I joined Tom Keene and Francine Lacqua to talk about US GDP with David Riley from BlueBay Asset Management. Here is a link to a 2.5-minute clip. The initial estimate of Q1 US growth was well more than nearly anyone expected. The details were underwhelming as the consumption was halved and the GDP deflator was halved. Final private domestic sales, which strips away inventories, trade, and government spending rose 1.3%,...

Read More »Is Keith Weiner an Iconoclast? Report 28 Apr

We have a postscript to our ongoing discussion of inflation. A reader pointed out that Levis 501 jeans are $39.19 on Amazon (in Keith’s size—Amazon advertises prices as low as $16.31, which we assume is for either a very small size that uses less fabric, or an odd size that isn’t selling). Think of the enormity of this. The jeans were $50 in 1983. After 36 years of relentless inflation (or hot air about inflation), the...

Read More »There Are Two Little Problems with “Taxing the Rich” to Pay for “Free Everything”

No super-wealthy individual or household is going to pay billions in additional taxes when $10 to $20 million will purchase political adjustments. The 2020 election cycle has begun, and a popular campaign promise is “free everything” paid for by new taxes on the super-wealthy. Who doesn’t like free stuff? Who will vote for whomever offers them free stuff? No wonder it’s a popular campaign promise. As even the most...

Read More »FX Daily, April 29: The Busy Week Begins Slowly

Swiss Franc The Euro has risen by 0.15% at 1.1386 EUR/CHF and USD/CHF, April 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It promises to be an eventful week with the FOMC and BOE meeting, US jobs report and EMU April CPI and Q1 GDP on tap. However, the week is marked by the May Day holiday in the middle of the week. Japan’s markets are closed all week, while...

Read More »Switzerland slides one place in 2019 press freedom ranking

© Pavel Abramov | Dreamstime.com In 2019, Switzerland lost one place slipping from 5th to 6th place out of 180, according to the latest world ranking of press freedom by the organisation Reporters Without Borders. The change was largely driven by the stronger performance of Denmark, which moved up into 5th place. According to the report, the press in Switzerland continues to face economic pressure and to suffer from a...

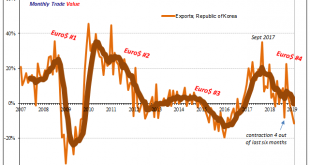

Read More »Globally Synchronized…

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death. What that meant in the context of globally synchronized growth, 2017’s repeatedly dominant narrative, wasn’t the end of synchronized as many tried to...

Read More »Swiss vote could cause chaos at Zurich and Geneva airports

© Toxawww | Dreamstime.com A referendum on revising gun laws scheduled for 19 May 2019 could cause major disruption at airports in Zurich and Geneva if it succeeds, according to various newspapers. If the vote passes it might eventually lead to the exclusion of Switzerland from the Schengen area. If this happened, Swiss airports would need to check the passports of all those entering from and departing to other Schengen...

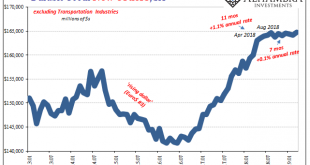

Read More »Durably Sideways

Next month, in the durable goods series, the Census Bureau will release the results of its annual benchmark changes. In May 2019, the agency will revise the seasonal adjustments going back to January 2002. Unadjusted data will not be, well, further adjusted. None of this, apparently, will include any information gleaned from the comprehensive 2017 Economic Census. I haven’t closely followed the progress of the latter,...

Read More »The 3 things driving Geneva’s residents to shop in France

© Viorel Dudau | Dreamstime.com A recent study by Geneva’s department of economic development (DDE) looks at the shopping habits of its residents and the residents of neighbouring Vaud and neighbouring France – an area including Nyon and parts of the French Ain and Haute Savoie regions. Every year, the residents of this greater Geneva region spend around CHF 7.2 billion francs on consumable items in physical stores....

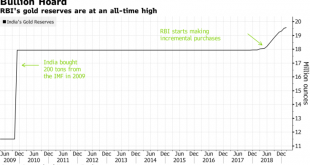

Read More »World’s Central Banks Want More Gold – India May Buy 1.5M Ounces In 2019

Royal Bank of India (RBI) may buy another 1.5 million oz this year according to OCBC Many other central banks including large creditor nations Russia and China are also adding to gold holdings via Bloomberg India’s central bank is likely to join counterparts in Russia and China scooping up gold this year, adding to its record holdings and lending support to worldwide gold bullion demand as top economies diversify their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org