What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Fed Funds Futures Offer Bond Market Insights

Profitable bond trading opportunities arise when your expectations about Fed policy differ from those of the market. Therefore, with the Fed seemingly embarking on a series of interest rate cuts, it behooves us to appreciate how many interest rate cuts the Fed Funds futures market expects and over what period. Equally important, Fed Funds futures help us assess the market’s economic growth and inflation expectations. Currently, Fed Funds futures imply the Fed...

Read More »Neue Schweizer Crypto Assets-Ökosystem Studie der Hochschule Luzern

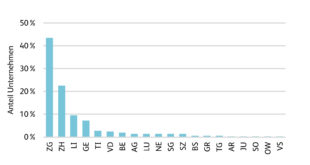

In der Schweiz und Liechtenstein hat sich in den letzten Jahren ein diverses Ökosystem rund um Investitionen in Crypto Assets entwickelt. Auch in den letzten zwölf Monaten ist dieses stetig gewachsen und hat an Vielfalt hinzugewonnen. Die Regionen Zug und Zürich beherbergen die grösste Anzahl von Unternehmen. Einen aktuellen Überblick gibt die neueste «Crypto Assets Study» der Hochschule Luzern. Zwischen Juli 2023 und Juni 2024 haben sich die Preise und die...

Read More »Drogenpolitik: Liberal statt fiskal

Die Libertäre Partei (LP) begrüsst den Vorschlag der Jungfreisinnigen, weiche und harte Drogen zu liberalisieren. Im Gegensatz zur Jungpartei geht es ihr dabei jedoch um prinzipielle Überlegungen. Eine Drogenliberalisierung bedingt gleichzeitig eine Reform des Gesundheitswesens. Mit der Forderung, sowohl weiche als auch harte Drogen zu liberalisieren, haben die Jungfreisinnigen im Zuge der Street Parade für Aufmerksamkeit gesorgt. Mit ihrem Vorschlag haben sie grundsätzlich Recht....

Read More »USD/CHF approaches 0.8700 with US Inflation on horizon

USD/CHF marches toward 0.8700 as safe-haven flows to the Swiss Franc have diminished. Investors divide over the size of Fed’s interest-rate cuts in September. Investors await the US PPI and CPI data for July, which will be published at 12:30 GMT and Wednesday, respectively. The USD/CHF pair gains to near 0.8675 in Tuesday’s European session. The Swiss Franc asset strengthens as the appeal of the Swiss Franc as a safe-haven asset diminishes due...

Read More »Gold price ticks lower amid positive risk tone and some repositioning ahead of US inflation

Gold price pulls back from the vicinity of the monthly peak retested earlier this Tuesday. Bulls opt to lighten their bets amid a positive risk tone and ahead of the US inflation data. Geopolitical risks and bets for a 50-bps rate cut by the Fed should help limit the downside. Gold price (XAU/USD) attracts some sellers following an Asian session uptick back closer to the monthly peak and erodes a part of the previous day's strong gains of more...

Read More »EUR/CHF: Spread compression to weigh – ING

It looks like G10 policy rates (ex-Japan) are going lower, ING’s FX analysts Francesco Pesole and Chris Turner note. EUR/CHF may struggle to stay above 0.95 “We are looking for at least another 125bp of ECB easing into next summer, if not 175bp. Switzerland is closer to the zero-bound constraint, however, and markets are reluctant to price the Swiss National Bank policy rate below 0.50% - just 75bp lower from current levels. Spread compression...

Read More »Subdued Market Compared to a Week Ago: Is the Dramatic Position Unwinding Over?

Overview: The capital markets have begun the week in subdued fashion. Japanese markets were closed for the Mountain Day celebration, and this week's key events, which include US and UK CPI, and the Reserve Bank of New Zealand meeting and potentially its first rate cut. The uncertainty about the market positioning and the extent of the carry-trade may also be dampening activity. The yen and Swiss franc are the weakest of the G10 currencies today, off around 0.4%. The...

Read More »Tax the Rich? Not a good idea

In the popular book “The Trading Game,” British author Gary Stevenson recounts his journey as a trader at a major U.S. bank in London. He has made lofty claims about his trading career and used it as a springboard for his successful YouTube channel, “Garys Economics.”A tailwind to his popularity is that he holds many fashionable views — for example, that money “is a token,” that printing money is akin to creating wealth, and that capitalism is the problem. He holds...

Read More »Aktueller Marktbericht zu Bitcoinkurs, Tetherkurs, Etherkurs und Ripplekurs

Am Sonntagnachmittag knickt der <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a>-Kurs ein. Um 17:11 sank <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a> um -1,17 Prozent auf 60'162,38 US-Dollar und damit unter den Stand vom Vortag (60'873,68 US-Dollar).<!-- sh_cad_1 -->Währenddessen zeigt sich <a... [embedded content]...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org