In an NBER working paper, Niels Johannesen, Patrick Langetieg, Daniel Reck, Max Risch, and Joel Slemrod discuss the effects of recent U.S. tax enforcement initiatives on tax compliance. They offer background information about U.S. initiatives since 2009 and conclude, based on administrative microdata, that [e]nforcement caused approximately 60,000 individuals to disclose offshore accounts with a combined value of around $120 billion. Most disclosures happened outside offshore voluntary...

Read More »Tax Evasion in Hong Kong and the US

The Economist reports about new strategies to evade taxes. One is based on an occupational retirement scheme (ORS) in Hong Kong: A German or Australian with money to hide can set up a Hong Kong shell company, appoint himself as its director, with a local employment contract, and sign up with a trust company that provides an ORS. He can throw in cash, property or other assets, oversee the account himself, retire as soon or as far in the future as he likes, and then take out as much or as...

Read More »Tax Evasion in a (the) New World

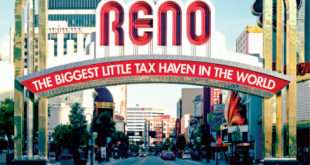

In the FT, Vanessa Houlder reports about the tax evasion business. The new regulatory environment has led to portfolio adjustments and new types of behavior, and it exposes vast differences in enforcement across countries: Diamonds in vaults rather than financial assets. Trusts in South Dakota rather than anonymous bank accounts. Moving to a different country rather than just shifting assets. FATCA versus the Common Reporting Standard. The article also links to an article by Kara Scannell...

Read More »FATCA in Reverse?

The Greens/EFA group in the European Parliament wants the European Union to exert more pressure on the United States: the US should no longer serve as a “tax haven” for European tax dodgers. Proposed measures include blacklisting and a FATCA-type 30% withholding tax on EU-sourced payments. From the executive summary of the report commissioned by the group: Two global transparency initiatives are underway that could help tackle financial crimes including tax evasion, money laundering and...

Read More »Les Etats-Unis ont phagocyté la place financière suisse. Liliane Held-Khawam+Le nouveau paradis fiscal favori de la planète:… les Etats-Unis! Bloomberg

Etats-Unis, plus grand paradis fiscal de la planète! Voici un article édité par Bloomberg qui dénonce les pratiques fiscales américaines. On y apprend que les capitaux quittent la Suisse pour aller retrouver un havre de paix avec des conditions meilleures que ce que la Suisse offrait. Mais cette nouvelle qui entérine la mise à mort de la place financière suisse nous interpelle à au moins deux niveaux: La politique de Eveline Widmer-Schlumpf qui a désossé la place financière suisse et qui a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org