Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows. “New...

Read More »Here are three things you can learn from the Fed

Anyone who has decided to buy gold, or follows the gold price will be aware of how powerful the US Federal Reserve is. This year the Federal Reserve will turn 110 years old, only in recent years is dollar hegemony appearing to falter. Below we look at the central bank’s origins and three lessons we can learn from the history of the world’s most powerful bank, in order to help our investment decisions in 2023. Is the FED’s institutional history about to repeat...

Read More »Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Scottsdale, AZ–Nov 15, 2022 Monetary Metals is pleased to announce it has closed a Gold Bond for Akobo Minerals AB (AKOBO.OL), a publicly traded company, headquartered in Oslo, Norway. The term of the bond is two years, and investors are earning an annual interest rate of 19% on gold, paid in gold. The proceeds will be used to develop the mine entrance to Akobo’s Segele gold deposit, in addition to building and installing a processing plant on site. The bond was...

Read More »Swissquote vs Interactive Brokers

(Disclosure: Some of the links below may be affiliate links) Interactive Brokers is my favorite foreign broker, and Swissquote is my favorite Swiss broker. Both brokers are very well known and have a good reputation. So, it is time to compare Swissquote vs Interactive Brokers in detail. In this article, I look at their fees, features, and usability. We also look at the user reviews for these two tools. Best foreign broker Best Swiss Broker 5.0...

Read More »How do commission-free brokers make money?

(Disclosure: Some of the links below may be affiliate links) These last few years, we have seen more and more commission-free brokers pop up. At first sight, they look great. Who would not want to pay fewer transaction fees? But usually, if something is too good to be true, that is because it is! How do these commission-free brokers make money if they do not charge anything? We discuss that exact question in this article! By the end of this article, you will know how these brokers make money...

Read More »Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen...

Read More »Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld From the Seinfeld episode “The Opposite” I...

Read More »Giant Corporations Are Causing Inflation?

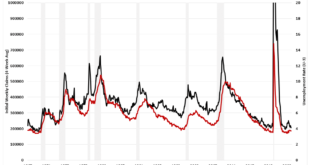

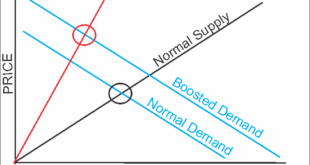

“Giant corporations are using inflation as cover to raise their prices & boost their profits. In industry after industry, we have too little competition & companies have too much power to increase prices. I’ve been calling out this corporate profiteering & price gouging” – Sen. Elizabeth Warren Another version of this argument as of late is accusing “Big Oil” of price-gouging consumers to make record-profit margins at a time when consumers are struggling....

Read More »Charles Schwab International Review – Pros & Cons

(Disclosure: Some of the links below may be affiliate links) Charles Schwab is a giant financial firm in the United States. Among other services, they offer stock broker services. And through Charles Schwab International, they are open to non-US residents. Many of my readers have requested that I write about it. Therefore, I will review Charles Schwab International from the point of view of a Swiss investor. We will how much it costs to invest with Charles Schwab International and the...

Read More »Just Keep Buying – Book Review

(Disclosure: Some of the links below may be affiliate links) I have not done a book review in a long time on this blog. I felt like most books did not deserve to be talked about. However, I felt like Just Keep Buying, from Nick Maggiulli, deserved to be talked about. In this article, I will review this book, what I liked and what I did not like. By the end of the book review, you should know whether you want to read that book or not. Just Keep Buying The book’s title already tells the main...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org