Swiss Franc The Euro has fallen by 0.32% to 1.1599 CHF. EUR/CHF and USD/CHF, November 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equities are on the march. US indices shrugged off their first back-to-back weekly decline in three months to set new record highs yesterday. The MSCI Asia-Pacific followed suit and recorded their highest close. The Dow Jones...

Read More »What do the Swiss spend their money on?

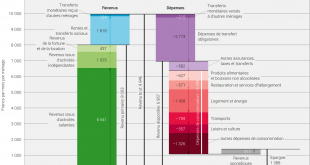

The Swiss had an average net household disposable income in 2015 of CHF6,957 ($7,007) a month, the Federal Statistical Office has reported. Every month, around CHF560 was spent on leisure and cultural activities – and CHF89 on cats and dogs. Average net disposable income is calculated by deducting compulsory expenditures from gross income. In 2015external link, average compulsory expenditures came to CHF2,990 a month,...

Read More »Bi-Weekly Economic Review: A Whirlwind of Data

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle. This being a particularly long half cycle, it has had...

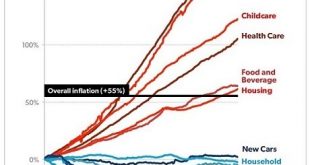

Read More »Want Widespread Prosperity? Radically Lower Costs

As long as this is business as usual, it’s impossible to slash costs and boost widespread prosperity. It’s easy to go down the wormhole of complexity when it comes to figuring out why our economy is stagnating for the bottom 80% of households. But it’s actually not that complicated: the primary driver of stagnation, decline of small business start-ups, etc. is costs are skyrocketing to the point of unaffordability. As I...

Read More »Business Cycles and Inflation, Part II

Early Warning Signals in a Fragile System [ed note: here is Part 1; if you have missed it, best go there and start reading from the beginning] We recently received the following charts via email with a query whether they should worry stock market investors. They show two short term interest rates, namely the 2-year t-note yield and 3 month t-bill discount rate. Evidently the moves in short term rates over the past ~18...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »Great Graphic: Euro Approaching Key Test

Summary: Euro is testing trendline and retracement objective and 100-day moving average. Technical indicators on daily bar charts warn of upside risk. Two-year rate differentials make it expensive to be long euros vs. US. Beware of small samples that may exaggerate seasonality. This Great Graphic, created on Bloomberg, shows that the euro is approaching key area. The white trendline drawn off the September 8,...

Read More »Swiss still richest, according to Credit Suisse

© Wrangel | Dreamstime - Click to enlarge The Credit Suisse 2017 Global Wealth Report, shows total global wealth rose 6.4% to USD 280 trillion in 2016, taking it to the its highest level since 2007, before the financial meltdown in 2008. Globally, average wealth per adult was USD 56,540. In Switzerland, the same figure was USD 537,600 (CHF 533,000), close to ten times the global average, placing Switzerland in the...

Read More »Swiss Government stays mum on EU Negotiations Strategy

The Swiss are getting ready to negotiate with the EU when European Commission President Jean-Claude Juncker visits next week (Keystone) The seven-member Federal Council has refused to reveal its position on future negotiations with the European Union over CHF1 billion (little over $1 billion) in voluntary ‘cohesion’ payments destined for central and eastern European countries. On Wednesday, the government discussed its...

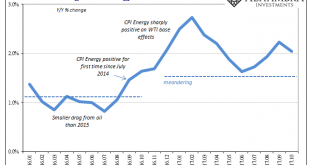

Read More »Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found. It’s confounding even central bankers who up...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org