(Disclosure: Some of the links below may be affiliate links) Even before my son was born, I knew I was going to invest for my children. It is a great idea to invest for your children, and it makes a lot more sense than to let money rests on a bank account with very low interest rates. However, until recently, I never worried about how to achieve that. Once my son was born, it was time to research the best way to invest for my children! And I found a great way to do so. In this article, I...

Read More »Freya 3a Review – Pros & Cons

(Disclosure: Some of the links below may be affiliate links) Using the third pillar in Switzerland is a great way to save money on your taxes. However, it is not always easy to choose a third pillar provider since there are many of them, and new ones are regularly coming. Freya 3a is a new third pillar available in Switzerland. They aim to provide sustainable investments for the third pillar, and they claim that they are doing differently than the existing third pillars and at a reasonable...

Read More »Findependent Review 2021 – Pros & Cons

(Disclosure: Some of the links below may be affiliate links) It seems that there will not be a shortage of Robo-Advisors in Switzerland anytime soon. These last few years, there has been more and more new Robo-Advisor available for Swiss investors. Findependent is a recent Robo-Advisor. They only started in 2021. But they have some interesting characteristics already. This review will cover all there is to know about Findependent and its pros and cons. It is important to mention that...

Read More »The Inflation Tide is Turning!

In our post on January 28, 2021 “Gold, The Tried-and-True Inflation Hedge for What’s Coming!” we outlined four reasons that we expect higher inflation over the next several years. The brief bullet points are: Money Supplies have risen dramatically Commodity Prices are rising again Reduced Globalization as ‘Made at Home’ policies are proliferating Pent up demand Headlines such as this one last week from Bloomberg “Inflation gauge Hits Highest Since 1991 as Americans...

Read More »How do stock options work?

(Disclosure: Some of the links below may be affiliate links) A stock option is an advanced financial instrument. In essence, it is a contract that conveys a right to buy or sell at a specified price up to a specified date. In my advanced investing series, I want to cover options as I think they are interesting. Now, I do not recommend investing in options, and I have never done it myself either. They are an advanced financial instrument that most people will never need. Regardless, I...

Read More »How to Open an Interactive Brokers Account in 2021?

(Disclosure: Some of the links below may be affiliate links) Interactive Brokers is an excellent broker from the United States. It is known for its cheap fees and its unique range of offered investment products. It is being used by many personal finance bloggers, for instance. It is currently the best broker that allows access to U.S. ETFs. And U.S. ETFs are the most efficient ETFs for Swiss investors. In this guide, I go over the details of how to open an Interactive Brokers account. It...

Read More »The Changing Role of Gold

In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system. Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce. This week we explore the two questions that concluded last week’s...

Read More »clevercircles Review 2021 – Pros & Cons

(Disclosure: Some of the links below may be affiliate links) clevercircles is a new Robo-advisor in Switzerland that has been brought to my attention. They are adding a community feature to the Robo-advisory world. Some people have asked me whether they should use this Robo-advisor or not. So, in this review, I will analyze clevercircles in detail to see how good they are really, how much fees we need to pay, and how they invest their money. By the end of the review, you will know exactly...

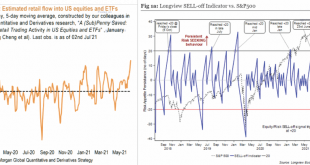

Read More »Technically Speaking: Hedge Funds Ramp Up Exposure

The “Fear Of Missing Out” has infected retail and hedge funds alike as they ramp up exposure to chase performance. We have previously discussed the near “mania” of retail investors taking on exceptional risk in various manners. From increasing leverage, engaging in speculative options trading, and taking out personal loans to invest, it’s all evidence of overconfident investors. However, that “risk appetite” is not relegated to retail investors alone. Professional...

Read More »How to Choose an ETF or an Index Fund

(Disclosure: Some of the links below may be affiliate links) If you have decided to invest in a precise stock market index, you must first choose the stock market index. And once you have selected an index to invest in, you will have to decide through which index fund you will invest in this index. For this, you can choose either a mutual fund or an Exchange Traded Fund (ETF). For popular indexes, there will be a wide choice of index funds replicating the performance of this index. Even if...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org