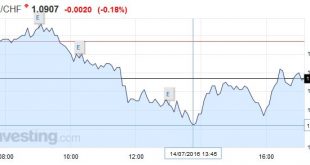

Swiss Franc The euro-Swiss is moving back to reality, after the risk-on run in the beginning of the week. The continued yen weakening is slightly negative for the franc given that some algorithms correlate the two safe-haven currencies. Click to enlarge. United Kingdom After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new...

Read More »Great Graphic: If You Think Sterling has Bottomed, Where may it Go?

Summary: Many think sterling has bottomed. A number of technical factors point to potential toward $1.42. Fundamental considerations do not appear as supportive as technicals. With the Bank of England apparently surprising the market more than one might have expected, given the split surveys, many are thinking sterling has bottomed. If it has bottomed, where could it go? A number of technical...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »BOE Surprises by Doing Nothing, but Tips August Action

Summary: BOE neither cut rates not announced a new asset purchase plan. Sterling rallied hard. However, the BOE indicated an August ease and I look for sterling to pare knee-jerk gains. The Bank of England surprised many, if not most, participants by not changing policy. There was no rate cut and no asset purchase plan. However, there can be little doubt that the BOE will take action next month. The minutes...

Read More »Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Negative for 10 Years Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon. As it turned out the issue was historic in another way as well: with the prevailing 10Y bond trading well in negative yield territory, it was largely expected that today’s bond auction would likewise issue at a negative yield, and...

Read More »Swiss Producer and Import Price Index, June 2016: +0.1 percent MoM, -1.0 percent YoY

14.07.2016 09:15 – FSO, Prices (0353-1607-00) Producer and Import Price Index in June 2016 0.1% rise in Producer and Import Price Index Neuchâtel, 14.07.2016 (FSO) – The Producer and Import Price Index rose in June 2016 by 0.1% compared with the previous month, reaching 99.9 points (base December 2015 = 100). Whereas the Producer Price Index declined by 0.2%, the Import Price Index rose by 0.8%. The slight increase...

Read More »Emerging Markets: Preview of the Week Ahead

EM and other risk assets rallied on Friday after the strong US jobs data. It appears that markets are pricing in a benign backdrop for risk near-term; that is, the US economy is recovering but not by enough to warrant an imminent Fed rate hike. The July 27 meeting seems unlikely, and so the next likely window would be September 21. Yet EM typically weakens in the run-up to FOMC meetings and so investors should...

Read More »FX Weekly Preview: Sources of Movement

Summary: Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins. Investors are under siege. A growing proportion of bonds in Europe and Japan offer negative yields. The German and Japanese curves are negative out 15-years, while one cannot find a positive yield among any tenor of Swiss government bonds. Despite a string of...

Read More »Alan “Bubbles” Greenspan Returns to Gold

Faking It Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. — Alan Greenspan, 1961 He was in it for the power...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org