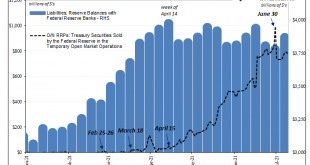

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big. To end Q2 2021, financial counterparties “lent” just about $1 trillion to the Fed. Holy cow! A trillion! There’s way too much money! Eh. The RRP, especially around its more informative margins, has little to do...

Read More »Measuring Inflation and the Week Ahead

There is quite an unusual price context for new week’s economic events, which include June US CPI, retail sales, and industrial production, along with China’s Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan. In addition, the US Treasury will sell $120 bln in coupons while the US earned income tax credit and the child tax credit is rolled out. The dollar surged even while interest rates fell. The US 10-year yield...

Read More »EU Now Accepts Swiss Covid Certificates

The European Commission has given the Swiss Covid certificate a green light for inclusion on the EU-wide digital Covid certificate platform. This means that holders of Swiss Covid certificates are able to present their Swiss-issued Covid certificate QR codes at ports of entry into EU nations under the same conditions as holders of certificates from EU nations. © maramade | Dreamstime.com The Swiss Covid certificates are valid in 27 EU countries plus Iceland and...

Read More »EU recognition of Swiss Covid certificate imminent

According to RTS, Brussels is close to giving the Swiss Covid certificate a green light for inclusion on the EU-wide digital Covid certificate platform. This means that Swiss residents will soon be able to present their Swiss-issued Covid certificate QR codes at ports of entry into EU nations. © Valerio Rosati | Dreamstime.com Swiss digital Covid certificates are expected to work in the EU by Friday 9 July 2021 or next Monday. According to RTS, a commission, composed...

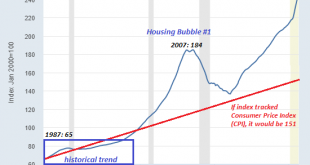

Read More »Housing Bubble #2: Ready to Pop?

All debt-fueled speculative bubbles pop, even as cheerleaders claim otherwise. The expansion of Housing Bubble #2 is clearly visible in these two charts of house valuations, courtesy of the St. Louis Federal Reserve database (FRED). The first is the Case-Shiller Index, which as you recall tracks the price of homes on an “apples to apples” basis, i.e. it tracks price movements for the same house over time. Note that this is an index chart where the index is set at 100...

Read More »Human Rights Sports Body granted Upgraded Swiss Legal Status

An organisation set up in Switzerland to prevent sport from harming society and athletes has been granted full association status in Geneva. Qatar has drawn criticism for failing to protect workers building stadiums for the next World Cup. Copyright 2019 The Associated Press. All Rights Reserved. The Centre for Sport and Human RightsExternal link was awarded the status of an independent non-profit association under Swiss law on Thursday. It has been running since...

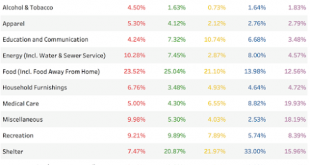

Read More »The Phillips Curve Myth

According to a popular way of thinking, the central bank can influence the rate of economic expansion by means of monetary policy. It is also held that this influence carries a price, which manifests itself in terms of inflation. For instance, if the goal is to reach faster economic growth and a lower unemployment rate then citizens should be ready to pay a price for this in terms of a higher inflation rate. Note that inflation is defined by a popular way of thinking...

Read More »FX Daily, July 09: PBOC Cuts Reserve Requirements after Inflation Measures Ease

Swiss Franc The Euro has risen by 0.17% to 1.0859 EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are winding down what has been a challenging week that has seen equity markets slide and the dollar and bonds rally. The MSCI Asia Pacific fell for the fourth consecutive session, but the more interesting story may be the intrasession recovery that could set the...

Read More »Visa Customers Spent More Than US$1 Billion on Crypto-Linked Cards in 2021

Visa revealed that its customers had spent more than US$1 billion on its crypto-linked cards in the first half of 2021. The payments giant reported that it had partnered with 50 leading crypto platforms on card programmes that make it easy to convert and spend digital currency at 70 million merchants worldwide. Visa had previously announced in March 2020 that it will allow the use of USD Coin (USDC), a stablecoin backed by the US dollar, to settle transactions on...

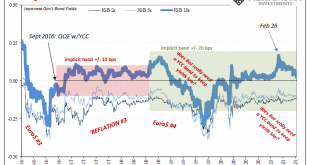

Read More »Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change. Inflation had finally been achieved across multiple geographies, it was widely repeated, and this would create problems, purportedly, as these various places would have to grapple with higher interest rates. The idea behind...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org