While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously...

Read More »Bi-Weekly Economic Review: Housing Market Accelerates

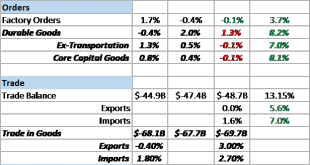

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the...

Read More »Bi-Weekly Economic Review: Animal Spirits Haunt The Market

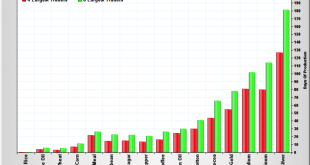

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits? Is it possible that the mere anticipation of tax cuts was sufficient to break us out of the 2% growth...

Read More »Weekly Technical Analysis: 18/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, EUR/CHF

USD/CHF The USDCHF pair traded with clear negativity yesterday to break 0.9892 level and settles below it, which stops the recently suggested positive scenario and put the price within the correctional bearish track again, noting that there is a bearish pattern that its signs appear on the chart, which means that breaking its neckline at 0.9840 will extend the pair’s losses to surpass 0.9800 and reach 0.9730 as a...

Read More »Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

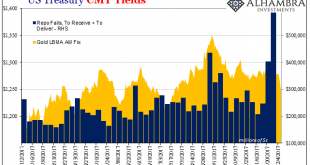

Read More »Chart of the Week: Collateral

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week. With all that, there’s really nothing much to say about what’s below. OK, there is, but I’ll save that for next...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

Read More »Weekly Technical Analysis: 11/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, Gold

USD/CHF The USDCHF pair begins to bounce higher after approaching from 0.9892 level, supported by the EMA50 that meets the mentioned level, while stochastic shows clear bullish trend signals on the four hours time frame. Therefore, these factors encourage us to keep our positive expectations in the upcoming period, waiting for visiting 1.0038 level as a next main station, being aware that breaking 0.9892 will stop...

Read More »Bi-Weekly Economic Review: Who You Gonna Believe?

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive. We also have a change in tax policy that...

Read More »Bitcoin Tops $10,100 – Fed’s Powell Says “Cryptocurrencies Just Don’t Matter”

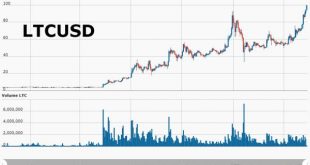

Update: Cryptocurrencies are widely bid tonight with Bitcoin over $10,150, Ether holding $475, and LiteCoin topping $100 for the first time… LiteCoin Price in USD, Mar - Nov 2017(see more posts on Litecoin, ) - Click to enlarge Bitcoin has now soared over 20% since Black Friday’s close, topping $10,000 for the first time in history (rising from $9,000 in just 2 days)… now up over 950% year-to-date. image courtesy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org