Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account. It can be a store of value, but the price fluctuates compared with other forms of money, or other commodities, like oil or silver. Some argue that it is a store of value because of the limited supply, but that argument applies to many other goods, including commodities and real estate (which Mark Twain said you have to...

Read More »Gold Is Slowing

A Loss of Momentum Photo credit: R.P. Visual The price of gold moved down slightly this week, while that of silver dropped more substantially—1.9%. We don’t see much decrease in the enthusiasm yet from this minor setback. This was a shortened week due to the May Day holiday outside the US. Let’s look at the only true picture of supply and demand fundamentals. Gold and silver prices. First, here’s the graph of the metals’ prices. Gold and silver prices – click to enlarge....

Read More »Paper Gold Is Rising

The Metals Take Off Photo via sprottmoney.com The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if not the collapse of the price-suppression cartel, are now inevitable. The headlines and articles, screaming for gold to hit $10,000 to $50,000, are pervasive. Today we won’t dwell on our favorite point that if the...

Read More »Gold, Bonds and Negative Interest Rates Give SNB a Q1 profit

The Swiss National Bank has achieved a profit of 5.7 billion CHF in Q1/2016. The total yield on assets per annum was 3.4%.The main contribution comes from gold with price change of 10% in this quarter, hence a total yield of 48%.The total yield on debt was positive with +0.2% thanks to negative interest rates.The deflationary environment let to rising bond prices. Bonds, make up 74% of the SNB portfolio. Here the details of our calculation: Position Total Positionin bn CHF % of Total...

Read More »What prospects for gold prices?

Macroview After hitting a low point at the end of 2015, fundamentals point to a rise in gold prices--but market conditions suggest the upside potential remains limited Read the full report here After the hefty gains made by gold this year, the attached Flash Note examines what might lie ahead for the precious metal by analysing the five key underlying drivers of gold prices: financial stress, inflation, real interest rates, the US dollar and supply and demand. Our conclusions are as...

Read More »Great Graphic: Is that a Head and Shoulders Top in Gold?

This Great Graphic, created on Bloomberg shows the price of gold over the last six months. The price peaked a month ago near $1285. It seems a distribution top is being formed. Specifically, it looks like a potential head and shoulders top. The left shoulder was formed by the spike on February 11, which also marked the bottom of many equity markets. The head was formed in the first half of March. The right shoulder was put set earlier this week. To be sure, the neckline has...

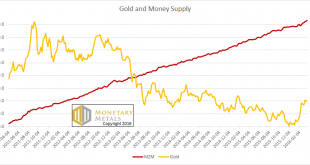

Read More »The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on Tuesday to drive this move down in the dollar? (We always use italics when referring to gold going up or down, because it is really the dollar going down or up). Janet Yellen happened, that’s what. Our Federal Reserve Chair spoke to the...

Read More »The Voldemort Effect: Gold Price and Gold Sales

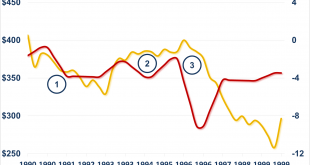

Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners hedging their production. To-date no one has been able to identify the hidden source of demand that was obviously supporting the gold market during that period. In addition, conventional justifications that accelerated sales by central banks...

Read More »Silver Relative Strength Report, 27 Mar, 2016

Gold went down (as the muggles would measure it, in dollars). It dropped almost 40 bucks. Silver fell almost 60 cents. Since silver fell proportionally farther than gold, the gold-silver ratio went up. Why do we keep reiterating that gold goes nowhere, that it’s the dollar which mostly goes down over long periods of time and sometimes up as in 2011-2015? Why do we insist that the dollar be measured in gold, and that gold cannot be measured in dollars the way a steel meter stick cannot be...

Read More »Greenback Finds Better Traction

The US dollar rose against all the major and most emerging market currencies last week. After selling off following the ECB and FOMC meetings, the dollar found better traction. It was helped by widening interest rate differentials. Regional Fed manufacturing surveys for March suggest the quarter is ending on a firm note. With new orders rising, it is reasonable to expect the momentum to carry into Q2. Nearly half of the regional Fed presidents spoke last week, and the general...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org