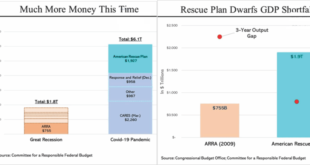

High inflation has captured the headlines as of late particularly as CPI recently hit the highest levels since 1981. Some are even suggesting we will face hyperinflation. However, while inflation is certainly present, the question to be answered is whether it will remain that way, or if the worst may already be behind us? To answer that question, let’s define the difference between an inflationary increase and hyperinflation. Not surprisingly, as Milton Friedman...

Read More »Simplewealth Review 2022 – Pros & Cons

(Disclosure: Some of the links below may be affiliate links) It is time for yet another Robo-advisor review. Simplewealth is a Swiss Robo-advisor that aims to be affordable, transparent, and easy to use. This review will analyze Simplewealth in detail: its pros and cons, its fees and strategies. By the end of the article, you will know whether you should use Simplewealth for your investing. Simplewealth Simplewealth LogoSimplewealth was born in 2015 from the minds of Jeremy Cohen and Adrien...

Read More »Market Perspective Is Important To Avoid Mistakes

Market perspective is essential in avoiding investing mistakes. With CNBC airing “Markets In Turmoil” every time the market dips, it’s no wonder investor sentiment is now the lowest we have seen financial crisis lows. Of course, as shown, extremely negative investor sentiment tends to be the hallmark of the bottom of corrections and bear markets. Nonetheless, now that we are connected constantly to financial media, we are inundated with headlines designed to get...

Read More »SWIFT Ban: A Game Changer for Russia?

As part of the sanctions against Russia, seven Russian banks have been cut off from SWIFT. We start by discussing what SWIFT is, and then the implications of completely cutting Russia out of SWIFT. What is SWIFT and Why Russia is Being Excluded SWIFT – The Society for Worldwide Interbank Financial Telecommunication is a messaging system that links more than 11,000 banks in 200 countries. The system doesn’t move actual money between the banks but...

Read More »Hiking Rates Into Peak Valuations Is A Mistake

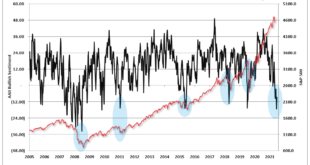

Hiking rates into a wildly overvalued market is potentially a mistake. So says Bank of America in a recent article. Optimists expecting the stock market to weather the rate-hike cycle as they’ve done in the past are missing one important detail, according to Bank of America Corp.’s strategists.While U.S. equities saw positive returns during previous periods of rate increases, the key risk this time round is that the Federal Reserve will be “tightening into an...

Read More »Sell Energy Stocks? The Time May Be Approaching

“Sell Energy Stocks” Was Originally Published At Marketwatch.com Sell energy stocks? Such certainly seems counter-intuitive advice given high oil prices, geopolitical stress, and surging inflation. However, some issues suggest this could indeed be the time to “sell high.” Before we go further, it is essential to state that I am not recommending selling energy stocks in total. As is always the case, portfolio management is about minimizing risk and preserving...

Read More »The ‘Fed Put’ – Gone Until There’s Blood in the Streets

The ‘Fed put’ – gone until there’s blood in the streets Well, it’s happening. Bitcoin (and other cryptocurrencies are sharply down, along with equity markets in many advanced economies. And the Federal Reserve (the U.S. Central Bank) statement and press conference on Wednesday didn’t indicate any backing down from raising interest rates, maybe as soon as the March meeting. The Fed’s stance pivot from ‘the economy needs additional stimulus’ to ‘it is time to start...

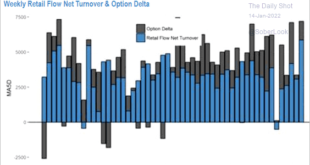

Read More »Market Selloff Into January

The market selloff into January rattled investors as concerns of “So Goes January, So Goes The Year” began to dampen expectations. Combined with a more aggressive stance from the Federal Reserve, rising inflation, and a reduction in liquidity, investor concerns seem to be well-founded. As discussed last week in “Passive ETFs Are Hiding A Bear Market,” the “blood bath” in the high-beta stocks is particularly humbling for the retail crowd that piled into risk with...

Read More »How to invest with high inflation?

(Disclosure: Some of the links below may be affiliate links) Recently, inflation has started to climb again, especially in the United States. And many investors are worried about what this will do to their investments. So, I want to talk about what we should do to our investments when inflation rises and what assets classes perform best when prices increase. The return of inflation First, let’s not forget that inflation never went anywhere. In the united states, like in most countries,...

Read More »The cost of owning our house after a year

(Disclosure: Some of the links below may be affiliate links) Many people are wondering how much is our house costing us. But, it was difficult to answer that question before we lived inside for a while. After one year spent in our house, I want to summarize all the fees we have paid. I am only going to compare what changed. For instance, we still pay about the same electricity as before, so this does not change. But heating is different, and we have to pay for water, for instance. Hopefully,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org