Importance of Hiding Gold Creatively and Securely If Taking Delivery Why gold retains value? Interesting unknown gold facts "Prepare your jaws for a sizeable drop!" History, finite, rare and peak gold "It is beautiful to look at..." 'Heavy metal' - Thud sound of a gold bar (kilo) 'Going for gold' - Olympic gold medals to Chelthenham 'Gold Cup' Peak gold ... "Hard work to get gold out of the ground..." How much an Oscar is actually worth? Importance of hiding gold creatively and securely...

Read More »The Oscars – Gold Plated and Debased Like Dollar

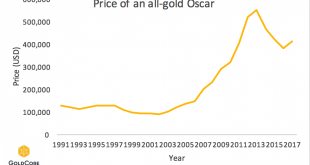

The Oscars - Worth Their Weight in Gold? 89th Oscars to air this weekend Oscars have been dipped in 24 karat gold since 1929 If the Oscars were made of solid gold they would weigh 330 ounces 330 ounces of gold is worth $408,210 at today's prices (nearly €400k & £330k) Oscars cannot be sold, making them a tricky investment piece Steven Spielberg keeps his gold Oscar with the Academy for ‘safe-keeping’ Shows importance of owning gold in safest ways Price of gold has climbed from $20.67...

Read More »Not Recession, Systemic Rupture – Again

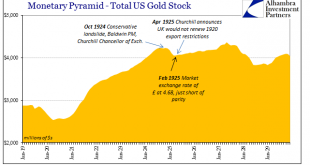

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »Not Recession, Systemic Rupture – Again

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

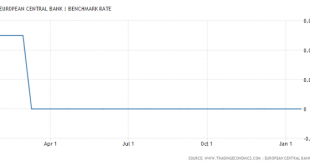

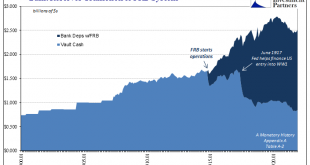

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

Read More »Are Rate Hikes Bad For Gold?

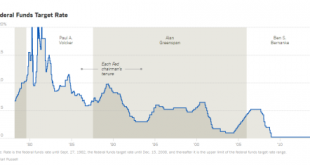

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. - Click to enlarge Here’s an alternative view courtesy of @HedgeEye. - Click to enlarge Let’s take the fist chart and see what correlations exist between...

Read More »A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it. Chairman of the Federal...

Read More »How The Flash Crash Trader Was Scammed Out Of A $50 Million Fortune

The sad saga of Navinder Sarao, who on April 20, 2015 became the scapegoat for the May 2010 flash crash and was sentenced to up to 360 years in prison - he will find out later this year the actual length of his prison sentence - got its latest twist today thanks to a fascinating report how in addition to having lost his freedom, Nav also lost all of trading fortune, some $50 million of it. As Bloomberg's Liam Vaughn recounts, "it took Navinder Singh Sarao a long time to accept that he might...

Read More »Vollgeld, the Blockchain, and the Future of the Monetary System

Presentation at the Liechtenstein Institute about the Vollgeld initiative, the blockchain revolution, and their possible effects on banks and the monetary system. Report in Liechtensteiner Vaterland, February 1, 2017. HTML. Interview in Wirtschaft Regional, February 4, 2017. PDF.

Read More »Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org