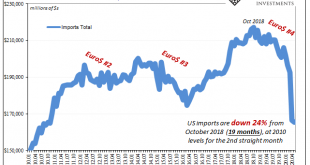

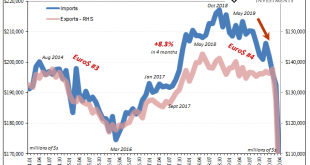

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting. Getting closer to a bottom. Unlike any of the sentiment numbers, however, these trade figures better demonstrate just how far from a rebound let alone recovery the world...

Read More »Someone’s Giving Us The (Trade) Business

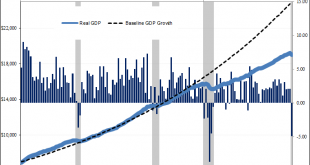

The NBER has made its formal declaration. Surprising no one, as usual this group of mainstream academic Economists wishes to tell us what we already know. At least this time their determination of recession is noticeably closer to the beginning of the actual event. The Great “Recession”, you might recall, wasn’t even classified as an “official” contraction until December 2008 – a full year after the NBER figured the thing had begun. Rather than becoming much...

Read More »GDP + GFC = Fragile

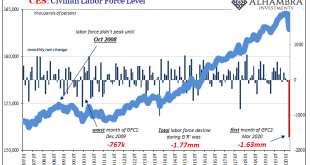

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation. It wasn’t until the middle of March that the first major shutdown orders began to appear – on Twitter feeds – and these weren’t the total lockdowns...

Read More »The Real Diseased Body

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter? For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work. And if Ben Bernanke grew so concerned he felt a second dose was required… Put another way, if a central bank keeps doing “bigger” things,...

Read More »Two Years And Now It’s Getting Serious

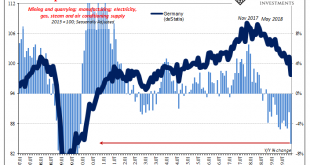

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot. IP absolutely plummeted in the final month of 2019. Compared to the prior December, the index was down an alarming 6.7%. Minus seven...

Read More »The Big And Small of Leading Japan

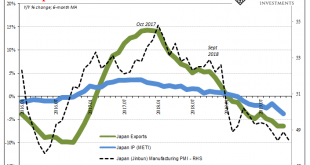

In the middle of 2018, Japan, they said, was riding so high. Gliding along on the tidal wave of globally synchronized growth, Haruhiko’s courage and more so patience had finally delivered the long-promised recovery. The Japanese economy had healed to a point that its central bank officials believed it time to wean the thing off decades of monetary “stimulus.” They even publicly speculated on just when QQE would be terminated. At least that was the story, one which...

Read More »Clarida Picks Up Some Data

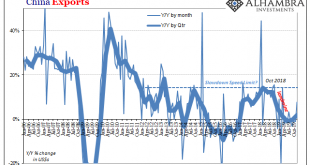

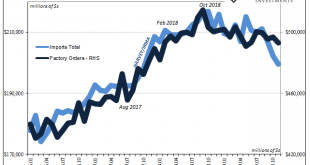

I should know better than to make declarative all-or-none statements like this. I said there isn’t any data which comports with the idea of a global turnaround, this shakeup in sentiment which since early September has gone right from one extreme to the other. Recession fears predominated in summer only to be (rather easily) replaced by near euphoria (again). Narrative yes, sentiment maybe, data nope. The vast majority of the economic accounts, anyway. There are a...

Read More »The Real Trade Dilemma

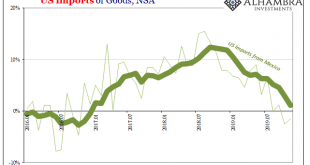

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are. They may be winners because of it but somehow they all still end up in the losing column. Late...

Read More »More Trends That Ended 2019 The Wrong Way

Auto sales in 2019 ended on a skid. Still, the year as a whole wasn’t nearly as bad as many had feared. Last year got off on the wrong foot in the aftermath of 2018’s landmine, with auto sales like consumer spending down pretty sharply to begin it. Spending did rebound in mid-year if only somewhat, enough, though, to add a little more to the worst-is-behind-us narrative which finished off 2019. That’s the version that is being described, Jay Powell’s underlying...

Read More »Everything Comes Down To Which Way The Dollar Is Leaning

Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.” That is a demonstrably false guess, one easily dispelled by the facts. A trade war produces winners from its losers. But we cannot find a single one. There have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org