The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year. Or are we? Well, yes, the 10 year is back where it was but that doesn’t mean everything else is and, as you’ve probably...

Read More »Measuring Inflation and the Week Ahead

There is quite an unusual price context for new week’s economic events, which include June US CPI, retail sales, and industrial production, along with China’s Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan. In addition, the US Treasury will sell $120 bln in coupons while the US earned income tax credit and the child tax credit is rolled out. The dollar surged even while interest rates fell. The US 10-year yield...

Read More »Central Banks Will Still Do “Whatever It Takes”!

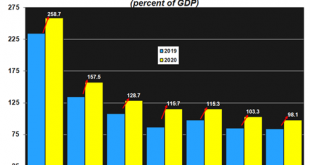

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels. During the throes of the financial crisis almost a decade ago Mario Draghi, then President of the European Central Bank (ECB) pushed the ECB’s mandate to the limits with his speech in July 2012: “within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough” This was during a...

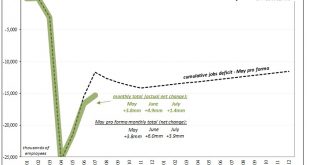

Read More »There Have Actually Been Some Jobs Saved, Only In Place of Recovery

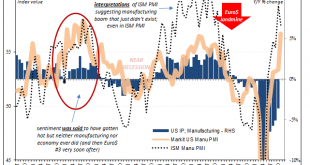

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5. At that level, it really wasn’t any different from where it had been at its multi-year high the month before. Neither are indicative of any sort of “V” shaped recovery, or any shaped recovery....

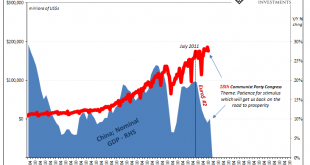

Read More »The Prices And Costs Of What Xi Believes He’s Got To Do

It does seem, at first, a huge contradiction. On the one hand, what we know so far of China’s 14th 5-year plan apparently will lean heavily on new technologies not-yet invented to rescue the country’s economy from the pit of de-globalization the eurodollar system had thrown it into years ago. If the global economy isn’t going to recover, and there’s absolutely no sign that it will, then the one seemingly logical (though far-fetched) way forward would be if the...

Read More »Writing Rebound in Italian

As the calendar turned to September, the US Centers for Disease Control and Prevention (CDC) issued new guidelines expanding and extending existing moratoriums previously put in place to stop evictions during the pandemic. Families affected by COVID either through the disease or as a result of job loss due to the coronavirus have been protected from landowner actions including eviction as a final means to reclaim rental properties from non-conforming tenants. There...

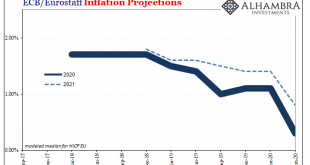

Read More »ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press. It never ends. If you...

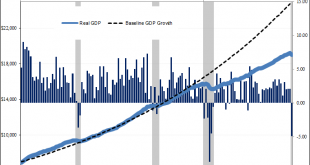

Read More »GDP + GFC = Fragile

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation. It wasn’t until the middle of March that the first major shutdown orders began to appear – on Twitter feeds – and these weren’t the total lockdowns...

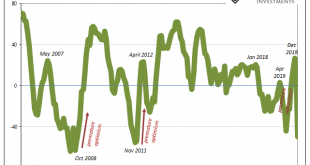

Read More »Stagnation Never Looked So Good: A Peak Ahead

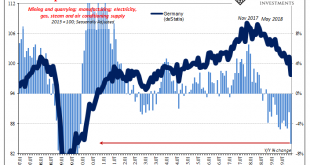

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry. The latest sentiment figures from ZEW as well as IFO are sobering. Taking the former first, it had been quite buoyant last year on the false...

Read More »As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be probed. In other...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org