In our recent two-part series on the yield curve (Part One Part Two) we discussed the four predominant yield curve shifts and what they imply about economic activity and monetary policy. Additionally, given the current bullish steepening trend of the yield curve, we provided data on how prior bull steepening environments impacted various stock indexes, sectors, and factors. Missing from our analysis was a discussion of a specific type of REIT whose valuations are...

Read More »50 Basis Point Rate Cut – A Review And Outlook

Last week, the Federal Reserve made a significant move by cutting its overnight lending rate by 50 basis points. This marks the first rate cut since 2020, signaling the Fed is aggressively supporting the economy amid a backdrop of softening economic data. For investors, understanding how similar rate cuts have historically impacted markets and which sectors tend to benefit is key to navigating the months ahead. In this post, we will explore the historical market...

Read More »Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever. Economists and experts have long argued that technological advances drive U.S. economic...

Read More »Bull Steepening Is Bearish For Stocks – Part Two

Part One of this article described the burgeoning bull steepening yield curve environment and what it implies about economic growth and Fed policy. It also discussed the three other predominant types of yield curve shifts and what they suggest for the economy and Fed policy. Persistent yield curve shifts tend to correlate with different stock performances. With the odds growing that a long bull steepening may be upon us, it’s incumbent upon us to quantify how...

Read More »Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story. It is true that “a rising tide lifts all boats,” meaning that as the market rises, investors begin to chase higher stock prices, leading to a virtual buying spiral. Such leads to an improvement in...

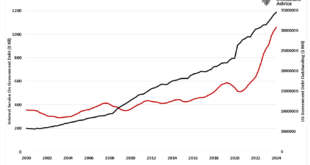

Read More »Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically. Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to fund itself, given...

Read More »Overbought Conditions Set Up Short-Term Correction

As noted in this past weekend’s newsletter, following the “Yen Carry Trade” blowup just three weeks ago, the market has quickly reverted to more extreme short-term overbought conditions. Note: We wrote this article on Saturday, so all data and analysis is as of Friday’s market close. For example, three weeks ago, the growth sectors of the market were highly oversold, while the previous lagging defensive sectors were overbought. That was not surprising, as the...

Read More »Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and auto loans suggest...

Read More »Fed Funds Futures Offer Bond Market Insights

Profitable bond trading opportunities arise when your expectations about Fed policy differ from those of the market. Therefore, with the Fed seemingly embarking on a series of interest rate cuts, it behooves us to appreciate how many interest rate cuts the Fed Funds futures market expects and over what period. Equally important, Fed Funds futures help us assess the market’s economic growth and inflation expectations. Currently, Fed Funds futures imply the Fed...

Read More »UBI – Tried, Tested And Failed As Expected

A Universal Basic Income (UBI) sounds great in theory. According to a previous study by the Roosevelt Institute, it could permanently increase the U.S. economy by trillions of dollars. While such socialistic policies sound great in theory, history, and data, they aren’t the economic saviors they are touted to be. What Is A Universal Basic Income (UBI) To understand why the theory of universal basic income (UBI) is heavily flawed, we need to understand what UBI...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org