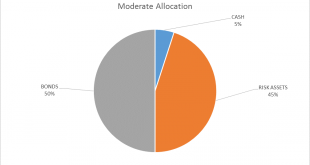

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash. Prediction is very difficult, especially about the future… Niels Bohr Every time I see that quote I think to myself, “but that...

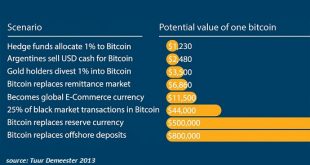

Read More »My Crazy $17,000 Target for Bitcoin Is Looking Less Crazy

The basis of this admittedly crazy forecast was simple: capital flows. I think we can all agree that bitcoin (BTC) is “interesting.” One of the primary reason that bitcoin (and cryptocurrency in general) is interesting is that nobody knows what will happen going forward. Unknowns and big swings up and down are characteristics of open markets.It’s impossible to forecast bitcoin’s future price because virtually all the...

Read More »Precious Metals Supply and Demand – Thanksgiving Week

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Grain of Salt Required The price of gold fell $7, and that of silver 24 cents. This was a holiday shortened week, due to Thanksgiving on Thursday in the US (and likely thin trading and poor liquidity on Wednesday and Friday). So take the numbers this week, including the basis, with a grain of that once-monetary commodity,...

Read More »Bitcoin Facts

A Useful Infographic When we last wrote more extensively about Bitcoin (see Parabolic Coin – evidently, it has become a lot more “parabolic” since then), we said we would soon return to the subject of Bitcoin and monetary theory in these pages. This long planned article was delayed for a number of reasons, one of which was that we realized that Keith Weiner’s series on the topic would give us a good opportunity to...

Read More »Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

– Geopolitical risk highest “in four decades” should push gold higher – Citi – Elections, political and macroeconomic crises and war lead to gold investment – Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank– “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank – Reduce counter party risk:...

Read More »Ne conservez pas votre or dans une banque. Egon Von Greyerz

Ne détenez pas d’or dans une banque suisse ou dans n’importe quelle autre banque. Nous voyons régulièrement des exemples dans des banques suisses de taille moyenne et de grande taille qui devraient fortement inquiéter les clients. En voici quelques-uns : Un client entrepose de l’or physique dans une banque, mais lorsqu’il souhaite le transférer vers des coffres privés, l’or n’y est plus et la banque doit s’en...

Read More »Bi-Weekly Economic Review: A Whirlwind of Data

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle. This being a particularly long half cycle, it has had...

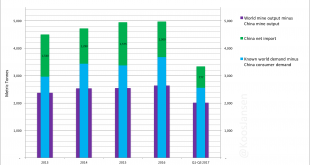

Read More »China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day. The Chinese appear to be price sensitive regarding gold, as was mentioned in the most recent World Gold Council Demand Trends report, and can also be...

Read More »The Strange Behavior of Gold Investors from Monday to Thursday

Known and Unknown Anomalies Readers are undoubtedly aware of one or another stock market anomaly, such as e.g. the frequently observed weakness in stock markets in the summer months, which the well-known saying “sell in May and go away” refers to. Apart from such widely known anomalies, there are many others though, which most investors have never heard of. These anomalies can be particularly interesting and profitable...

Read More »How Will Bitcoin React in a Financial Crisis Like 2008?

If the ownership of bitcoin is as concentrated as some estimate, then the liquidity issue distills down to the actions of the top tier of owners. Whenever I raise the topic of bitcoin and cryptocurrencies, I feel like an agnostic in the 30 Years War between Catholics and Protestants. There is precious little neutral ground in the crypto-is-a-bubble battle; one side is absolutely confident that bitcoin and the other...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org