Summary Moon Jae-in was elected president of South Korea Philippine President Duterte named Nestor Espenilla as central bank governor Nigerian President Buhari traveled to London for a follow-up to the initial medical visit earlier this year Market expectations for 2018 inflation in Brazil rose for the first time in more than a year Peru’s central bank unexpectedly started the easing cycle with a 25 bp cut to 4.0%...

Read More »Emerging Markets Preview

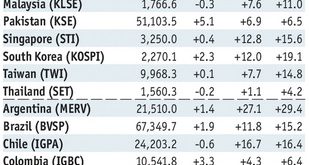

Stock Markets EM FX got some limited traction as the week closed, helped by stabilizing commodity prices. However, oil, copper, and iron ore have all broken important technical levels that suggest further weakness ahead. We also think the FOMC and jobs data support our view that the next Fed hike will be in June. This backdrop should keep EM on the defensive this week. Stock Markets Emerging Markets, May 06...

Read More »Emerging Markets: What has Changed

Summary Relations between China and North Korea appear to be worsening. The THAAD missile shield has been deployed earlier than expected in South Korea. An amendment to India’s Banking Regulation Act gives the RBI more power to address bad loans. Tensions are rising between Czech Prime Minister Sobotka and Finance Minister Babis. Brazil pension reform bill was passed 23-14 in the lower house special committee. Stock...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended last week on a mixed note. Indeed, the week and the month were also very much mixed for EM, reflecting a variety of global and country-specific drivers impacting these countries. This week’s US jobs data could bring Fed tightening back as a major driver for EM. We will also get the first snapshots of trade in April from Korea and Brazil, as well as Caixin PMI readings for China. Official...

Read More »Emerging Markets: What has Changed

Summary Moody’s moved the outlook on Vietnam’s B1 rating from stable to positive. Nigeria’s central bank introduced a new FX window for portfolio investors. Moody’s moved the outlook on Romania’s Baa3 rating from positive to stable. Central Bank of Russia accelerated its easing cycle. Central Bank of Turkey delivered a hawkish surprise. Brazil’s lower house easily approved the labor reforms, but popular resistance is...

Read More »Global Asset Allocation Update

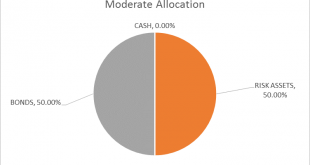

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX was mostly firmer last week, helped by Trump comments and softer US data. Whilst this seems positive for EM, the global backdrop remains uncertain. Some in EM (Russia, Turkey, and Korea) remain vulnerable to geopolitical concerns. In addition, idiosyncratic domestic political risks remain in play for other EM countries, such as Brazil, South Africa, and Turkey. We expect the investment climate...

Read More »Emerging Markets: What has Changed

Summary Malaysia’s central bank said it will allow investors to fully hedge their currency exposure. Egypt declared a 3-month state of emergency after two deadly church attacks. South Africa’s parliamentary no confidence vote has been delayed Argentina central bank surprised markets with a 150 bp hike to 26.25%. Brazil central bank accelerated the easing cycle with a 100 bp cut in the Selic rate. Stock Markets In the...

Read More »Where Europe Meets Asia

For two decades now, the Asian Investment Conference (AIC), the region's largest and most exclusive investment conference, has delivered unrivalled access to expert speakers from around the world and provided thought-provoking insights. And this year was no different. Over 3,000 attendees joined an impressive line-up of political leaders, entrepreneurs,...

Read More »Emerging Markets Preview for the Week Ahead

Stock Markets EM FX ended the week on a soft note, as the weaker than expected US jobs data was unable to derail the dollar’s rally. For the week, the worst performers were ZAR (-3%), TRY (-2.5%), and RUB (-2%). CZK bucked the trend, rising after the CNB exited the cap. This week, higher inflation readings in the US could draw market focus back to Fed tightening, which would be negative for EM. Risks of further flare...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org