The Transition “The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better.” Ron Paul The intricate relationship between energy markets and our global financial system, can be...

Read More »FX Weekly Preview: EMU Returns to Center Stage in the Week Ahead

Summary: Key event in Europe is not on many calendars–it is a ruling by the European Court of Justice. UK government and Tory Party stabilizing, leaving the Labour Party in disarray. US economy appears to have accelerated into the end of Q2. BOJ’s meeting at the end of the month. Four large dramas being played out among the major high income countries. The drama in the eurozone moves center stage in the...

Read More »Speculative Sentiment Shifts

The combination of a robust US jobs report, speculation of bolder action by Japan, the possibility that the ECB drops the capital key to overcome the ostensible shortage of some core bonds (e.g. German bunds), and the anticipation of easier BOE policy appears to have generated a change in sentiment among speculators in the currency futures market. A pattern was clear in the speculative position adjustments in the...

Read More »FX Weekly Review, July 11 – July 15: It is not About the Dollar, but About Other Currencies

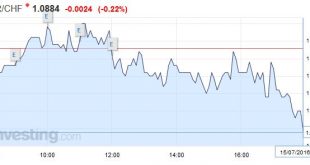

Swiss Franc Currency Index The Swiss Franc continues to under-perform the dollar index in the month after Brexit. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 40% of the SNB portfolio and of...

Read More »Brexit or not, the pound will crash

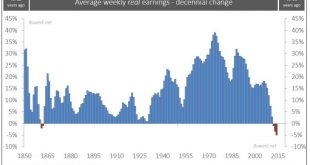

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience we believe it says something...

Read More »Helping Robots Find Jobs…

Meaningless Noise BALTIMORE – The Dow rose 250 points on Friday… putting it back near its all-time high. A “blow-out jobs report” was said to be the inspiration. Oh my… so many dots.. so little time. Friday’s jobs report said that 278,000 Americans found work in June – up from 11,000 in May. This was considered such good news that investors rushed to buy stocks. At least, that was the line taken by the mainstream...

Read More »Great Graphic: Equities Since Brexit

Since the UK voted to leave the EU, emerging market equities have outperformed equities from the developed markets. This Great Graphic, composed on Bloomberg, shows the MSCI Emerging Market equities (yellow line) and the MSCI World Index of developed equities (white line). Both time series are indexed as to June 15, but they were at nearly identical levels as the UK voted. The developed market equities fell more...

Read More »Swatch profit plunges as demand falls across europe, asia

Swatch Group AG said first-half profit fell by more than half — the most in at least 15 years — as demand for its watches in Hong Kong, France and Switzerland collapsed. © Radub85 | Dreamstime.com Sales fell about 12 percent, the Biel, Switzerland-based maker of Omega and Tissot timepieces said in an unscheduled statement on preliminary results. Analysts expected a 22 percent drop in net income and a 7 percent...

Read More »FX Daily, July 15: Sterling and Yen Remain Key Drivers in FX

Swiss Franc While the yen remained weak, the other major safe-haven, the Swiss Franc had gains. We often emphasized the main differences: The Swiss have a far higher trade surplus per capita The Swiss government does not do fiscal experiments like helicopter money, the SNB does only the monetary part. While the Swiss monetary stimulus is higher than the Japanese one. The effect of FX interventions is stronger than...

Read More »Swiss stocks higher on stimulus bet

SMI last Week The Swiss Market Index (SMI) is set to finish this week higher tracking equity market gains around the world as investors begin to anticipate a new wave of economic stimulus from central banks. Bonds Swiss Bond yields remained under zero, even until the duration of 30 years. Swiss Company News In Switzerland, economic news was light. Data showed that producer and import prices continued to decline...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org