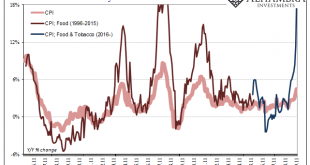

Forget about trade wars, or even the eurodollar’s ever-present squeeze on China’s monetary system. For the Communist Chinese government, its first priority has been changed by unforeseen circumstances. At the worst possible time, food prices are skyrocketing. A country’s population will sit still for a great many injustices. From economic decay to corruption and rising authoritarianism, the line between back alley grumbling and open rebellion is usually a thick...

Read More »More Signals Of The Downturn, Globally Synchronized

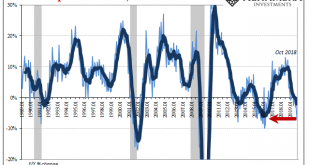

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October. For the Census Bureau’s trade data, that means this is the month that shines above...

Read More »The Real Boom Potential

For the last five years Larry Summers has called it secular stagnation. It’s the right general idea as far as the result, if totally wrong as to its cause. Alvin Hansen, who first coined the term and thought up the thesis in the thirties, was thoroughly disproved by the fifties. Some, perhaps many Economists today believe it was WWII which actually did the disproving. For many of them, it is the typical broken windows stuff. The war devastated Europe and much of the...

Read More »China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

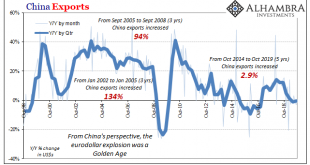

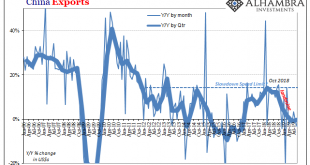

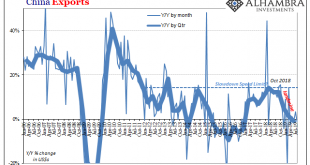

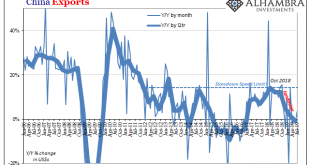

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we...

Read More »The Big Picture Doesn’t Include ‘Trade Wars’

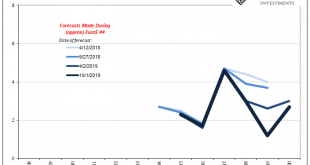

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors. Last September, the same outfit was still forecasting trade growth would nearly reach 4% in...

Read More »Waiting on the Calvary

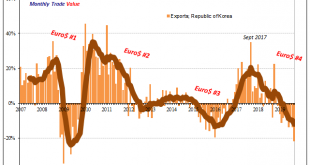

Engaged in one of those protectionist trade spats people have been talking about, the flow of goods between South Korea and Japan has been choked off. The specific national reasons for the dispute are immaterial. As trade falls off everywhere, countries are increasingly looking to protect their own. Nothing new, this is a feature of when prolonged stagnation turns to outright contraction. While the dispute with Japan hasn’t helped, it isn’t responsible for the level...

Read More »Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances. It was reported last week that Maersk and MPC would “temporarily suspend” their sailings on one of the biggest routes between Europe and Asia. Weakening...

Read More »Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009. And there’s more to come. As Bloomberg reported late last week: Over the next 12 months, interest-rate swap markets have priced in around 58 more...

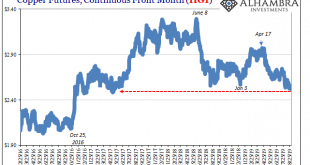

Read More »Copper Confirmed

Copper prices behave more deliberately than perhaps prices in other commodity markets. Like gold, it is still set by a mix of economic (meaning physical) and financial (meaning collateral and financing). Unlike gold, there doesn’t seem to be any rush to get to wherever the commodity market is going. Over the last several years, it has been more long periods of sideways. That’s what makes any potential breakout noteworthy. Dr. Copper’s place in the hierarchy is...

Read More »The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out. Even after all that supposed “stimulus” starting in the middle of last year...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org