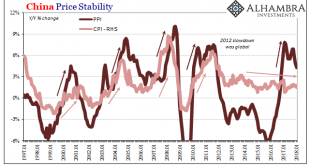

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference. There was, to me anyway, a lot of Japan in it, even still if “globally...

Read More »Bi-Weekly Economic Review

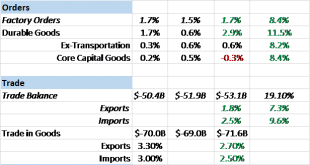

Economic Reports Economic Growth & Income Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion. Two items in this...

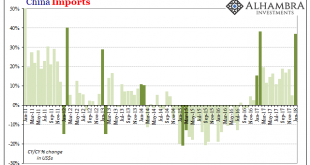

Read More »CNY, Not Imports

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February. For economic statistics, that meant extreme difficulty translating year-over-year...

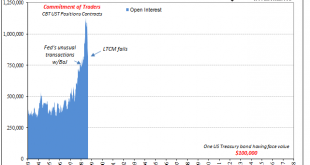

Read More »COT Blue: Interest In Open Interest

For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders. Behind all that was some darker evolutions. It was a period...

Read More »Global Asset Allocation Update:

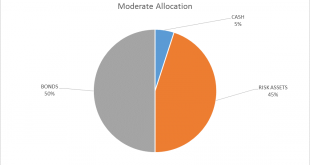

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in...

Read More »US Imports: A Little Inflation For Yellen, A Little More Bastiat

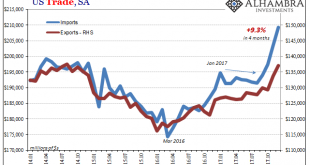

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower. The question is, obviously, what has changed? Did the boom...

Read More »How Global And Synchronized Is A Boom Without China?

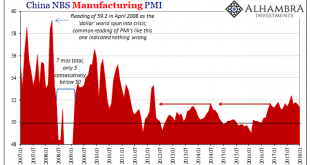

According to China’s official PMI’s, those looking for a boom to begin worldwide in 2018 after it failed to materialize in 2017 are still to be disappointed. If there is going to be globally synchronized growth, it will have to happen without China’s participation in it. Of course, things could change next month or the month after, but this idea has been around for a year and a half already. Without China, growth won’t...

Read More »The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname. One fable has it where the goddess’s sacred...

Read More »Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn: A decade after the world descended into a devastating economic...

Read More »Bi-Weekly Economic Review: Markets At Extremes

Economic Reports Production Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org