The following is an excerpt from David Enrich's nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at Citigroup, kicking government investigations into interest-rate-rigging into a...

Read More »This Is Not Expansion

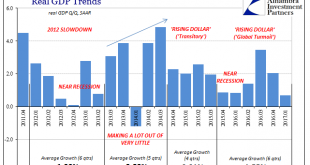

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric. The Federal Reserve had been since 2014 itching to “raise rates” if for no other reason than to...

Read More »To The Asian ‘Dollar’, And Then What?

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property). What might differ were the standards for satisfying those claims (“good delivery”...

Read More »Where There’s Smoke…

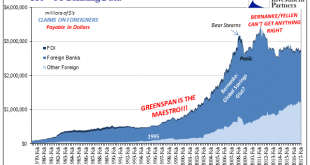

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »Optimal Lunacy

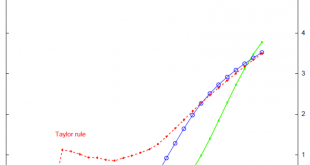

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this...

Read More »Saxo Warns Reflation Trade Ends In Q2 With “Healthy Correction”

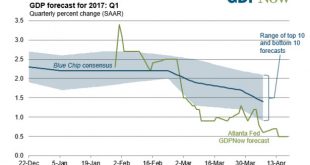

The reflation trade that started before Donald Trump’s victory in the US presidential elections accelerated in Q1 as global economic data improved and surprised against expectations. Global equities are up 6.5% in dollar terms with markets such as Hong Kong, emerging markets, and Brazil the clear outperformers. In its Q2 2017 Outlook report, Saxo Bank warns that the reflation trade will end in Q2 with a healthy correction in global equities. The biggest perception-versus-reality...

Read More »Money Without a Government II

On his blog, JP Koning discusses the case of Somalia which has managed without central bank issued money for decades. Old, legitimate notes and newer, counterfeit notes trade at the same price which equals the cost of producing counterfeits. See also this previous post.

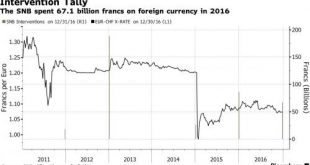

Read More »SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold...

Read More »CS and UBS Tell Wealthy Retail Clients To Buy Stocks…”Here, Can You Please Hold This Bag”

Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and “be fearful when others are greedy and be greedy when others are fearful.” In fact, being dismissive of the wall street ‘herd mentality’ has resulted in some of Buffett’s most successful trades over the years including his decision to load up on bank stocks during the ‘great recession’. But the market wizards at Credit...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org