Euro has risen by 0.10% to 1.1687 CHF. EUR/CHF and USD/CHF, November 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed’s Powell prepared remarks for his confirmation...

Read More »Precious Metals Supply and Demand – Thanksgiving Week

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Grain of Salt Required The price of gold fell $7, and that of silver 24 cents. This was a holiday shortened week, due to Thanksgiving on Thursday in the US (and likely thin trading and poor liquidity on Wednesday and Friday). So take the numbers this week, including the basis, with a grain of that once-monetary commodity,...

Read More »Weekly Technical Analysis: 28/11/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, GBP/JPY

USD/CHF The USDCHF pair fluctuates around 0.9800 level, accompanied by stochastic reach to the overbought areas now, while the EMA50 keeps pushing negatively on the price and protects trading inside the bearish channel that appears on chart. Therefore, these factors encourage us to continue suggesting the bearish trend in the upcoming sessions, and breaking 0.9800 will confirm opening the way to head towards 0.9730...

Read More »Demographic Dysphoria: Swiss Village Offers Families Over $70,000 To Live There

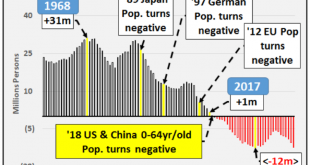

Across the world, demographic dysphoria is taking shape, creating numerous headaches for governments. To avoid the next economic downturn, governments are searching for creative measures to increase population growth and deliver a sustainable economy. In Europe, a near decade of excessive monetary policy coupled with a massive influx of refugees have not been able to reverse negative population growth– first spotted in...

Read More »Bitcoin Facts

A Useful Infographic When we last wrote more extensively about Bitcoin (see Parabolic Coin – evidently, it has become a lot more “parabolic” since then), we said we would soon return to the subject of Bitcoin and monetary theory in these pages. This long planned article was delayed for a number of reasons, one of which was that we realized that Keith Weiner’s series on the topic would give us a good opportunity to...

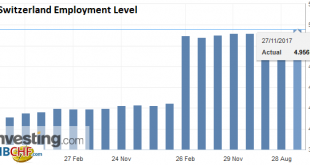

Read More »Employment barometer in the 3rd quarter 2017: Employment continues to increase in the 3rd quarter 2017

Neuchâtel, 27.11.2017 (FSO) – In the 3rd quarter 2017, total employment (number of jobs) rose by 0.8% in comparison with the same quarter a year earlier (+0.3% with the previous quarter). In full-time equivalents, employment in the same period rose by 0.5%. The Swiss economy counted 4000 more vacancies than in the corresponding quarter of the previous year (+7.5%) and the employment outlook indicator is also indicating...

Read More »FX Daily, November 27: Slow Start to Busy Week

Swiss Franc The Euro has risen by 0.08% to 1.1702 CHF. EUR/CHF and USD/CHF, November 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed and is largely consolidating last week’s losses as the market waits for this week’s numerous events that may impact the investment climate. These include the likelihood of the US Senate vote on tax reform,...

Read More »Switzerland’s 1.3 billion franc payment to EU proves divisive

© Marko Bukorovic | Dreamstime - Click to enlarge Switzerland’s deal with the EU involves a financial contribution. The sum announced by the Federal Council is CHF 1.3 billion over the next 10 years.The arrangement, announced on Thursday to coincide with a visit by european commission president Jean-Claude Juncker, extends a previous 10 year deal. Not everyone is happy with the deal. Some, such as the Swiss...

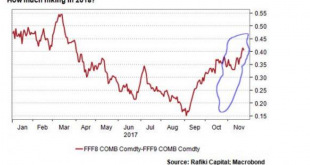

Read More »Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

– FOMC minutes show uncertainty and concern about markets are affecting officials’ decision-making – Officials were cautious when evaluating market conditions and the ‘damaging effects on the economy’ – Worry about ‘potential buildup of financial imbalances’ and a sharp reversal in asset prices’ – Members seem oblivious to impact of inflation on households and savings – Physical gold and silver remain the only assets...

Read More »Les banques centrales demandent aux banques commerciales de créer la monnaie. La preuve.

M Marc Luckx Ghisi, ancien conseiller de M Jacques Delors apporte la preuve que nous défendons depuis des années sur ce site: Les banques centrales ne créent pas de monnaie. Elles s’endettent auprès des banques commerciales! - Click to enlarge Cette entrée a été publiée dans Autres articles. Bookmarquez ce permalien. [embedded content] Related...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org