Swiss Consumer Price Index in September 2016 Consumer prices increase by 0.1% Neuchâtel, 06.10.2016 (FSO) – The Swiss Consumer Price Index (CPI) increased by 0.1% in September 2016 compared with the previous month, reaching 100.2 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings from the Federal Statistical Office (FSO). Switzerland...

Read More »Canadian Dollar: A Little Less About Oil, a Little More about Rates

Summary: The Canadian dollar’s link to oil has loosened. Its sensitivity to interest rates has increased. Lumber issue is coming to a head shortly. Of the majors, only sterling was weaker than the Canadian dollar in Q3. Sterling’s drop was a function of its decision to leave the EU and ease monetary policy. The Canadian dollar fell 1.6% compared with sterling’s 2.6% fall. The other dollar-bloc currencies...

Read More »Statistics on tourist accommodation in August 2016: Overnight stays decline in August 2016

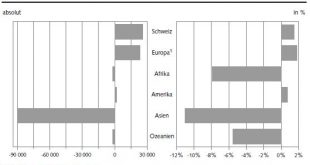

06.10.2016 09:15 – FSO, Tourism (0353-1609-80) Statistics on tourist accommodation in August 2016 Overnight stays decline in August 2016 Neuchâtel, 06.10.2016 (FSO) – The Swiss hotel industry registered 4.1 million overnight stays in August 2016, which corresponds to a decrease of 1.0% (-43,000 overnight stays) compared with August 2015. Foreign visitors generated 2.4 million overnight stays, representing a...

Read More »FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

Swiss Franc EUR/CHF - Euro Swiss Franc, October 05 2016. Federal Reserve While the markets can be an incredibly efficient discounting mechanism, it sometimes is also an echo chamber. What began off as a Bloomberg report indicated that there was an agreement at the ECB that when it decided to end its asset purchases, it would gradually taper back rather than come to a fast stop, by the end of the day, it had...

Read More »The Dying Middle Class

Largest Theft in History As expected, Ms. Yellen smiled last week, announcing no change to the Fed’s extraordinary policies. For the last eight years, she has been aiding and abetting the largest theft in history. Thanks to ZIRP (zero-interest-rate policy) and QE (quantitative easing), every year, about $300 billion is transferred from largely middle-class savers to largely better-off speculators, financial asset...

Read More »London Gold and Silver Fix lawsuits

By Allan Flynn, Guest Post at BullionStar.com Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things. Judge...

Read More »Why Portugal Matters

Summary: DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating. Many observers continue to tout Italian risks as the greatest in the euro area into the year end. The constitutional referendum that would emasculate the Senate, and end the perfect bicameralism that has contributed to...

Read More »It’s Time We Crush the Putrid Roach Motels of Philanthro-Crony-Capitalism, Starting with the Clinton Foundation

Philanthro-crony-capitalist corruption in the U.S. has reached levels that put Lower Slobovia to shame. Granted, the fantasy of philanthrocapitalism is appealing: take a bunch of fabulously successful entrepreneurial billionaires, grant their foundations tax-free status, and then unleash them on the world as philanthropists who will solve problems by applying the incentives of capitalism. While this sounds great in a...

Read More »It’s Time We Crush the Putrid Roach Motels of Philanthro-Crony-Capitalism, Starting with the Clinton Foundation

Philanthro-crony-capitalist corruption in the U.S. has reached levels that put Lower Slobovia to shame. Granted, the fantasy of philanthrocapitalism is appealing: take a bunch of fabulously successful entrepreneurial billionaires, grant their foundations tax-free status, and then unleash them on the world as philanthropists who will solve problems by applying the incentives of capitalism. While this sounds great in a...

Read More »50 Slides for Gold Bulls – The New Incrementum Chart Book

A Companion Update to this Year’s “In Gold We Trust” Report Our good friends Ronnie Stoeferle and Mark Valek of Incrementum AG have just published a new chart book, which recaps and updates charts originally shown in this year’s 10th anniversary edition of the “In Gold We Trust” report and provides an overview of recent developments relevant to the gold market. The chart book can be downloaded in PDF form via the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org