A decline in the yearly growth rate of the Consumer Price Index (CPI) to 8.5 percent in July from 9.1 percent in June has prompted many commentators to suggest that inflation has likely peaked. If this assessment is valid then it is held Fed policy makers are unlikely to push for an aggressive interest rate tightening in the months ahead. Before one decides to agree or disagree on the likely interest rate policy of the Fed there is the need to ascertain what do we...

Read More »Switzerland key to rehabilitating tarnished crypto exchange

The BitMEX cryptocurrency exchange wants to reincorporate from its present location in the Seychelles. Keystone Troubled cryptocurrency exchange BitMEX is charting its revival in Switzerland after the platform and its three co-founders were prosecuted in the United States. When not covering fintech, cryptocurrencies, blockchain, banks and trade, swissinfo.ch’s business correspondent can be found playing cricket on various grounds in Switzerland – including the...

Read More »Credit Suisse reportedly slashing 5,000 jobs globally

The company has faced a string of scandals and mounting legal costs. It is currently undergoing what it calls a transition phase with a new CEO. © Keystone / Melanie Duchene Embattled Swiss bank Credit Suisse is planning to cut around 10% of its workforce as part of a major cost cutting drive, according to several media reports. Reuters reported on Thursday that someone with direct knowledge of the matter indicated that 5,000 positions are expected to be slashed,...

Read More »Swiss GDP growth jumps in 2021

© Bartolomiej Pietrzyk | Dreamstime.com Switzerland’s Gross domestic product (GDP) grew 4.2% in 2021, according to recently released data by Switzerland’s Federal Statistical Office (FSO). The increase follows a decrease of -2.4% in 2020, a year marking the beginning of the Covid-19 pandemic. Thanks to this upswing, GDP in 2021 was above the level of 2019, although some areas of the Swiss economy, such as hospitality, continued to suffer from the pandemic. Gross...

Read More »The Global Energy Crunch

If we insist on doing the transition the hard, slow, costly way rather than the easy, fast, cheap way, it’s going to be a needlessly arduous, soul-crushing slog. Let’s cover a few common-sense points and ask a few questions about the Global Energy Crunch.Let’s start with the high-tech, super-costly solutions that many promote as the surefire source of abundant, affordable energy: thorium reactors, mini/modular-reactors, clean coal plants and fusion. Every one of...

Read More »The Praxeological Origins of the Price System

The introduction of commodities into the market has interesting implications concerning Carl Menger’s value imputation. The subjectiveness behind this approach illustrates that marginal utility analysis may be used in the explanation of the price phenomena of a commodity, or more specifically, the price phenomena of a new item into the market. In the imaginary construction of Robinson Crusoe’s island, in which there is a community that does trade among a few...

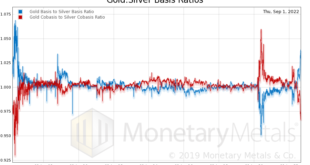

Read More »Silver Update: Scarcity Gets More Extreme

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading. Warren Buffett, 2008, and the Cobasis But first, let’s look at a chart we have discussed a few times over the years. It shows two ratios: gold basis to silver basis, and gold cobasis to silver cobasis. It shows a measure of gold’s...

Read More »Swiss Retail Sales, July 2022: 4.6 percent Nominal and 2.6 percent Real

01.09.2022 – Turnover adjusted for sales days and holidays rose in the retail sector by 4.6% in nominal terms in July 2022 compared with the previous year, with just under half of this upturn due to price increases. Seasonally adjusted, nominal turnover fell by 0.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 2.6% in July...

Read More »The System Is Busy Cannibalizing Itself

As the word suggests, cannibalism won’t end well for those consumed by the infinitely insatiable few. Cannibalize is an interesting word. It is a remarkably graphic way to describe the self-inflicted destruction of a system by stripping previously functional subsystems to sustain the illusion of system functionality. Here are some examples. An Air Force which routinely posts photos of its impressive fleet of 100 aircraft has been cannibalizing parts from 80 aircraft...

Read More »SIX Digital Exchange Goes Live With Ethereum Staking Service for Institutional Clients

SDX Web3 Services, the newly launched business unit from SIX Digital Exchange, is now live with its non-custodial Ethereum staking service. This new offering is a straightforward and secure way to launch new validators, generate yield from staking, and manage Ethereum validator nodes through a fully managed, API based infrastructure. The service is tailored to institutional clients who need to scale their Ethereum staking capabilities. SDX Web3 Services said that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org