Financial markets often move in cycles where enthusiasm drives prices higher, sometimes far beyond what fundamentals justify. As discussed in last week's #BullBearReport, leverage and speculation are at the heart of many such cycles. These two powerful forces support the amplification of gains during upswings but can accelerate losses in downturns. Today’s market environment shows growing signs of these behaviors, particularly in options trading and leveraged...

Read More »Credit Spreads: The Markets Early Warning Indicators

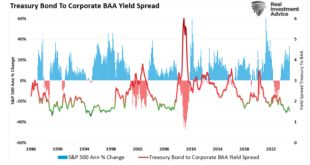

Credit spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often involves Treasury bonds (considered risk-free) and corporate bonds (which carry default risk). By observing these spreads, investors can gauge risk appetite in financial markets. Such helps investors identify stress...

Read More »Yardeni And The Long History Of Prediction Problems

Following President Trump's re-election, the S&P 500 has seen an impressive surge, climbing past 6,000 and sparking significant optimism in the financial markets. Unsurprisingly, the rush by perma-bulls to make long-term predictions is remarkable. For example, Economist Ed Yardeni believes this upward momentum will continue and has revised his long-term forecast, projecting that the S&P 500 will reach 10,000 by 2029. His forecast reflects a mix of factors...

Read More »The MACD: A Guide To This Powerful Momentum Gauge

When we discuss technical analysis in our articles and podcasts, we often examine the moving average convergence divergence indicator, better known as the MACD, or colloquially the Mac D. The MACD is one of our favored technical indicators to help forecast prices and manage risk. Accordingly, let's learn more about the MACD to see how it detects trends, potential trend changes, and assesses momentum. It's important to stress we use many technical and fundamental...

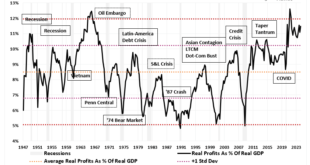

Read More »Exuberance – Investors Have Rarely Been So Optimistic

Investor exuberance has rarely been so optimistic. In a recent post, we discussed investor expectations of returns over the next year, according to the Conference Board's Sentiment Index. To wit: "Consumer confidence in higher stock prices in the next year remains at the highest since 2018, following the 2017 “Trump” tax cuts." (Note: this survey was completed before the Presidential Election.) We also discussed households' allocations to equities, which,...

Read More »Exuberance – Investors Have Rarely Been So Optimistic

Investor exuberance has rarely been so optimistic. In a recent post, we discussed investor expectations of returns over the next year, according to the Conference Board’s Sentiment Index. To wit: “Consumer confidence in higher stock prices in the next year remains at the highest since 2018, following the 2017 “Trump” tax cuts.“ (Note: this survey was completed before the Presidential Election.) We also discussed households’ allocations to equities, which,...

Read More »Trump Presidency – Quick Thoughts On Market Impact

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic growth, monetary and fiscal policy, and geopolitical events. Here are some quick thoughts about what we at...

Read More »Why Is Gold Surging?

Record deficit spending, soaring money supply, and inflation are among the likely responses we would hear from investors to the question of why gold is surging. Instead of presuming those or other market narratives about gold prices are correct, let’s analyze historical correlations between gold and economic and market data. In addition to helping you better appreciate why gold is surging, our analysis will help you recognize that market narratives explaining...

Read More »Can Paul Tudor Jones and Stanley Druckenmiller Be Wrong?

Can famed investors Paul Tudor Jones and Stan Druckenmiller, who recently proclaimed they are short bonds, thus betting on higher yields, be wrong? Instead of mindlessly assuming such legendary investors are correct, let’s do some homework. First, though, let’s remind ourselves that Paul Tudor Jones and Stanley Druckenmiller are known for their aggressive trading styles. Therefore, we don’t know whether their bets are short term trades for a quick profit, or...

Read More »Key Market Indicators for November 2024

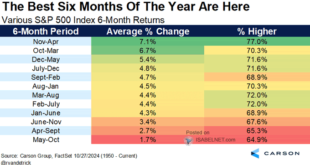

Key market indicators for November 2024 present a complex but opportunity-filled environment for traders and investors. Following the first phase of Federal Reserve rate cuts and growing global uncertainties, the technical landscape suggests several notable shifts. Let’s explore the key market indicators to watch. Note: If you are unfamiliar with basic technical analysis, this video is a short tutorial. [embedded content] Seasonality and Breakout Patterns...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org