Swiss Franc The Euro has risen by 0.11% to 1.1962 CHF. EUR/CHF and USD/CHF, April 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying a firmer tone against major and most emerging market currencies. Sterling, which has become a market darling, hit an air pocket after softer than expected CPI. Sterling had reached its highest level since the 2016...

Read More »EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East – Middle East war involving Russia may badly impact energy dependent & fragile EU – Trade and actual wars on European doorstep show the strategic weakness of the EU– Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations– Investors should diversify to hedge investment, currency...

Read More »Global Asset Allocation Update: The Certainty of Uncertainty

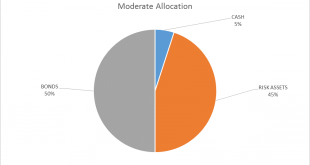

There is no change to the risk budget this month. For the moderate risk investor, the allocation to bonds is 50%, risk assets 45% and cash 5%. Stocks continued their erratic ways since the last update with another test of the February lows that are holding – for now. While we believe growth expectations are moderating somewhat (see the Bi-Weekly Economic Review) the change isn’t sufficient to warrant an asset...

Read More »Elektronisches Zentralbankengeld hat Vorteile

- Click to enlarge Die Schweizerische Nationalbank hat dem E-Franken eine Absage erteilt – zu Unrecht, sagt Dirk Niepelt im Interview mit finews.ch. Der Direktor des SNB-nahen Studienzentrums Gerzensee erklärt, warum digitales Geld Vorteile bringt. Vergangene Woche hat sich Andréa Mächler, Mitglied des dreiköpfigen Direktoriums der Schweizerischen Nationalbank (SNB), kritisch zur Einführung eines elektronischen...

Read More »Nine out of ten Swiss want to buy less, survey finds

A World Wildlife Fund (WWF) survey published on Monday has found that the majority of people in Switzerland are considering shopping less, and young people are particularly likely to take a critical look at their buying behaviour. The Swiss consume “as if there is no tomorrow”: they fly twice as frequently as their neighbours, buy the heaviest cars in Europe, and produce more waste per capita than in any other nation...

Read More »FX Daily, April 13: Markets Struggle to Find Footing while News Stream Improves

Swiss Franc The Euro has fallen by 0.03% to 1.1858 CHF. EUR/CHf and USD/CHF, April 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It had looked to many investors that world was headed for a trade war and an escalating risk war in Syria. But now it seems less clear. US President Trump’s rhetoric on trade took a more constructive tone, and a divided Administration...

Read More »Great Graphic: Aussie-Kiwi Approaches Trendline

Today is the fifth consecutive session that the Australian dollar has weakened against the New Zealand dollar. It has now fallen to test a three-year old trendline that we show on the Great Graphic, composed on Bloomberg. The last leg down in the Aussie actually began last October, and through today’s low, it is off by a little more than 7%. In fairness, it has really been in a broad range fro several years, roughly...

Read More »US Gold & Silver Futures Markets: “Easy” Targets

Following news coverage of the charging of five precious metals traders and three banks in January, Commodities Futures Trading Commission and Department of Justice documents reveal a global criminal cabal of 16 traders operating in at least four major financial institutions between 2008 and 2015 to defraud COMEX gold and silver futures markets. Of the many examples published, one reveals a UBS AG precious metals...

Read More »Création monétaire: Entente illégale entre banques centrales et commerciales sur fond de silence politique

Les crises permanentes du marché financier ont permis, aux banques centrales qui comptent, de justifier des programmes communs de quantitative easing. Cela consiste en une transformation de la monnaie bancaire scripturale en centrale, passée en mains des banques centrales. Ainsi, celles-ci offrent au marché de la haute finance un socle monétaire garanti par le contribuable, le citoyen, l’épargnant et le retraité....

Read More »Cross-border workers in Geneva face ‘toxic’ environment

Cross-border workers are tired of being the target of political attacks in Geneva, says the president of a French-Swiss cross-border lobby group, who calls for a change in current rhetoric to prevent future damage to the Swiss economy. For Michel Charrat, president of the Groupement transfrontalier européenexternal link, disenchantment between Geneva and its cross-border workers may be at its lowest point. The lobby...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org