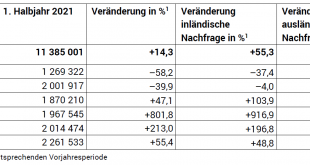

04.08.2021 – The hotel sector registered 11.4 million overnight stays in Switzerland in the first half of 2021, representing an increase of 14.3% (+1.4 million) compared with the same period of 2020. With a total of 9.2 million units, domestic demand rose by 55.3% (+3.3 million). Foreign visitors registered a 45.4% decrease (–1.8 million) with 2.2 million overnight stays. These are the provisional results from the Federal Statistical Office (FSO). . Download press...

Read More »Moving from Gold-Redeemable to Irredeemable Currency

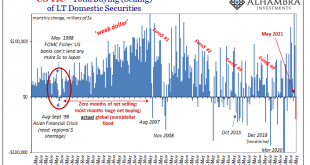

When we saw the following comment from a prominent otherwise-free-marketer, we knew it was time to write this article. “…the value of the Fed’s “liabilities”(which are so in name only) [scare quotes and parenthetic comment in original] bears only a very loose connection to the value of its assets.” This statement seems so simple. The Fed is the issuer of America’s and the world’s reserve currency (mainstream pronunciation “muhn-ee”). Observing that this paper has...

Read More »Swiss think it’s vital that other people reduce CO2 emissions

Respondents thought reducing driving was necessary – for other people Keystone / Urs Flueeler A majority (70%) of Swiss believe it’s important to avoid emissions in their everyday lives, although fewer are likely to back up their views with action, according to a survey. There were no significant differences between women and men, but the over-50 age group believed it was more important to avoid emissions than younger age groups, said a surveyExternal link by...

Read More »How the Federalists Bullied Rhode Island into Joining the United States

Doughty, courageous little Rhode Island was the last state left. It is generally assumed that—even by the most staunchly Antifederalist historians—Rhode Island could not conceivably have gone it alone as a separate nation. But such views are the consequence of a mystique of political frontiers, in which it is assumed that a mere change in political frontiers and boundaries necessarily has a profound effect in the lives of the people or the validity of a territory or...

Read More »Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries. This from the IMF’s July 30, 2021, statement gleefully announcing its governing body(ies) has(d) agreed to a general allocation of $650 billion in SDR’s, biggest in history, according to existing quotas. The purpose: “to boost existing liquidity.” This really does sounds very...

Read More »Swiss Consumer Price Index in July 2021: +0.7 percent YoY, -0.1 percent MoM

02.08.2021 – The consumer price index (CPI) fell by 0.1% in July 2021 compared with the previous month, reaching 101.0 points (December 2015 = 100). Inflation was +0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The decrease of 0.1% compared with the previous month is due to several factors including falling prices for clothing and footwear due to seasonal sales. The prices for air transport also...

Read More »Rising numbers of hikers and bikers boost Swiss economy

Almost 8% of Swiss residents over the age of 15 rode mountain bikes. Keystone / Laurent Gillieron Numbers engaging in outdoor activities like walking, cycling or mountain biking continued to rise in Switzerland in 2019, the Federal Office for Roads (ASTRA) has reported. This is also good news for the economy. Some 57% of Swiss residents labelled themselves as walkers in 2019, going on an average of 15 walks per year for an average of three hours each, ASTRA said in a...

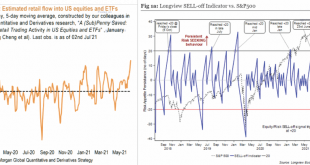

Read More »Technically Speaking: Hedge Funds Ramp Up Exposure

The “Fear Of Missing Out” has infected retail and hedge funds alike as they ramp up exposure to chase performance. We have previously discussed the near “mania” of retail investors taking on exceptional risk in various manners. From increasing leverage, engaging in speculative options trading, and taking out personal loans to invest, it’s all evidence of overconfident investors. However, that “risk appetite” is not relegated to retail investors alone. Professional...

Read More »Modern Monetary Theory

Recorded at the Mises Institute in Auburn, Alabama, on 21 July 2021. [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-08-04 Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars. Government Land Ownership and Management 2021-08-03...

Read More »When Should Governments Ban Bitcoin?

When Should Governments Ban Bitcoin? When should governments ban new technologies? Watch on Rumble ““When Should Governments Ban Bitcoin?” [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-08-04 Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org